Maruti Suzuki share price rose 2 percent in the morning trade on December 17 after Bank of America Merrill Lynch (BofAML) upgraded the stock and raised the target price to Rs 8,650 from Rs 7,450, implying a 22 times FY22 price-to-earnings ratio (PE).

The updated target price translates into an upside of 21 percent from the closing price of December 16 at Rs 7,135.05.

In the calendar year 2019, the stock has lost 4 percent of its market value as of December 16 close, while the equity benchmark Sensex gained almost 14 percent in the same period.

BofAML's upgrade of Maruti is underpinned by its belief that India’s biggest carmaker by value is well placed for cyclical uptick in FY22, with limited BS-VI risks.

Let's take a look at the five factors that led to Maruti's upgrade.

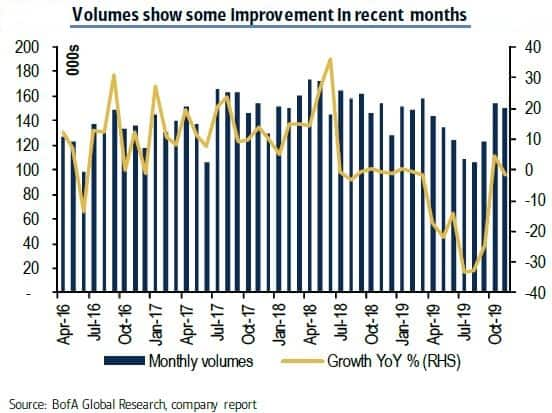

Volume growth set to recoverVolumes are expected to see an uptick from Q3 itself as the overall de-stocking cycle is largely over, thinks BofAML.

Besides, despite discounts being higher in Q3, the overall volumes are expected to be much higher than Q2, which, according to BofAML, should offset any negative impact of lower volumes.

"We expect volume growth of 10 percent and 11 percent in FY21 and FY22, respectively. This is based on restocking of inventory levels, the cyclical recovery in volumes and low base effect," said BofAML.

On year to date basis, Maruti’s volume decline has been 20 percent year-on-year (YoY) (domestic volumes) against 20 percent for the industry, BofAML said. Volume growth for the passenger vehicle (PV) industry and Maruti Suzuki has been weak since July 2018 as sales have remained soft.

During this period, original equipment manufacturers (OEMs), especially Maruti Suzuki, aggressively cut production to align wholesale and retail volumes. However, November 2019 data suggests that production increased 4 percent YoY after many months of decline, BofAML said.

The financial firm's assessment shows that the inventory is under control and the overall levels are likely to increase in FY21 as OEMs restock back to 40-45 days.

The switch-over to BS-VI emission norms is expected to be disruptive for demand due to the 4-12 percent increase in average selling price.

"For Maruti, that risk is much lower as an estimated 60 percent of products have already transitioned to BS-VI this year itself. Currently, only diesel vehicles and some petrol products are yet to transition," said BofAML.

Margins expected to bottom in Q3Pricing trends are suggesting that in November, discounts were meaningfully lower for Maruti Suzuki but not for the industry.

"While discounts are coming off from their September 2019 highs, Q3 levels are likely to be a peak on a quarterly basis, in our view. With price increases and new launches, we expect pricing trends to improve from January 2020," said BofAML.

In addition to pricing trends, Maruti Suzuki is taking many cost-reduction initiatives to boost margins. Also, weak input prices (steel and aluminium in particular) are a tailwind to margins in the near-term, BofAML said.

"With improving volumes and stability of pricing, we expect margins to improve to 13 percent by FY22. This compares to a high of 15 percent in FY16. We expect margins in the current recovery cycle to lag the previous cycle as the previous cycle was led by new launches and thus a very favourable pricing scenario," said BofAML.

Earnings growth set to pick upWith an improvement in volumes and margins, BofAMl expects earnings per share (EPS) growth to accelerate, with 26 percent CAGR (FY20-22E) against a (-2) percent CAGR over the last four years (FY17-20).

"We highlight that during previous recovery cycles, Maruti has seen high growth (38 percent EPS CAGR FY14-17)," BofAML said.

Given the sharp decline in margins in FY20 and potential recovery from the second half of FY21, BofAML's estimate of earnings improvement is back-ended because of which Maruti still looks expensive on a one-year forward basis. "However, on FY22E earnings, the stock is currently trading at 21 times PE, which is below its historical average of 25 times," BofAML said.

"Despite Maruti already being one of the more expensive stocks under our coverage–regionally too–we see room for the multiples to sustain if indeed the volume recovery goes as expected."

During previous cycles, Maruti’s valuation multiples expanded to 30 times on a one-year forward basis, it said. The premium to the valuation is also partially based on the lack of other alternatives in the PV sector in India.

Valuation shows healthy potentialBofAML said it followed the triangulated approach to valuation, where it valued the stock using DCF (discounted cash flow), EV/EBITDA and price/book value methods.

"DCF assumes long-term earnings growth of 16 percent, with terminal growth of 4 percent and WACC (weighted average cost of capital) of 9.9 percent, EV/EBITDA of 16 times on FY22E and P/BV (price to book value) of 4 times based on the company’s return on equity compared with its peers," BofAML said.

Along with these 5 key factors that resulted in an upgrade for Maruti, there are some risks as well.

Increasing competition from other OEMs could lead to more discounting to maintain the market share, which in turn will hamper the margins for the company, BofAML said.

The contraction in valuation multiples if earnings recovery is delayed is also a concern. Maruti trades at a premium to the broader Indian market as well, which can correct if the earnings improvement doesn’t materialise, BofAML said out.

There is talk of GST rate hike across categories. If applicable rates increase materially for PVs, it can adversely impact demand.

Besides, being a net importer, a depreciation in rupee would raise import costs, which again is a cause of concern, BofAML said.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.