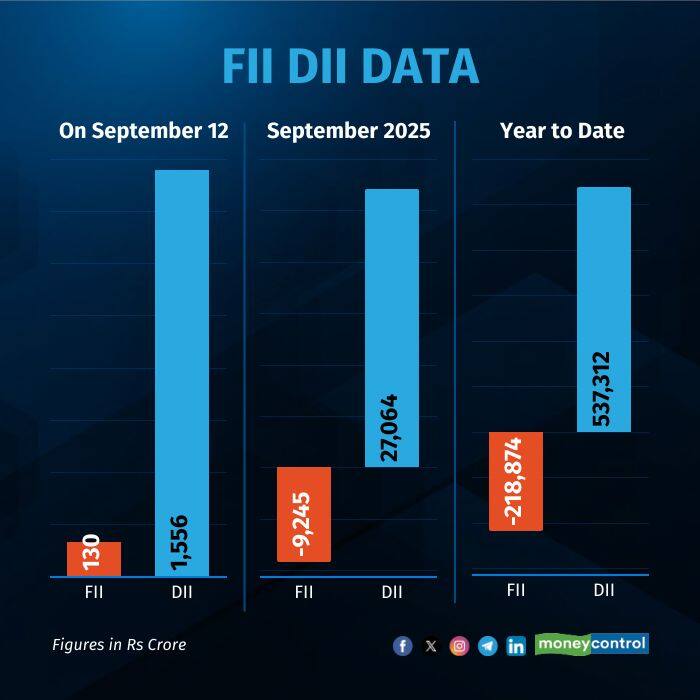

On Friday, September 12, Foreign Institutional Investors (FIIs/FPIs) net bought Rs 130 crore Indian equities while Domestic Institutional Investors (DIIs) net bought Rs 1,556 crore, as per provisional data on NSE.

During the trading session, DIIs bought Rs 11,675 crore worth equities and sold Rs 10,119 crore. On the other hand, FII/FPIs bought Rs 11,094 crore and sold Rs 10,965 crore.

For the year so far, FPI/FIIs have net sold equities worth Rs 2.18 lakh crore equities while DIIs have net bought worth Rs 5.37 crore.

Market Performance

Indian markets ended the week on a strong footing, with the Nifty closing above the 25,000 level and broader indices outperforming the benchmark. Vinod Nair, Head of Research, Geojit Investments highlighted that the upturn was supported by optimism over the anticipation of stronger H2FY26 earnings, driven by GST rationalisation and the benefits of monetary easing, which also provide resilience to valuations. "Sentiment was further lifted by reports that the EU may reject U.S. tariff proposals on India’s Russian oil imports," he added.

This week also continued foreign outflows weighed on the rupee, while gold reached fresh highs on strong safe-haven demand amid global trade tensions. The market, however, found support in improving prospects for India-US trade negotiations, suggesting tariff-related risks may prove short-lived. Another significant happening during the week is that of the global bond yields rising to new peaks.

Reflecting on the market's performance today, Nair said "The IT index exhibited its rally, driven by renewed hopes of a Fed rate cut, Infosys’ buyback announcement, and optimism over a revival in technology spending. Consumer-centric sectors, particularly Auto, displayed steady resilience, supported by expectations of GST-driven demand recovery and festive season tailwinds. Domestic CPI inflation registered a slight uptick; however, ongoing tax reforms are expected to help ease pressures in the period ahead."

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!