The market corrected for the fifth consecutive week ended August 25, but the loss amid volatility was lower compared to the previous four weeks. Subdued global cues, inflationary concerns raised by the RBI, and FII outflow weighed on the sentiment. Also, the market participants were cautious ahead of Federal Reserve Chair Jerome Powell's speech at the Jackson Hole symposium, who expressed the central bank's readiness to continue increasing interest rates, emphasising the goal of keeping borrowing costs high, until inflation reaches to its 2 percent target.

Considering the consistent selling pressure, the benchmark indices may try to rebound, but unless and until we get strong positive triggers, the rangebound trend may continue in the coming week too, experts said, adding the focus would be on Reliance AGM, macroeconomic numbers, FII Flow, and US data points.

The BSE Sensex fell 62 points to 64,887, and the Nifty50 declined 44 points to 19,267, while the broader markets outpaced benchmarks, which experts feel may continue in short term, too.

The Nifty Midcap 100 and Smallcap 100 indices gained 1.7 percent and 1.6 percent respectively. Oil & gas, pharma, energy, infra and PSU banks were under pressure, but the buying was seen in technology, private banks, financial services, and select metal stocks.

"We continue to expect Nifty to be in a narrow range due to lack of positive triggers," Siddhartha Khemka, head - of retail research at Motilal Oswal Financial Services said.

In the meantime, niche mid and small-cap sectors are likely to remain in action, he feels.

Here are 10 key factors to watch out for next week:

All eyes will be on the much-awaited 46th Annual General Meeting by billionaire Mukesh Ambani-owned Reliance Industries which will be held on August 28. After the demerger and listing of Jio Financial Services last week, analysts and investors may be looking for the timeline for IPOs of telecommunication and retail businesses, new segments wish to enter by Jio Financial, more updates on 5G rollout, and new plans & progress of various projects initiated under the new energy business, experts said.

GDP Growth for Q1FY24

The second factor to watch out for would be first quarter (FY24) GDP growth numbers, scheduled on August 31. Whether the growth meets the RBI estimates of 8 percent for Q1 or not will be seen, especially after 6.1 percent growth we have seen in Q4CY23 led by positive surprises in private consumption, services exports and manufacturing.

What is important is to see what the structural trends are as global growth slowing down will have some impact on our growth as well, Shailendra Kumar of Narnolia Financial Services said, while Barclays sees GDP expanding by 7.8 percent YoY in Q1, and SBI Research estimates GDP growth at 8.3 percent as public & private sectors bank credit expanded at robust & equal pace, and capital expenditure of centre & states expanded a rapid pace in Q1FY24.

Fiscal deficit and infrastructure output for July will also be released on same day.

Manufacturing PMI

We will also have S&P Global Manufacturing PMI numbers for August next week, releasing on September 1. Most experts expect the manufacturing activity to be strong, given the above 50 level indicates expansion, but whether it is extending fall further like we saw in June and July will be seen. In July, the India's manufacturing sector activity continued to expand, though the S&P Global Purchasing Managers' Index (PMI) dropped marginally to 57.7, against 57.8 in June. In May, it was at a 31-month high of 58.7.

Further, foreign exchange reserves for the week ended August 25 will also be released on the same day. The reserves in the week ended August 18 stood at $594.89 billion against $601.45 billion in the previous week.

Q2CY23 US GDP Estimates

Globally, investors will closely watch the second estimates for US GDP numbers for Q2CY23, releasing on August 30. As per the advance estimates announced last month, US economy increased at an annual rate of 2.4 percent during the quarter against 2 percent in Q1CY23.

The global market participants will also look at JOLTs job openings & quits for the month of July due on August 29, and unemployment rate & non-farm payrolls for August, releasing on September 1, apart from manufacturing PMI numbers for August globally. The US unemployment rate is likely to be steady at 3.5 percent against the previous month.

