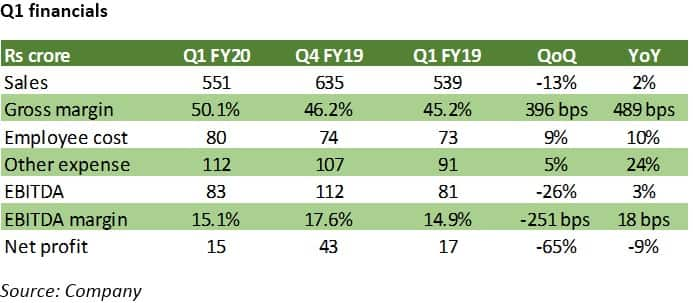

Laurus Labs posted a mixed set of numbers wherein adverse impact of transition in ARV-API business was partially offset by strong growth in formulation space. Favourable product mix helped in better gross margins. However, EBITDA margin could improve moderately due to higher other expenses. The management notes that operating expenses increased due to higher production volume required for ramp up of sales from Q2 FY20.

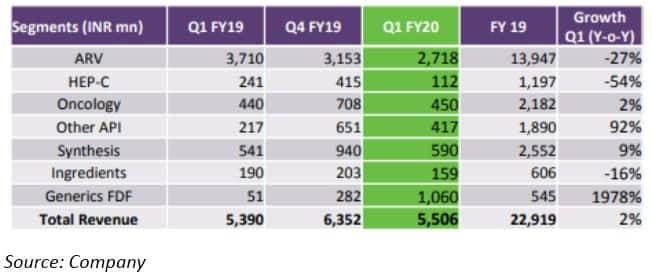

Sales growth was lacklustre at 2 percent YoY rise, mainly on account of weak growth posted by the largest segment - APIs (67 percent of Q1 FY20 Sales). Note that the company’s ARV (antiretroviral)-API (active pharmaceutical ingredients) sales (49 percent of June quarter sales) have been impacted as the end industry is shifting from the ARV medication of Efavirenz to Dolutegravir (DTG), Lamivudine and Tenofovir intermediates. In the quarter gone by, there was lower offtake of Efavirenz combined with slower pick-up in Lamivudine due to approval delays. The pharma player is hopeful of a faster offtake in next generation ARV-APIs in coming days.

Hepatitis APIs sales as well dropped. But there was a sharp pick-up in sales of other APIs.

Table: Segmental performance

Highlight of the quarter has been strong performance improvement for generic FDF (fixed dosage formulation) business. This segment share of total sales has improved to 19 percent now, from 1 percent in Q1 FY19. The growth had been led by Rs 80 crore sales coming from LMIC (low and middle-income countries) business. The company expects similar business opportunity in coming quarters. Other noticeable aspect of the quarter has been launch of Pregabalin (epilepsy drug) in the US in July.

In case of synthesis business/CDMO (contract development and manufacturing organisation services), strong sales growth traction sustained. Segment accounts for 11 percent of total sales. Note that in the quarter gone by, the company has commenced commercial supplies from Unit 5 for ASPEN.

Outlook:In the medium term, we continue to expect low double-digit sales growth driven by increasing share of formulation business, extension in API portfolio and strong momentum in synthesis play. Note that the company has completed the validation of all second-line ARV-APIs and now offers a comprehensive basket of the same. Additional lever of growth for the company is its increasing export exposure (47 percent of sales in FY19 vs 38 percent in FY18), which speaks about its international penetration through key API value chain and synthesis business.

On the margin front, we view that surge in prices for KSM (key starting material) remains a risk and should be more than offset by better product mix. Furthermore, the company’s forward integration into formulation business, along with operating leverage, should help in improving EBITDA margins to ~18 percent in the medium term.

Finally, the stock has corrected by 32 percent from its 52-week high and trades at EV/EBITDA multiple of 9x for FY21. This is broadly in line with the sector average. However, given the exposure to promising therapeutic areas and diversified portfolio backed by strong R&D investment (7.6 percent of Q1 FY20 sales), the company warrants investor attention.

For more research articles, visit our Moneycontrol Research pageDisclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.