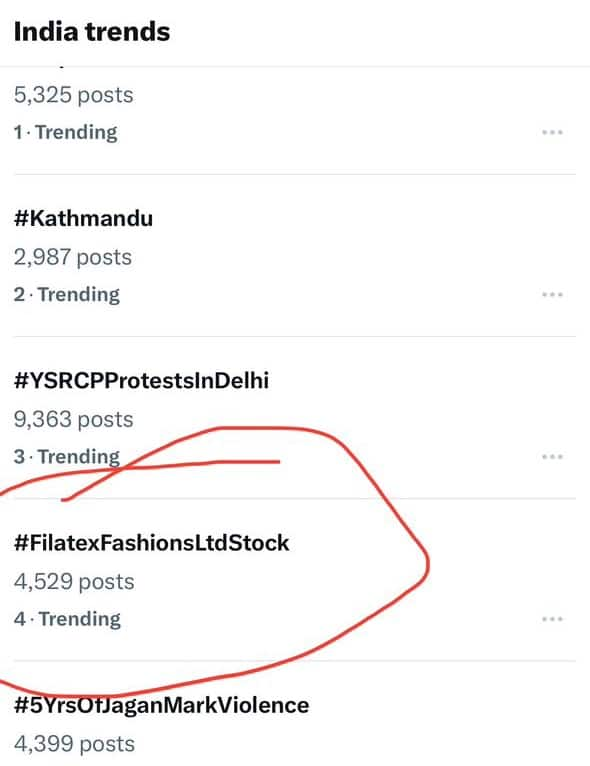

Filatex Fashions, a relatively obscure socks maker, recently trended on Twitter, now known as X, under the hashtag #FilatexFashionsLtdStock.

However, market observers pointed out the suspicious similarity of numerous posts that repeated the idea that the stock delivered 145 percent returns over the past three years and is expected to rise to Rs 78 by 2025. That is more than 12 times the stock's current price. It was trading at Rs 6.61 at 2:30 pm, after opening at Rs 6.58 and hitting a high of Rs 7.

Also read: MC Exclusive : Be extra cautious while approving SME IPOs, Sebi tells exchanges

Such social media strategies are often used to manipulate stock prices. Operators try to inflate stock prices by flooding X with bullish messages about a stock's prospects, luring unsuspecting investors to buy shares. Once retail investors start buying the stock, the operators sell off their holdings, causing the stock to crash.

Filatex was listed on BSE in 1996 and was listed on NSE on May 6. The company announced August 9 as the record date for a stock split. One share of face value of Rs 5 will be split into five shares.

Moneycontrol wrote to the company two days ago, and the article will be updated with their response, if any.

Here are some examples of the posts...

...another...

...and another...

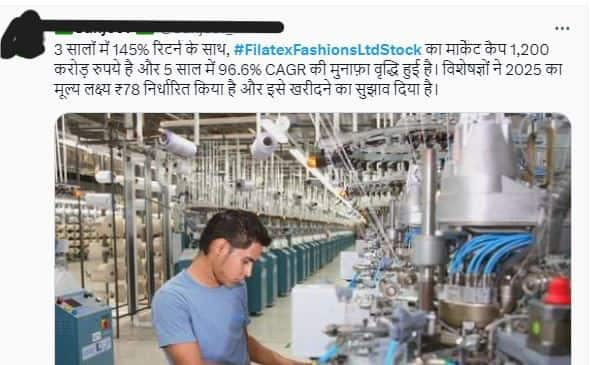

Similar content is also being used to highlight the stock in Hindi...

Strangely, many posts featured images of denim clothes, despite the company being known for making socks.

An insider, who did not want to be named, pointed out that perhaps the Twitter brigade was using the same images they used to make a denim maker's name trend recently. Towards the close of June, various influencers were talking about a denim maker, saying that the company was a multibagger waiting to be discovered. However, the influencers made no mention of the corporate governance issues faced by the company, such as the resignation of the statutory auditor, who claimed that they were not being paid enough for the work that needed to be done.

Moneycontrol has written about how social media and influencers' reach are being used frequently to pump and dump stocks.

It starts with the operators providing the text of the message that needs to be shared online, which allows them to control the narrative and maximize profits. They use multiple social media platforms and rope in people who can engage the audience. That is, the posters need not be the ones who have the most followers but need to get their audience to repost, like, or even read the message.

One strict no-no is tagging the company. A finfluencer, who has been approached by companies for this purpose and has turned down offers, told Moneycontrol that this is so that nothing is traced to the company or its senior officials.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!