Pharma intermediates manufacturer Blue Jet Healthcare’s Rs 840.27-crore initial public offering (IPO) opened for subscription on October 25. The IPO is purely an offer-for-sale of over 2.4 crore equity shares by promoters.

The IPO received good interest from non-institutional and retail investors and was subscribed 69 percent at the end of the first day.

The Rs 840 crore IPO’s non-institutional investor portion was fully subscribed. The retail portion was subscribed 78 percent. However, as is generally seen, the qualified institutional buyer (QIB) portion barely received any bids on the first day.

About the company

Blue Jet Healthcare has built a long-term customer base with innovator pharmaceutical companies and multinational generic pharmaceutical companies, supported by multi-year contracts of up to five years. The company directly supplies a critical starting intermediate and several advanced intermediates primarily to three of the largest contrast media manufacturers in the world: GE Healthcare AS, Guerbet Group, and Bracco Imaging S.p.A.

Product mix

The company operates mainly in three niche segments:

Blue Jet Product Mix

Blue Jet Product Mix

Blue Jet Healthcare operates in the global pharmaceutical industry, which can be generally divided into regulated and emerging markets. Emerging markets have relatively low entry barriers in terms of regulatory requirements, the qualification process, quality controls and intellectual property rights.

The company earns a major chunk of revenue from the international market, mainly Europe (74.49 percent), followed by India (13.94 percent), the US (4.88 percent), and Others (6.69 percent) as of Q1FY24. Blue Jet Healthcare has a total of 257 customers and 43 commercialised products across its business.

Blue Jet's Geographical Mix

Blue Jet's Geographical Mix

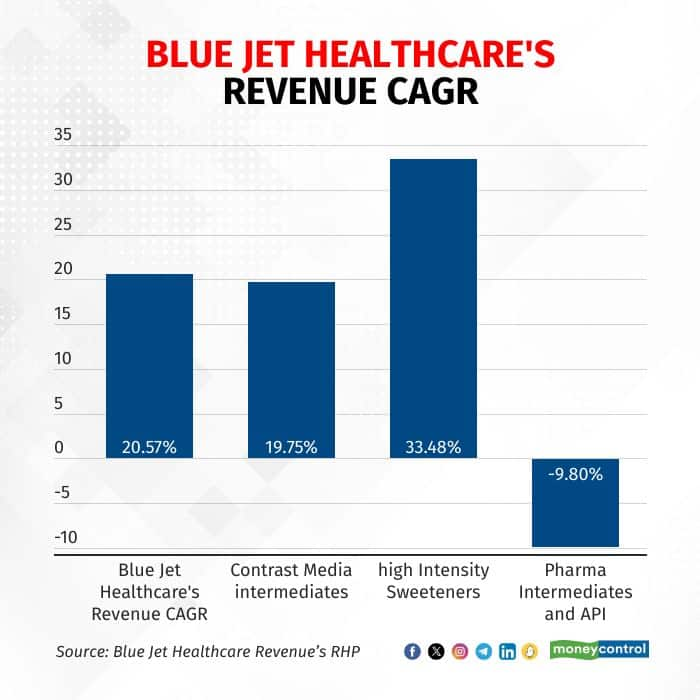

Blue Jet Healthcare’s high-intensity sweeteners witnessed the fastest revenue compound annual growth rate (CAGR) compared to the contrast media segment (20 percent), followed by Pharma intermediates and APIs, which actually witnessed a decline of close to 10 percent over the last three years. The company expects to maintain revenue CAGR of 20 percent over the next three years, similar to its growth in the previous three years.

