Equity mutual fund (MF) schemes witnessed a 4.4 percent month-on-month (MoM) decline in cash holdings in May 2025.

The total cash held across these schemes fell by Rs 7,607 crore, down to Rs 1.65 lakh crore from Rs 1.73 lakh crore in April, according to PrimeMFdatabase.com.

As a share of equity assets under management (AUM), cash levels dropped to 3.56 percent in May from 3.92 percent the previous month, indicating a greater deployment of funds in equity markets.

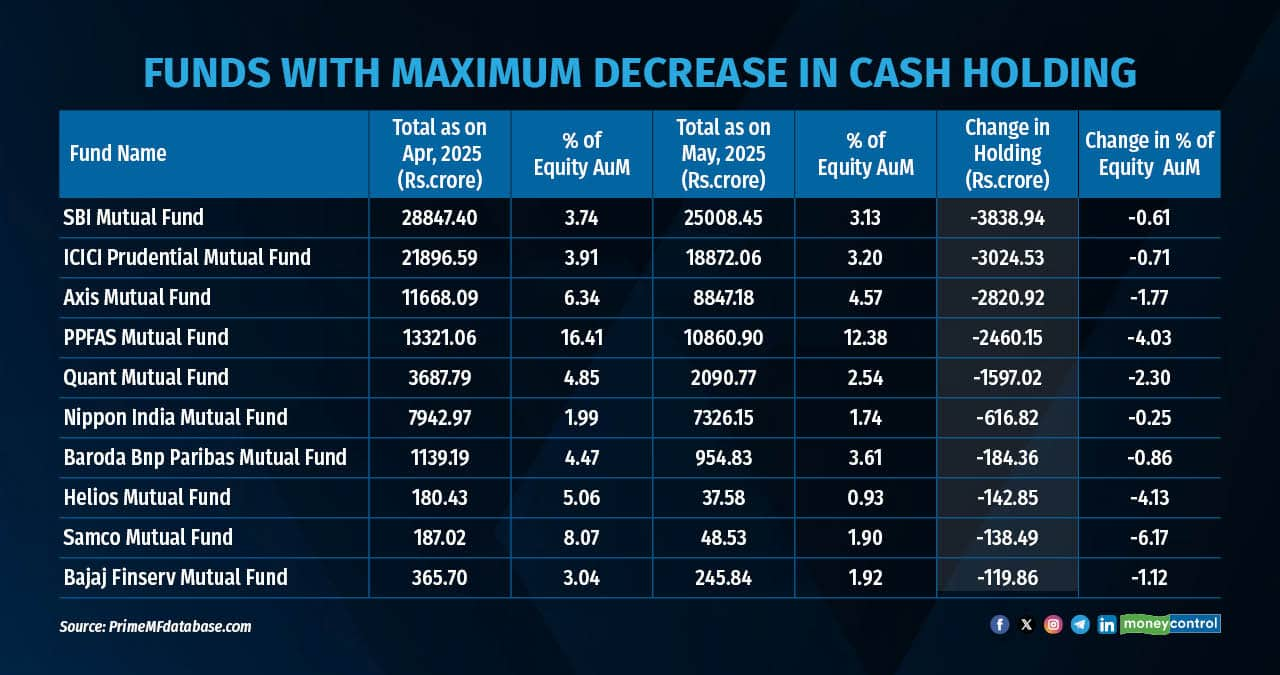

Out of 43 mutual fund houses analysed, 16 increased their cash holdings while 27 reduced them. The largest cuts came from some of the biggest fund houses. SBI Mutual Fund reduced its cash pile by Rs 3,839 crore, followed by ICICI Prudential Mutual Fund, with a reduction of Rs 3,025 crore. Axis Mutual Fund and PPFAS Mutual Fund also reduced cash holdings by Rs 2,821 crore and Rs 2,460 crore, respectively. Quant Mutual Fund lowered its holdings by Rs 1,597 crore.

Also read: SIP stoppage slows, inflows continue: Key takeaways from AMFI's May numbers for equity investors

On the other side, HDFC Mutual Fund raised its cash holdings by Rs 1,736 crore, the highest among peers. Kotak Mahindra Mutual Fund and DSP Mutual Fund increased their positions by Rs 1,007 crore and Rs 760 crore, respectively. Canara Robeco Mutual Fund added Rs 981 crore, while Bank of India Mutual Fund more than doubled its cash levels, with an increase of Rs 255 crore, representing a jump of 2.7 percentage points of its equity AUM.

Among fund houses with smaller AUMs, Old Bridge Mutual Fund raised its cash allocation from 3.5 percent to 13.4 percent of its equity AUM, marking the steepest proportional increase. Meanwhile, SAMCO Mutual Fund reduced its cash holding from 8.1 percent to 1.9 percent.

According to Motilal Oswal's Fund Folio report for May, equity AUM of domestic MFs , including ELSS and index funds, increased 4.7 percent MoM to Rs 351 crore in May 2025, owing to a rise in market indices. During the month, despite some market volatility, the Nifty 50 gained around 1.8 percent while the Sensex gained around 1.5 percent during the period.

Most experts remain positive on Indian markets. In a recent note from Bandhan Mutual Fund, they highlighted that India has been the top-performing market globally over the three months ending May 2025, significantly outperforming the emerging markets index and the world and developed market indices.

"As compared to a 16 percent gain for India, world and developed markets rose by a meagre 2 percent while emerging markets rose 5 percent in the 3-month period ending May 2025," said the report.

But not all find opportunities for investing. In a separate conversation with Moneycontrol, Chirag Mehta, CIO - Quantum Mutual Fund, noted that they still maintained cash positions of around 12-14 percent.

"It's not a reflection of the macro, it’s just that the valuations are not giving us enough opportunities to deploy capital. Cash is generally a residual of our process. If there are opportunities at our comfort valuation, we will go ahead and buy. But today, there are not many. Only a few sectors have opportunities; many others are expensive from a valuation standpoint," he explained in the interview.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.