The market recorded gains for sixth consecutive week ending July 12 and saw a fresh all-time closing high, driven majorly by technology following TCS earnings and FMCG stocks. In addition, good monsoon progress, the rising hope for Fed funds rate cut in September following softer-than-expected US inflation, and expectation of growth-oriented budget lifted market sentiment.

On Monday, the market will first react to June CPI inflation numbers released on Friday evening and HCL Technologies earnings. Further, in the coming week, experts see the market momentum to continue amid intermittent consolidation, with the benchmark indices likely to remain in uncharted territory till the budget, while the focus would be on next set of corporate earnings, Fed Chair Powell Speech, ECB policy meeting and China's GDP numbers.

The BSE Sensex climbed 523 points or 0.65 percent to 80,519, and the Nifty 50 jumped 178 points or 0.73 percent to 24,502, while the Nifty Midcap 100 and Smallcap 100 indices ended moderately higher, underperforming the benchmark indices.

Siddhartha Khemka, Head - Retail Research at Motilal Oswal Financial Services expects this market momentum to continue supported by the expectation of healthy quarterly results, hope of a rate cut, and a pre-budget rally.

In addition, according to Vinod Nair, Head of Research at Geojit Financial Services, the stock-specific moves are expected to gain traction due to the ongoing earnings season. "Indeed, IT will be in the limelight due to the good start to the earnings and outlook. The good progress in the monsoon and expectations of an uptick in volumes aided FMCG stocks to outperform the main indices."

In the week ahead, economic data like China GDP, EuroZone CPI inflation, ECB policy, and the US Fed chair speech will be watched carefully by investors to get cues on market momentum, he said.

Here are 10 key factors to watch next week:Corporate EarningsThe flow of corporate earnings will pick up in the coming week and the participants seem happy about technology stocks especially after TCS reporting in-line numbers as the Nifty IT index extended rally for fourth consecutive week. Over 190 companies will release their quarterly earnings next week.

The key results to watch include Reliance Industries, Infosys, HDFC Bank, HDFC Life Insurance Company, Bajaj Auto, Asian Paints, LTIMindtree, JSW Steel, UltraTech Cement, Wipro, Kotak Mahindra Bank, and Bharat Petroleum Corporation, which have over 36 percent weightage in the Nifty 50.

In addition, Jio Financial Services, HDFC Asset Management Company, Angel One, Bank of Maharashtra, SpiceJet, Aditya Birla Money, L&T Finance, Havells India, L&T Technology Services, Persistent Systems, Polycab India, Tata Technologies, ICICI Lombard General Insurance Company, One 97 Communications (Paytm), PVR Inox, Union Bank of India, Poonawalla Fincorp, RBL Bank, and Yes Bank will also release their quarterly earnings.

Domestic Economic DataOn the economic data front, the participants will focus on the WPI inflation numbers for June scheduled on July 15. Economists expect it to increase compared to 2.61 percent recorded in month of May.

Further, balance of trade for June will also be announced on the same day, while the foreign exchange reserves for week ended July 12 will be released on July 19.

ECB Policy Meet, Fed Chair Powell SpeechOn the global front, investors will keep an eye on the European Central Bank's policy meeting scheduled on July 18 as they mostly expect the central bank to keep interest rates unchanged but will look for a hint on the timing of the next interest rate cut.

Further, the focus will also be on the Federal Reserve Chair Jerome Powell's speech as traders see the 94 percent chance for a rate cut in September especially after the Fed acknowledged the cooling labour market and progress in controlling inflation.

Global Economic DataIn addition, globally, the market participants will also look for cues from retail sales and jobs data in the US, and inflation data of Europe, Japan and United Kingdom for the month of June.

Most importantly, June quarter GDP data and key political gathering (Communist Party of China Third Plenum), scheduled during July 15-18, in the China will also be closely watched as that may keep the metal sector in focus. Generally the world's second largest country focusses more on the longer-term political and economic reforms in such political gathering.

The buying activity at FII desk picked up the pace for another week, hence the focus will be on whether they will continue their buying spree or not in Indian equities for coming weeks. FIIs have net bought Rs 3,844 crore worth of equity shares in the cash segment in the week gone by, while the DIIs outpaced FIIs, purchasing Rs 5,391 crore worth shares during the week.

Meanwhile, the US dollar index dropped from 105.90 on July 1, to 104.08 on July 12, while US 10-year Treasury yield fell from 4.47 percent to 4.19 percent during the same period.

IPOIn the primary market, Sanstar will be the only IPO from the mainboard segment, opening for subscription next week on July 19 and planning to raise Rs 510.15 crore, while the action will continue in the SME segment with three companies launching public issues in the coming week.

Tunwal E-Motors will hit Dalal Street on July 15, while Kataria Industries, and Macobs Technologies will open their maiden public issues on July 16. Further, Sahaj Solar will close its IPO on July 15 and make its debut on the NSE Emerge on July 19.

Technical ViewTechnically, the Nifty 50 is likely to remain positive along with intermittent consolidation next week, with 24,600 seems to be key level to watch for further upside towards 24,800 and then 25,000, while the 24,300 is expected to be immediate support and 24,000 to be crucial support for further downside if any, experts said. The index formed bullish candlestick pattern on the weekly charts, with continuation of higher high formation for eighth straight session.

