What is Awesome Oscillator?

Awesome Oscillator is developed by famous technical analyst and charting enthusiast Bill Williams. Awesome Oscillator (AO) is an indicator that is a non-limiting oscillator, providing insight into the weakness or the strength of a stock. The AO is used to measure market momentum and to affirm trends or to anticipate possible reversals. It does this by effectively comparing the recent market momentum with the general momentum over a wider frame of reference.

The AO is useful for technical analysis as it takes other standard momentum oscillators and adjusts the calculation in order to remove the common weakness among them. AO uses a histogram consisting of slopes turning from red to green and vice versa. Because of its nature as an oscillator, the AO is designed to have values that fluctuate above and below a zero line. The generated values are plotted as a histogram of red and green bars. A bar is green when its value is higher than the previous bar. A red bar indicates that a bar is lower than the previous bar.

When AO's values are above the zero line, this indicates that the short-term period is trending higher than the long-term period. When AO's values are below the zero line, the short-term period is trending lower than the longer-term period. This information can be used for a variety of signals.

Why to buy Federal Bank?

The common values used are five periods for the fast and 34 periods for the slow.

As the entry signal, we will take the moment when the histogram’s slopes cross the zero level and change colour according to the trade rules.

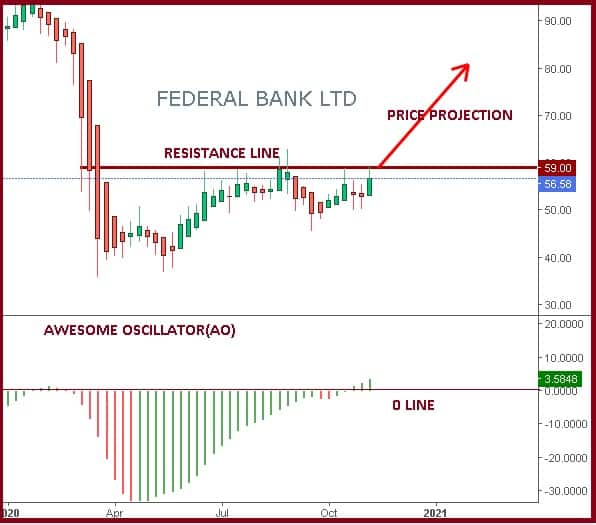

Federal Bank is having a strong resistance line standing around Rs 59 levels indicating strong bullish breakout only above these levels. Recent formation of AO and a green histogram whereby trading above the zero line gives buy signal in this stock. Volume can also add further insight while trading these patterns.

Figure 1. Awesome Oscillator and Buy signal on Federal Bank

Figure 1. Awesome Oscillator and Buy signal on Federal Bank

Buy Signal

1. A close above the resistance line (Rs 59) will give a fresh breakout and acceleration in prices.

2. Short-term moving average 20 SMA (Rs 54) defines that the short-term trend is providing support to buyers as prices are sustained and trading around it.

3. Decent volume participation while pattern breakout will also give additional confirmation.

Profit Booking

Target as per AO is calculated by adding height of recent saucer of the oscillator above the zero line. A price breakout above Rs 59 will push prices on the higher side. Therefore, one can book profits near the previous swing high, which is around Rs 79.

Stop Loss

Entire bullish view negates on breaching of recent swing low on closing basis and one should exit from long position. In case of Federal Bank, it is placed around Rs 49 levels.

Conclusion

We recommend buying Federal around Rs 56 with a stop loss of Rs 49, for a much higher target price of Rs 79 as indicated in the above chart.

(Shabbir Kayyumi, head - Technical Research, Narnolia Financial Advisors Ltd.)

Disclosure: Narnolia Financial Advisors Ltd. is a SEBI registered Research Analyst having SEBI Registration No. INH300006500. The Company/Analyst (s) does/do not have any holding in the stocks discussed but these stocks may have been recommended to clients in the past. Clients of Narnolia Financial Advisors Ltd. may be holding aforesaid stocks. The stocks recommended are based on our analysis which is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!