Banking, finance, and select infrastructure stocks were the runaway favourites of analysts in August as robust credit growth, stable asset quality, and a virtuous capex cycle burnished their appeal.

Banking and finance counters were the stars of the Q1 results season, and the optimism is reflected in Moneycontrol’s Analyst Call Tracker for August.

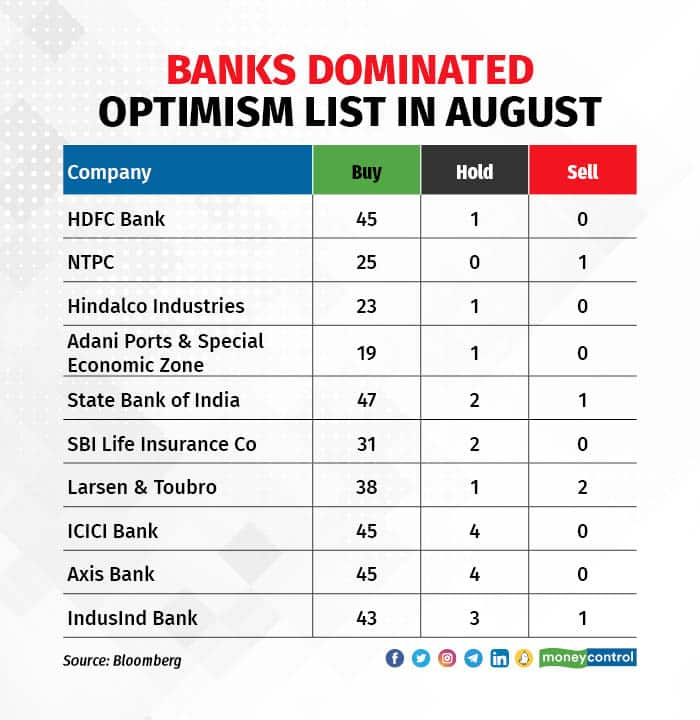

More than half of the companies with the most optimism score or with the maximum upgrades belong to the BFSI (banking, financial services and insurance) space.

In contrast, the gloom-and-doom narrative continued around the information technology sector, which had to endure a sombre Q1 earnings season marred by an uncertain demand environment due to recessionary headwinds in the West.

India’s largest lender SBI leads the chart in terms the most ‘buy’ calls in the month at 47.

Not without reason.

SBI posted its highest-ever quarterly earnings at Rs 16,884 crore for Q1 FY24, soaring 178 percent on-year, though net interest income came in below estimates at Rs 38,905 crore.

The management continues to remain optimistic on credit delivery through revamped buildout in SME, steady growth in retail, and existing pipeline in corporate loans.

“However, with pressure on NIMs (net interest margins) in a rising competitive environment and limited headroom on MCLR repricing, SBI needs to ramp up other avenues of productivity (fee income and lower opex)…,” domestic brokerage HDFC Securities said.

In fact, the pressure on net interest margin was the fly in the ointment for the sector as a whole.

While the RBI has been on a rate hike pause, banks are facing increasing pressure of hiking interest rates further to chase depositors. Moreover, since most of their loan book has been already repriced (more than half of it is linked to external benchmark lending rate (EBLR)), analysts expect the resultant squeeze in margins to weigh on banks’ balance sheets at least for this fiscal.

“The delayed pass-through of monetary-policy rate[1]hikes in deposit rates versus lending rates, coupled with faster growth in credit versus deposits, has resulted in a near 50bp contraction in spreads between lending and deposit rates for the banking system. This is likely to lead to compression of net interest margins for the banking system in FY24 versus FY23,” AnandRathi said in a note.

But the good news is that robust credit demand, which underpins the domestic consumption engine, limits the downside for banks.

“We remain optimistic on medium-term credit growth and expect sector credit to grow 13% y-y in FY24F and FY25F, respectively. We continue to view the banking sector favourably on its strong RoE, reasonable valuations and low imminent risks to earnings,” analysts at foreign brokerage firm Nomura said.

Private sector lenders HDFC Bank, ICICI Bank, Axis Bank and IndusInd Bank all scored over 40 ‘buy’ calls each, reflecting the consensus view on the sector.

Macro Strength

Infrastructure companies were the other top picks of analysts in August, with NTPC, Adani Ports and SEZ and L&T leading the pack.

The government’s focus on infrastructure development, coupled with rising state governments’ and private sector capex, has added sheen to the sector’s near-term outlook.

“Order inflow momentum remains strong and broad-based while some pockets are witnessing moderation on a high base of last year. While government capex continues to remain the major driver, some greenshoots of private capex are visible in traditional as well as new age industries (such as data centres, green energy),” Yes Securities said.

Analyst call tracker: Despite rise in downgrades, market leader UltraTech continues to charm

Most infra firms reported healthy order wins and a strong deal pipeline. Managements also gave out favourable guidance.

For example, engineering and construction major L&T expects revenue to increase 12-15 percent and order inflow to grow 10-12 percent in FY24.

In 1QFY24, consolidated revenue increased 33.6 percent YoY to Rs 47,882 crore, driven by strong growth in infrastructure projects, up 55.5 percent YoY to Rs. 22,396 crore.

“The company’s growing order inflows and order prospects pipeline will support performance in the future. Strong revenue, focus on cash generation, and sound capital allocation are expected to aid the company’s profitability,” analysts at Geojit said.

Pain Points

The Indian IT majors dominate the pessimism list for the month.

The sector as a whole is grappling with the fallout of global macroeconomic challenges, as record high interest rates take a toll on economies in the West and fan recession fears.

The top five Indian IT companies (by market capitalisation) have seen their sequential revenue growth on a constant currency basis at anywhere between -2.8 percent and 1 percent, a far cry from the high single-digit and double-digit growth seen last year. The biggest shocker, however, was Infosys’ sharp guidance cut for the year from 4-7 percent to 1-3.5 percent.

However, Wipro emerged as the company with the most ‘sell’ calls at 18.

The IT services company reported a net profit of Rs 2,870 crore in the first quarter. Though the bottomline was up around 12 percent on year, it fell 6.6 percent on a sequential basis, largely due to a decline across all major financial metrics. The net profit also lagged the Street's estimate of Rs 2,976 crore.

Revenue grew 6 percent on year to Rs 22,831 crore but that too missed estimate of Rs 23,014 crore. Sequentially, the topline was up 1.6 percent from Rs 23,176 crore seen in the previous quarter.

On top of that, the company rolled out a revenue growth guidance of -2 percent to 1 percent in constant currency terms for the July-September quarter on the back of a challenging macro environment.

Morgan Stanley highlighted that the deceleration in Wipro's revenue growth was much steeper than its peers. The firm believes that until Wipro manages to narrow that gap, its P/E discount will likely remain higher as compared to its peers.

Wipro’s Q1FY24 performance missed estimates on all fronts, ICICI Securities noted. EBIT missed Bloomberg estimates by 4 percent, orderbook was weak (down 10 percent QoQ), and revenue growth guidance for Q2 FY24 too fell short of expectations.

“Management commentary did not provide any visibility of pickup in demand ahead,” ICICI Securities added.

While the domestic IT firms tried to put on a brave face during their earning concalls by talking about their increasing focus on generative AI, analysts attributed this more to bluster than substance at the moment.

Another notable name in this list is Asian Paints -- another casualty of the rising competitive intensity in the aftermath of Grasim’s entry into the segment.

“The worst of margin pangs seem behind (for Asian Paints). It, however, will jostle with hard revenue growth comps in FY24. This, coupled with rising competitive intensity, could mean that the pricing lever may remain out of play,” analysts at HDFC Securities added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!