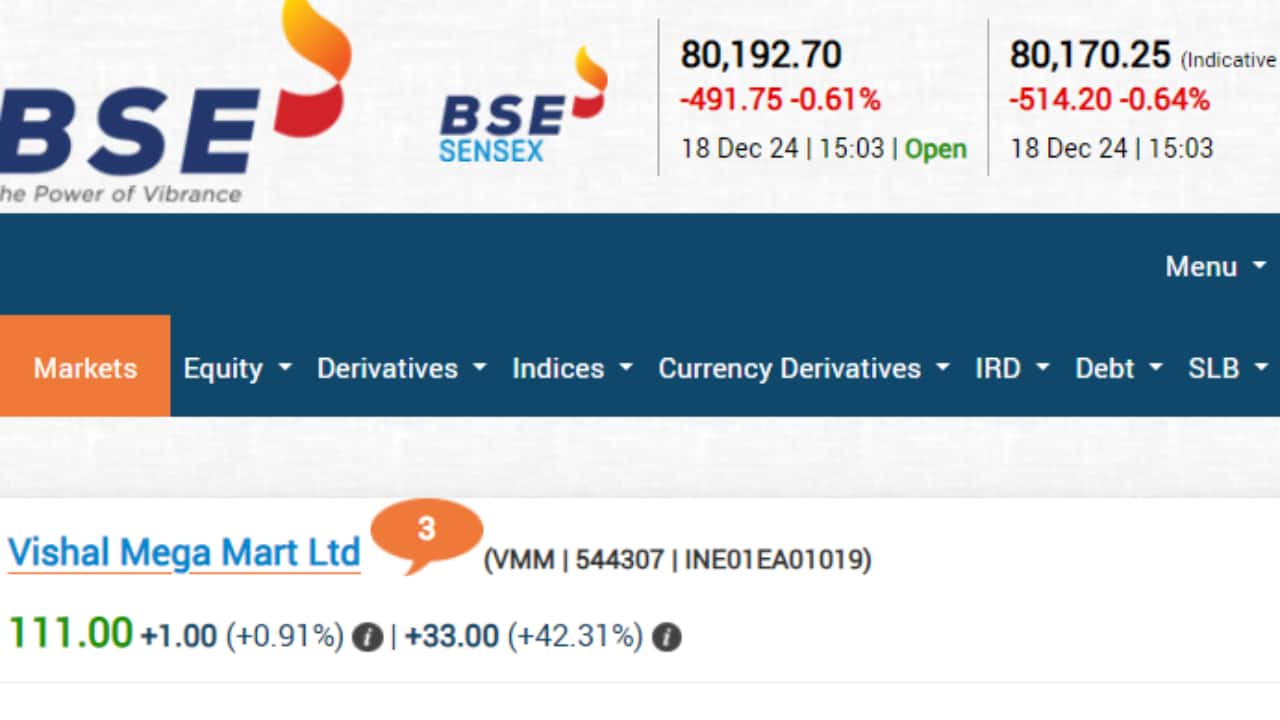

Vishal Mega Mart Listing Highlights: Vishal Mega Mart closes at Rs 111.70 on BSE after robust debut

Vishal Mega Mart Share Price Latest Updates Today (December 18): Vishal Mega Mart made an impressive market debut on December 18, opening at Rs 110, 41% premium over its IPO price, taking the company’s valuation to Rs 35,168.01 crore. Investors seem to have bet on the budget retailer’s growth prospects. The company’s revenue grew at CAGR of 26.3% from FY22 to FY24. It has 645 stores which sell grocery, apparels and household goods to middle and lower-middle-class consumers. Vishal Mega Mart ended the day at Rs 111.95 on BSE. Here are the highlights of Vishal Mega Mart’s debut day:

-330

December 18, 2024· 15:45 IST

Vishal Mega Mart Listing Highlights: Vishal Mega Mart closes at Rs 111.70 on BSE after robust debut

- Vishal Mega Mart had a strong debut, opening with a 41% premium over its IPO price.

- The company demonstrated robust financial performance, with a revenue CAGR of 26.3% from FY22 to FY24.

- It has an extensive market presence, with 645 stores catering to India’s middle and lower-middle-class consumers.

- On the listing day, Vishal Mega Mart’s stocks closed at Rs 111.95 on the BSE.

-330

December 18, 2024· 15:21 IST

IGI IPO allotment live: How to check International Gemmological Institute IPO allotment on KFin Technologies portal

- To check the allotment status on the KFin Technologies Limited portal, follow these steps:

- Visit the KFin Technologies Limited web portal.

- Select the IPO from the dropdown list (the name will appear only after the allotment is finalized).

- Choose one of the three modes: Application Number, Demat Account Number, or PAN ID.

- In the application type field, select either ASBA or non-ASBA.

- Enter the relevant details based on the mode selected in Step 3.

- Complete the captcha for security verification.

-330

December 18, 2024· 15:07 IST

Vishal Mega Mart Share Price Live: Vishal Mega Mart in green

-330

December 18, 2024· 14:46 IST

Vishal Mega Mart Share Price Live: What's Bajaj Broking’s listing day review of Vishal Mega Mart IPO

Vishal Mega Mart had an impressive debut on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) on December 18, 2024. The company’s shares listed at ₹110 on the BSE, a 41% premium to the issue price of Rs 78, and at Rs 104 on the NSE, a 33.33% premium. The IPO generated strong demand, with institutional investors oversubscribing their portion by 81 times, while the retail segment was oversubscribed 2.3 times. This robust performance reflects investor confidence in the company’s growth potential and strategic position in India’s retail sector.

