In June quarter, foreign institutional investors (FIIs) pumped in over Rs 14,000 crore in the cash segment of equity markets, and raised stake in over 200 companies on the BSE.

Out of these, as many as 106 stocks gave positive returns while the rest recorded a fall of up to 70 percent in 2020 year-to-date, data from AceEquity showed.

Most of the stocks in which FIIs have raised stake are from the small & midcap space.

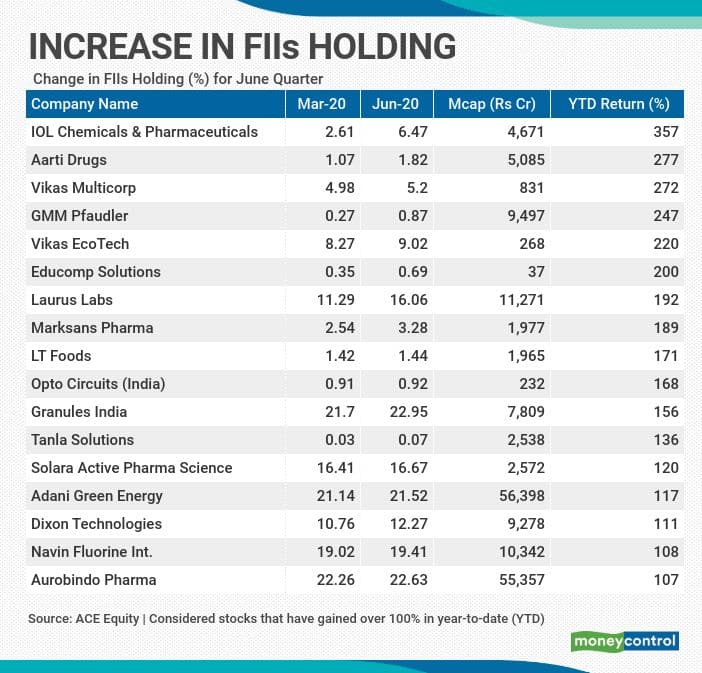

From 106 names that gave positive returns, 17 stocks more than doubled investor wealth in 2020 year-to-date. These include Granules India, Dixon Technologies, Adani Green, Laurus Labs, Aarti Drugs and IOL Chemicals.

The pandemic has opened new doors to business opportunities for some of these companies, suggest experts. The companies which have gained momentum are likely to benefit the most from the COVID situation or government policies.

“The broader markets have gained decent traction of late, thanks to valuation comfort and reopening of the activities which has increased hopes for economy getting back on track,” Ajit Mishra, VP Research, Religare Broking told Moneycontrol.

“Further, we’re seeing several themes playing out well in the market which include rural-focused stocks and Make in India, etc. and ever since the pandemic has started, the pharma pack is also seeing noticeable buying interest and mostly stocks mentioned in the list fall in these categories,” he said.

They are betting on stocks that were less impacted and have the potential to grow with recovery in the economy.

Foreign investors usually trust largecaps stocks due to liquidity, and being leaders in their own domain. But, experts feel that FIIs may have tweaked the strategy to accommodate small & midcaps in which they could see the potential for growth.

History suggests that they (FIIs) remain very selective when it comes in to investing as tons of research goes before they increase or decrease their stale. An increase in stake in some of these companies is indeed a positive sign.

“FIIs normally invest in large caps due to liquidity and market cap factor. However, if the story is compelling and future growth outlook is very high and scalable then we do see FIIs investing in such select mid-caps,” Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities told Moneycontrol.

“It is rare to see FIIs investing in small companies not having a scalable business model. Some of the names mentioned like Dixon, Aarti Drugs, Laurus Labs have a scalable business model and hence FIIs can take a longer view in anticipation of stock moving from a smaller mid-cap company to a larger mid-cap company in future,” he said.

Oza further added that FIIs do chase selective growth stocks in emerging markets otherwise they have enough large valued companies trading in the developed markets itself.

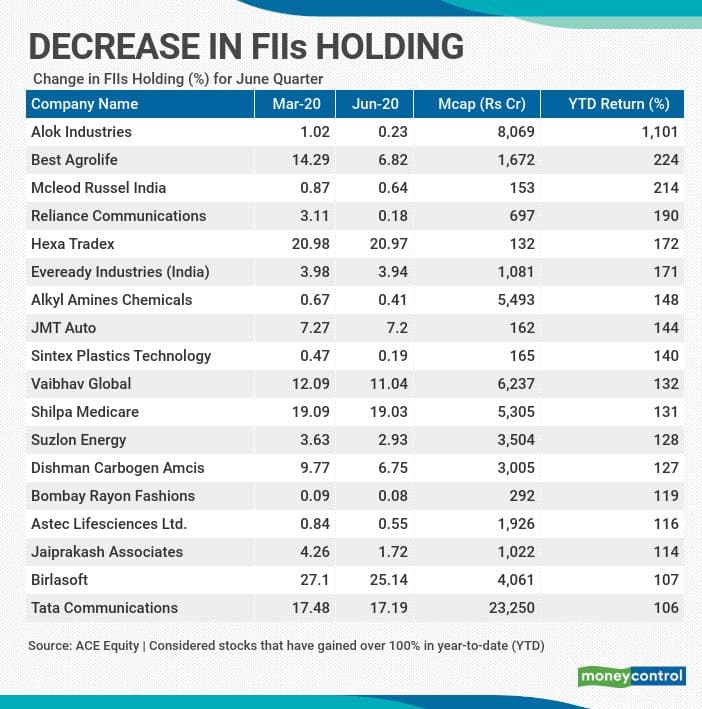

Decrease in stake:There are more than 600 companies in which FIIs decreased their stake sequentially in the June quarter, according to data collated from AceEquity.

Out of 632 companies, 18 companies in which FIIs reduced stake rose more than 100 percent so far in 2020 that include names like Aalok Industries, Best Agrolife, JMT Auto, Shilpa Medicare, Alkyl Amines etc. among others.

A decrease in FIIs holding could be considered a negative sign but investors should filter the reason behind fall in the holding before making a decision to either buy or sell, suggest experts.

“FII’s buying or selling the stock should not be the basis for investors to buy or sell the stock at the first instance. FII’s selling their stake at sometimes can be part of their rebalancing strategy,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited told Moneycontrol.

“It seems like the FII’s have reduced stake in most of the companies based on valuations and would buy again when valuations become attractive. Apart from FII’s interest in analyzing company’s cash flows, balance sheet and growth prospects are also extremely important,” he said.

Garg further added that investors are advised to perform a detailed analysis of the stock before they invest. A good business driven by a good set of people will always deliver good returns in the longer run.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.