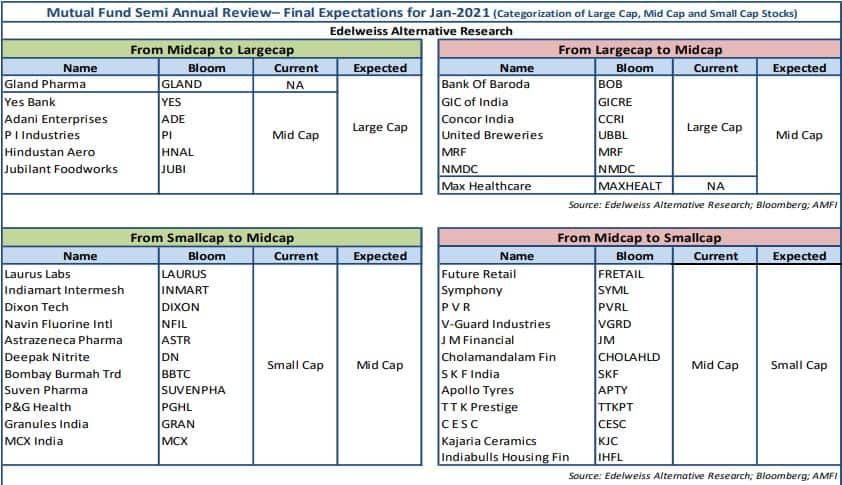

As the Association of Mutual Funds of India (AMFI) is expected to release the new list of large, mid and small-caps in the first week of January 2021, brokerage firm Edelweiss Securities believes Gland Pharma, YES Bank, Adani Enterprises, PI Industries, Hindustan Aeronautics and Jubilant FoodWorks are the stocks that may move from midcap to the largecap category.

On the flip side, Bank Of Baroda, GIC of India, Concor, United Breweries, MRF and NMDC are among the stocks that can move from the largecap to midcap category.

The final/official list of large, mid and small-caps will be released by AMFI by the first week of January 2021, which will be effective for the February-to-July 2021 period.

Indian Mutual funds will have to re-align the schemes within one month.

Laurus Labs, Indiamart Intermesh and Dixon Tech are among the stocks that may move from smallcap to midcap category while Future Retail, Symphony, PVR and V-Guard Industries are among the stocks that can move from mid-cap to small-cap category, Edelweiss Securities said.

As per the SEBI circular dated October 6, 2017, mutual funds have one month to align their portfolios as per the fresh list.

The market regulator on September 11 tweaked its October 2017 circular, mandating multi-cap funds to invest at least 25 percent each in small-caps, midcaps and large-cap stocks, leaving the remaining 25 percent to their discretion.

These funds are now required to invest a minimum of 75 percent of their assets in equity and equity-related instruments from 65 percent earlier.

On September 13, the regulator issued a clarification, reemphasising that mutual funds should be true to label and stick to appropriate benchmarking, indicating its seriousness to implement the circular strictly.

The SEBI said it was conscious of market stability and that is why it had given the industry time till January 31, 2021, to meet the new minimum limit norms pertaining to multi-cap funds.

All mutual funds are required to comply with the latest provisions by the first week of February 2021.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!