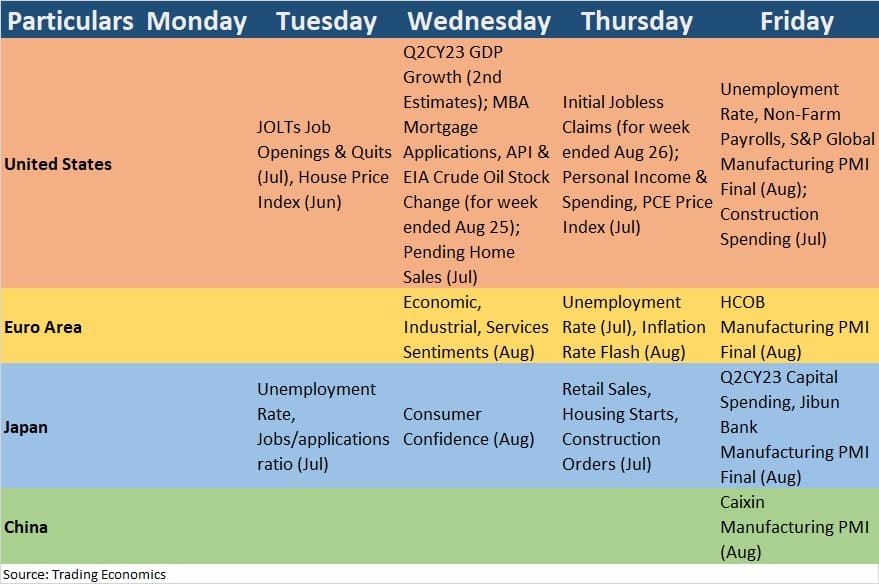

Global Economic Data Points

Here are key global economic data points to watch out for:

The FII flow seems to be heading for a negative close for the month of August, as so far, we have seen FIIs net selling at Rs 15,821 crore in the cash segment in current month against net inflow in previous five consecutive months, which largely attributed to the strength in US dollar index (trading above 104) and US 10-year treasury yield trading at around 4.25 levels. But, domestic institutional investors (DIIs) have managed to compensate the same, by pouring in Rs 17,742 crore in the current month.

Also read: This smallcap company just bought stakes in BSE, Manappuram Finance & Jio Financial

And similar was the case for the week gone by too, as FIIs have net sold Rs 4,895 crore worth shares, against Rs 8,496 crore of net buying by DIIs.

Technical View

The Nifty50 corrected for the fifth straight week but has formed an Inverted Hammer kind of pattern on the weekly charts, which is a bullish reversal pattern. Hence, the possibility of rebound initially next week can't be ruled out with immediate resistance at 19,300-19,400 levels and if it possibly closes and sustains above 19,500 then there can be extension for the upward journey, but in case of fall, 19,230-19250 area is likely be the immediate support, and breaking of which can drag the index up to 19,000-18,900 levels, which coincides with horizontal resistance trendline.

Also read: NSE IPO: SEBI has certain apprehensions, says NSE chief Ashishkumar Chauhan

Prices are currently trading near a 10-week EMA (exponential moving average - 19,250), which has been acting as a crucial support for a long. A decisive breach below the 19,200 mark would signal a continuation of this downward trend, potentially driving prices towards the range of 19,000-18,900, aligning closely with the vicinity of the 21-week EMA (18,876), Arvinder Singh Nanda, senior vice president at Master Capital Services said.

F&O Cues

The Options data indicated that the Nifty50 is likely to be in the range of 19,000, which can be critical support, and 19,500, which can be the key resistance area going ahead.

The maximum monthly Call open interest (OI) was seen at 19,500 strike, followed by 19,300 strike and 19,400 strike, with meaningful Call writing at 19,300 strike, then 19,400 strike. On the Put side, we have seen the maximum open interest at 19,000 strike, followed by 19,200 strike & 19,300 strike, with writing at 19,100 strike, then 19,200 strike and 19,000 strike.

On the primary market front, the activity will remain strong in the next week too, with four public issues opening for subscription and two closing, while there will be six listings on the bourses. In the mainboard segment, test and measuring instruments maker Rishabh Instruments will open its Rs 491-crore public issue from August 30-September 1, while the offer by Vishnu Prakash R Punglia will close on August 28, and the anchor book by Ratnaveer Precision Engineering will for open for a day on September 1 ahead of IPO. Further we will have Pyramid Technoplast listing on August 30 and Aeroflex Industries on August 31.

Also read: Bessemer Ventures and Investcorp-backed Medi Assist Healthcare refiles IPO papers

In the SME segment, the public issue of Mono Pharmacare will open from August 28-30, and the bidding for CPS Shapers offer will take place from August 29-31, while Basilic Fly Studio will launch offer on September 1, and Sahaj Fashions will be closing its IPO on August 29. Shoora Designs will be the first for listing among SMEs next week on August 29, as per IPO schedule, followed by Crop Life Science and Bondada Engineering both on August 30. Sungarner Energies will make its debut on August 31.

Corporate Action

Here are key corporate actions taking place next week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.