Blue-Jet-Healthcares-Revenue CAGR

Blue-Jet-Healthcares-Revenue CAGR

Financial parameters

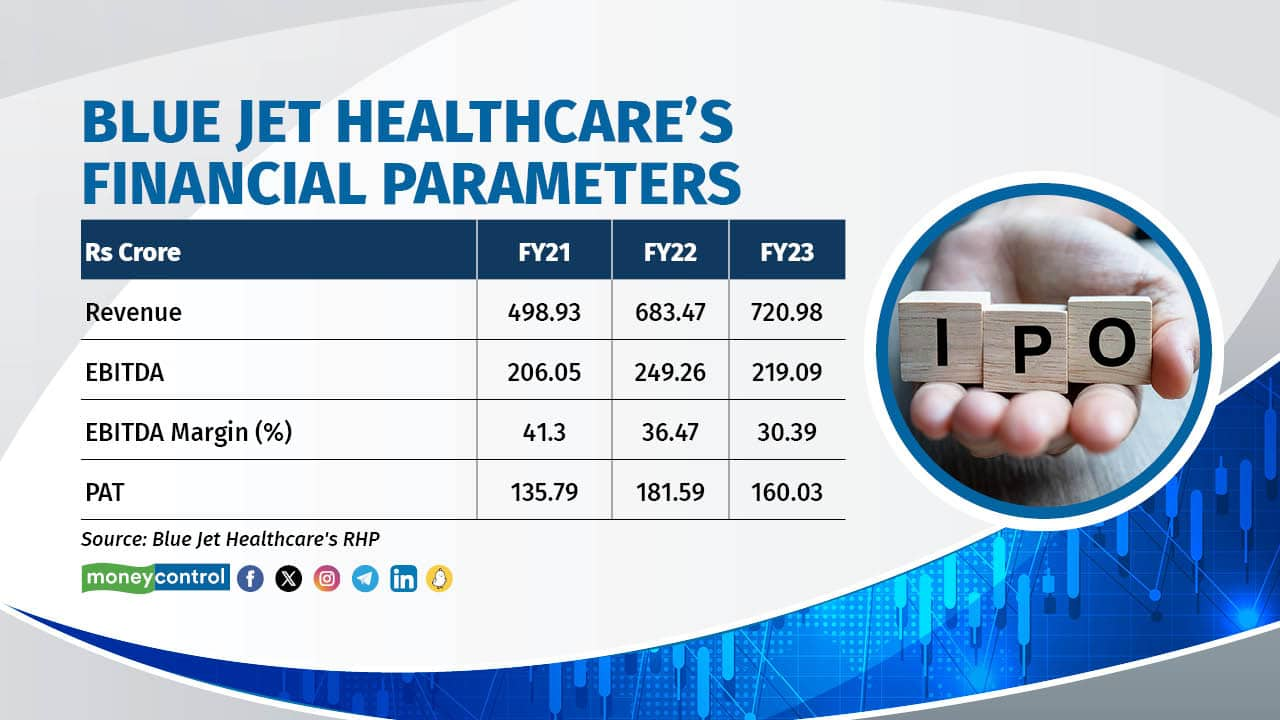

Blue Jet Healthcare’s revenue grew 37 percent in FY22 and moderated to 5 percent in FY23. The EBITDA Margin declined from 41.3 percent in FY21 to 30.4 percent in FY23. Profits contracted for the second consecutive year.

The company’s EBITDA decreased, partially due to an industry-wide trend of soaring prices for basic chemicals, resulting in higher raw material costs and reduced gross margins. Additionally, rising freight costs over the past two years added to its profitability challenges. As part of the company’s ongoing Capex cycle, it is expanding capacity by 50 percent over the next 12-18 months, which has led to increased manpower costs.

Blue Jet Financial Parameters

Blue Jet Financial Parameters

Shareholding pattern:

The company’s promoter shareholding will come down from 100 percent to 86 percent, while its public shareholding will conversely go up to 14 percent post the IPO. Akshay Bansarilal Arora, Shiven Akshay Arora, and Archana and Akshay Arora are the promoters of the company.

BLUE JET SHAREHOLDING PATTERN IPO

BLUE JET SHAREHOLDING PATTERN IPO

Valuation Profile

In terms of valuation, at the upper price band of Rs 346, the company’s IPO is valued at a P/E of 34.02 times its Q1FY24 annualised EPS of Rs.10.17 and at a P/E of 37.48x its FY23 post IPO EPS of Rs. 9.23.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!