The Sensex surged 1,000 points from 40,000 levels to 41,000 since June 2019. The swift rally had ups and downs which kept many investors at bay. But the upward march is only warming up, experts said, with most expecting the benchmark index to climb Mount 43K in the next 12 months.

The positive view on the stock market comes in the backdrop of weak macros, muted earnings growth, as well as, investors’ confidence which has been shaken due to defaults from top corporates.

Moneycontrol spoke to 12 analysts, fund managers and head of research of top brokerage firms who remain constructive on Indian markets for the next one year, but gains will remain largely capped at the index level while big money could be made in the broader markets.

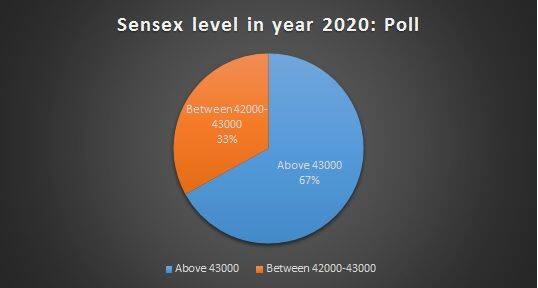

Almost 67 percent of the experts polled by Moneycontrol are of the view that the S&P BSE Sensex is well on track to hit 43,000 in the next 12 months while the rest, 33 percent feel that the index could hover in the range of 42,000-43,000.

Before benchmark indices hit fresh record highs, a correction or some consolidation cannot be ruled out, experts cautioned.

“The recent run-up was seen only in selected heavyweights (large cap), which pulled up the markets to record highs. Given the stretched valuation, a correction cannot be ruled out in the near-term,” Ajit Mishra, VP – Research, Religare Broking told Moneycontrol.

In terms of Nifty50, experts feel that the index which has risen nearly 11 percent so far in 2019 has more steam left, and investors should use dips to get into quality stocks, the poll showed.

As many as 64 percent of the poll respondents feel that the Nifty50 could hover in the range of 13,000-14,000 while the 18 percent fell that it could well surpass 14,000 and the rest 18 percent are of the view that the index could move in the range of 12000-13,000.

What should investors do?

The market is currently on a bull run, with only a select heavyweight contributing to the rally. In such a scenerio, experts suggest deploying capital in a staggered way. There is an opportunity for investors who are looking at a time horizon of 2-3 years to create wealth.

As many as 64 percent of the poll respondents are of the view that investors should deploy money in equity markets in a staggered way while 18 percent are of the view that they could put in a lump sum while the rest 18 percent feel that investors’ should wait for a dip.

“Market continues to remain polarised with few large caps driving the rally, however, given that there have been initial signs of earning outperformance from the midcaps vis-à-vis large caps in Q2 earning season,” Sanjeev Hota - Vice President, Head of Research at Sharekhan by BNP Paribas told Moneycontrol.

“We believe with large caps leading the rally, the valuation gaps between large caps and midcaps will gradually come down. Thus, this is an opportune time for investors to increase weightage in quality midcaps space in a staggered approach to get an impressive return over the next 2-3 years,” he said.

Where is the big money?

Experts are of the view that most investors have taken a risk-averse approach in 2019 which would likely change as economy shift gears and the big money could well be made in the small & midcaps, poll results showed.

As many as 60 percent of the poll respondents are of the view that large & midcap stocks are likely to do well in the next one year while the rest 30 percent are of the view that small & midcaps stocks will generate wealth.

Largecaps stocks which have rallied the most in the last one year and could lose their sheen. Only 10 percent of the respondents are confidents that largecaps would do well in the next 12 months.

“Though Nifty has made a new high in statistical number sense, the index over the last two years has made gains in lower single-digit less than a bank fixed deposit return and beyond Nifty stocks, Mid and Small Cap stocks are still down," said Shailendra Kumar, Chief Investment Officer at Narnolia Financial Advisors Ltd

Data suggests that the Nifty Midcap100 P/E ratio has corrected from 19.8x in October 18 to 17.9x currently. Midcaps now trade at 6 percent discount to largecaps, from a peak of 42 percent premium in March 18, suggest experts.

“After the government’s announcements to stimulate growth, the sentiments have revived and changed the narrative. We expect FII flows to respond positively to these measures and grow as the economic activity gets better,” Siddhartha Khemka, Head- Retail Research, MOFSL told Moneycontrol.

“We thus expect the sharp underperformance of midcaps to correct going forward, giving opportunities for select quality midcaps to start outperforming,” he said.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

List of analysts polled by Moneycontrol:

Naveen Kulkarni, Head of Research, Reliance Securities

Shailendra Kumar, Chief Investment Officer at Narnolia Financial Advisors Ltd

Atish Matlawala, Sr Analyst, SSJ Finance & Securities

Ajit Mishra, VP – Research, Religare Broking.

VK Sharma, Head PCG & Capital Markets Strategy, HDFC securities

Tradebulls Securities Research Team

Sanjeev Hota - Vice President, Head of Research at Sharekhan by BNP Paribas

Siddhartha Khemka, Head- Retail Research, MOFSL

Umesh Mehta, Head of Research, Samco Securities.

Suveer Chainani , CEO - Institutional Clients Group, Emkay Global Financial Services

Dyaneshwar Padwal – AVP Technical Analyst at KIFS Trade Capital Rusmik Oza, head of Fundamental Research, Kotak Securities

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!