"The Nifty is exhibiting strong momentum and is approaching the psychological mark of 25,000. While some momentum indicators are signaling overbought conditions, the market may remain overbought for a while longer," Santosh Meena, Head of Research at Swastika Investmart said.

F&O CuesThe weekly options data indicated the 25,000 is expected to be key resistance area for the Nifty 50 in coming days, with crucial support at 24,000 mark, while the immediate resistance and support may be at 24,700 and 24,400 levels, respectively.

On the Call side, the maximum open interest was seen at 25,000 strike, followed by the 25,500 and 24,500 strikes, with maximum writing at the 25,500 strike, followed by the 24,900 and 25,000 strikes. On the Put side, the maximum open interest was observed at the 24,000 strike, followed by the 24,400 and 24,300 strikes, with maximum writing at the 24,400 strike, followed by the 24,500 and 24,000 strikes.

Additionally, "the long-short ratio of FIIs remains elevated, signaling that the market is highly overbought and implying a potential short-term cooldown ahead," Rajesh Bhosale, Technical Analyst at Angel One said.

India VIXThe volatility remained rangebound and below all the key moving averages on weekly closing basis, which consistently may be giving comfort for bulls. The bulls need to be cautious if the volatility jumps to 15-16 levels. The India VIX, the fear gauge, rose 8.11 percent for the week, to 13.73, from 12.7 levels.

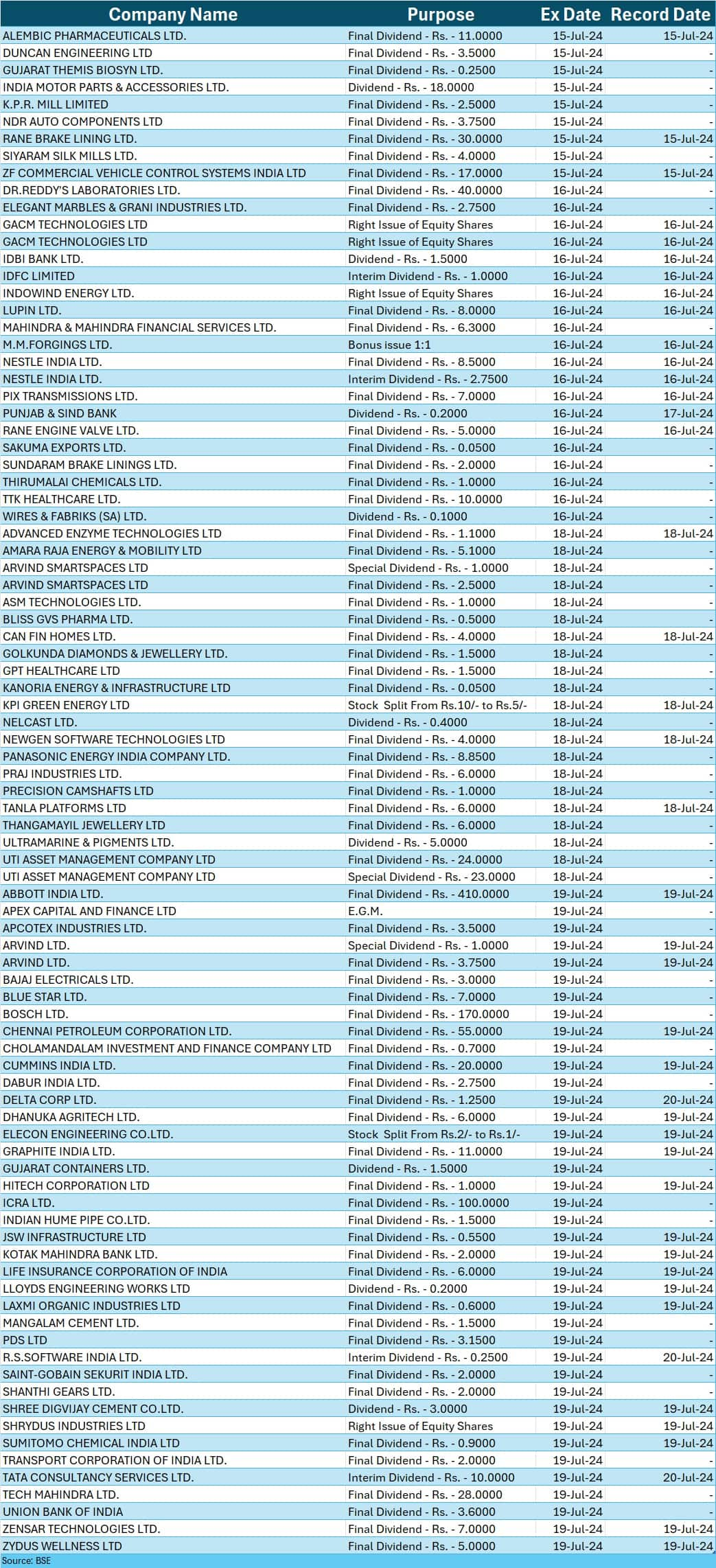

Corporate ActionHere are key corporate actions taking place next week:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.