Foreign institutional investors, who poured in more than Rs 40,000 crore in Indian markets in the March quarter, raised stake in 187 companies on a sequential basis.

On the other hand, they booked profits or reduced stake in over 200 companies, data from AceEquity showed.

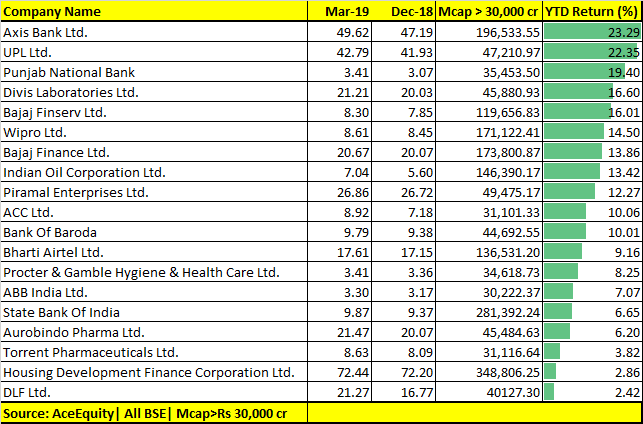

According to shareholding data declared by companies as of April 12, the stocks where foreign investors (FIIs) raised stake in the fourth quarter include Axis Bank, UPL, PNB, Bajaj FinServ, Wipro, Bajaj Finance, ACC, Bharti Airtel, SBI, Aurobindo Pharma, HDFC and DLF.

Thanks to the foreign money flowing in, benchmark indices gained momentum after January and strong buying was seen in sectors like banks, financial services, autos, oil & gas and pharma.

Most stocks in which foreign investors have raised stake are high beta names but there are stocks which are showing signs of growth and investors should take note of that because there's more to this than meets the eye, suggest experts.

“Most stocks that we have seen are yes into a high beta category but we also see some value in these companies. Stocks like Axis Bank, with improved asset quality, Higher NII which was up 18% QoQ, higher profit and drop in gross NPA is a stock that should be part of one's portfolio when the market is in an established uptrend. NCC, on the other hand, offers immense growth opportunity,” Mustafa Nadeem, CEO, Epic Research told Moneycontrol.

“Investors attribute high beta as a riskier asset bet but many high beta stocks are actually wealth creator,” he said.

After subdued January, FII flows picked up in February and March.

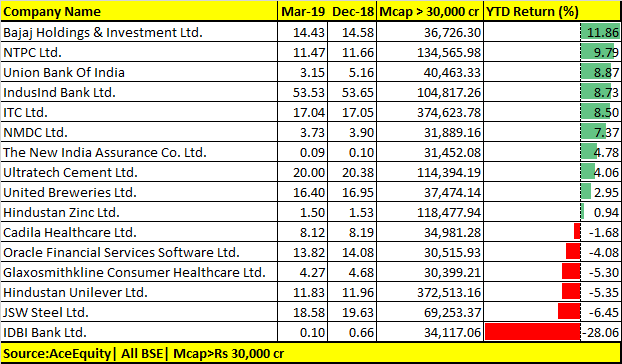

Foreign investors were net buyers of Indian assets in the March quarter, but they reduced stake in as many as 206 companies, as per shareholding data collated on April 12.

Companies in which foreign investors reduced their stake include Bajaj Holdings, NTPC, Union Bank of India, ITC, NMDC, IDBI Bank, Hindustan Unilever, Hindustan Zinc, UltraTech Cement, Cadila Healthcare, and JSW Steel.

Most analysts see this as routine profit taking from foreign investors whenever there is a change in trend or cyclicality of the market.

Sector rotation is normal and is done to change or rebalance the portfolio, suggest experts. They exit stocks which may have performed well in the past or previous rally but may not necessarily lead or perform again.

“Many of these stocks had an excellent run in last 4 years and are now trading at expensive valuations so we believe this is just a routine profit taking. We would advice buying these stocks once they are available at attractive valuations,” Atish Matlawala, Sr Analyst, SSJ Finance & Securities told Moneycontrol.

“Investors may get a bit cautious as many would like to stick to stocks where there is money flow or smart money,” he said.

Talking about ITC, Nadeem said it is well covered in many funds but it is usually a dividend factor and not in terms of price change.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!