February 11, 2019 / 15:34 IST

Market Closing

Benchmark indices continued to reel under selling pressure for third consecutive session on Monday. The30-share BSE Sensex fell 151.45 points to 36,395.03and the Nifty50 plunged 54.80 points to 10,888.80.

The broader markets also caught in bear trap with the Nifty Midcapindex falling 1.7 percent and Smallcapshedding 1.8 percent, underperforming frontliners.

The market breadth was largely in favour of bears as about two shares declined for every share rising on the NSE.

Reliance Industries and ICICI Bank were leading contributors to the Nifty's fall.

Dr Reddy's Labs and M&M were biggest losers among Nifty50 stocks, down more than 5 percent each. ONGC, Hindalco Industries and UltraTech Cement were down 4-5 percent.

However, Tata Steel, Cipla, IOC, Tata Motors and HCL Technologies gained 1-2.5 percent.

February 11, 2019 / 15:15 IST

Eicher Motors Q3 profit rises 0.4% to Rs 533 cr

Royal Enfield maker Eicher Motors' third quarter (October-December) consolidated profit grew by 0.4 percent year-on-year to Rs 533 crore with low revenue growth and weak operating income.

Revenue from operations in Q3 increased 3.2 percent to Rs 2,341 crore year-on-year, but Royal Enfield sales volume declined 6 percent YoY against 3.6 percent rise in Q2.

The company sold 1.94 lakh units during the quarter ended December 2018.

February 11, 2019 / 15:01 IST

Management Interview

V C Sehgal, Chairman of Motherson SumiSystems told CNBC-TV18 that December quarter was very tough & challenging and March quarter (Q4FY19) would continue to be challenging but he expects pick up in FY20.

Tariff issues & Brexitcontinued to be the hurdles for industry, he said, adding the company set up33 new plants in last 4 years which would help in additional volumes.

He has maintained company's guidance for 2020 and expectsQ2FY20to be the quarter when SMP picks up.

"We will make every effort to reduce debt further and cross 40 percent return on capital employed," Sehgalsaid.

February 11, 2019 / 14:54 IST

Crude Oil Prices Fall

Oil prices fell as drilling activity in the United States picked up and a refinery fire in the USstate of Illinois resulted in the shutdown of a large crude distillation unit.

Concerns about faltering economic growth curbing fuel demand also weighed on oil markets, traders said.

USWest Texas Intermediate (WTI) crude futures were at $52.43 per barrel, down 0.55percent, from their last settlement. Source: Reuters.

February 11, 2019 / 14:49 IST

DHFL's Clarification on Income Tax Department Notice

DHFL said the company was in receipt of a notice from the Income tax department on February 7 seeking information / evidence on certain aspects of the books of accounts.

"We are in the process of collating the requisite details and would be submitting before the regulatory department in due course of time. Kindly note that the notice does not refer to any suspicious transactions," the housing finance company added.

February 11, 2019 / 14:47 IST

MTNL Seeks Claims Of Up To Rs 500 Cr From DoT

Cash-strapped MTNL has approached the Telecom Department seeking claims of about Rs 500 crore, under multiple heads, including rendering of communications services and reimbursement of employees-related payments made, according to a source.

A source in Department of Telecom (DoT) said that the claims are spread over the last many years and that the request is currently under examination.

"MTNL has raised claims dating back to the year 2000-01 onwards. In all, it has sought about Rs 500 crore on various grounds," the official with knowledge of the matter said. Source: PTI.

February 11, 2019 / 14:43 IST

Earnings

State-runPower Finance Corporation's third quarter profit grew by 70.6 percent year-on-year to Rs 2,075.8 crore, driven by one-time gain of Rs 641 crore.

Revenue from operations during the quarter increased 18 percent to Rs 7,362 crore compared to Rs 6,246 crore in same period last year.

Provision write-back for the quarter stood at Rs 296 crore against provisions of Rs 59 crore in same period last year, the company said, adding exchange gain during the quarter was at Rs 347.2 crore against Rs 12 crore in corresponding period last fiscal.

Also there was dividend income of Rs 102 crore for the quarter against Rs 10 crore in year-ago.

February 11, 2019 / 14:29 IST

Shorts Build Up in Power Finance Corporation after Q3 Earnings

The stock declined a percent after Q3 earnings. Shorts build up was seen in the stock with increase in open interest as well as volume.

February 11, 2019 / 14:16 IST

CESC Ventures Q3 Earnings

Consolidated net profit fell 73.2 percent year-on-year to Rs11 crore and revenue from operations increased14.7 percent to Rs1,130 crore in quarter ended December 2018.

February 11, 2019 / 14:06 IST

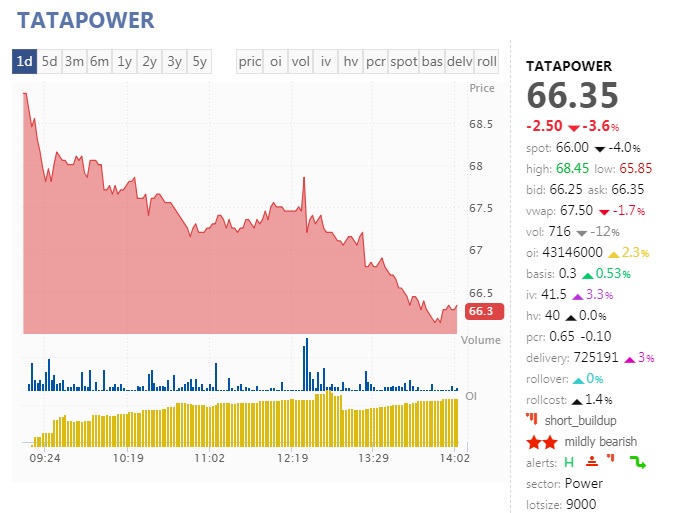

Tata Power fell nearly 4 percent.

Futures and Options data suggests that there is short build-up in the stock with increase in open interest, but the volume declined.

February 11, 2019 / 14:01 IST

Market Update

Benchmark indices remained under pressure with the Sensex falling 226.75 points to 36,319.73, dragged by Reliance Industries, ICICI Bank, L&T and Bajaj Finance.

TheNifty50 fell 71.10 points to 10,872.50, but there was sharp decline in broader markets. The Nifty Midcap and Smallcap indices dipped more than 1.5 percent.

Nearly threeshares declined for every share rising on the NSE.