-330

December 18, 2024· 13:50 IST

IGI IPO allotment live: Where to check International Gemmological Institute IPO allotment on registrar's portal

Investors can also check the allotment status through the online portal of KFin Technologies Limited, the registrar for the issue, at https://kosmic.kfintech.com/ipostatus.

-330

December 18, 2024· 13:10 IST

IGI IPO allotment live: How to check International Gemmological Institute IPO allotment on BSE

- Investors who applied for the International Gemmological Institute IPO can check their allotment status on the Bombay Stock Exchange (BSE) website by following these steps:

- Visit https://www.bseindia.com/investors/appli_check.aspx.

- Select Equity under the issue type.

- Choose International Gemmological Institute Limited from the issue name dropdown menu.

- Enter your application number.

- Provide your PAN card details.

- Complete the CAPTCHA by clicking on I am not a Robot and then click the Search button.

-330

December 18, 2024· 12:45 IST

IGI IPO allotment live: Who are the book-running lead managers for International Gemmological Institute?

Axis Capital, Kotak Mahindra Capital, Morgan Stanley India, and SBI Capital Markets are the book-running lead managers for the International Gemmological Institute IPO, with KFin Technologies serving as the registrar. The shares are scheduled to be listed on both the BSE and NSE on Friday, December 20.

-330

December 18, 2024· 12:14 IST

IGI IPO allotment live: International Gemmological Institute - company profile

Founded in February 1999, International Gemmological Institute (India) is a globally renowned organization specializing in certifying and grading diamonds, gemstones, and jewelry. IGI issues independent grading reports that assess and certify the characteristics of stones based on internationally recognized standards.

-330

December 18, 2024· 11:57 IST

IGI IPO allotment live: What happened during the 3 days of subscription period of International Gemmological Institute IPO

The IPO was oversubscribed by 33.78 times overall. The portion reserved for Qualified Institutional Buyers (QIBs) was subscribed 45.80 times, while Non-Institutional Investors (NIIs) subscribed 24.84 times. Retail investors and employees also showed strong interest, with their allocations being subscribed 11.21 times and 20.63 times, respectively, during the three-day bidding period.

-330

December 18, 2024· 11:48 IST

IGIIPO allotment live: A look at the IPO of International Gemmological Institute

The IPO of Mumbai-based International Gemmological Institute was open for bidding from December 13 to December 17. The shares were offered within a price range of Rs 397-Rs 417 per share, with a lot size of 35 shares. The company successfully raised Rs 4,225 crore through the IPO, comprising a fresh share issuance worth Rs 1,475 crore and an offer-for-sale (OFS) amounting to Rs 2,750 crore.

-330

December 18, 2024· 11:44 IST

International Gemmological Institute IPO allotment live: When, where and how to check allotment status of IGI's public offer - check here

The International Gemmological Institute is expected to finalize the share allotment for its IPO soon. Applicants can expect to receive messages, alerts, or emails regarding fund debits or IPO mandate revocations by Thursday, December 19. The diamond certification company received an enthusiastic response from investors during the bidding process.

-330

December 18, 2024· 11:11 IST

CII Summit Live: 'Reciprocity will matter in future,' top govt official on Trump's statement

"Reciprocity will matter in future is what I make of Donald Trump’s statement, this will be in clear violation of WTO norms. But there are instances where Trump has used Section 232 of tariff act. One will have to wait and watch. We have tariff peaks in many areas, but we don't export them to US market. For instance, some agri products. But in a few items where this might impact us," says DGFT DG.

-330

December 18, 2024· 11:03 IST

Vishal Mega Mart Share Price Live: What are core strength areas of Vishal Mega Mart

- Vishal Mega Mart has established a robust pan-India omnichannel network that includes:

- Offline Channel: A network of 645 physical stores spanning 414 cities across India.

- Online Channel: E-commerce platforms comprising the company’s website and mobile application.

- The online channel allows consumers to check product availability at their nearest stores and place orders online for home delivery or in-store pickup, providing a seamless shopping experience.

-330

December 18, 2024· 10:55 IST

Vishal Mega Mart Share Price Live: What's happening to Vishal Mega Mart stocks after strong listing

-330

December 18, 2024· 10:48 IST

Business news live: Govt to soon start pilot for less than a minute clearance for e-commerce exports, says DGFT DG

- Govt to start pilot for less than a minute clearance for e-commerce exports in February and March: DGFT DG

- There are plans for branding of medical tourism plans. We are trying to talk to big hospital chains like Apollo, Max and Fortis to ensure that we are able to target markets and get more medical value travellers: DGFT DG

-330

December 18, 2024· 10:06 IST

Vishal Mega Mart Share Price Live: Vishal Mega Mart makes stellar D-Street debut

Vishal Mega Mart shares make a robust debut on the exchanges, listing with a 41% premium at Rs 110. The stock opened on the NSE with a 33.3% premium, priced at Rs 104, indicating robust demand and positive investor sentiment.

-330

December 18, 2024· 09:56 IST

Vishal Mega Mart Share Price: Here's what Mehta Equities says about Vishal Mega Mart

Long-term investors are advised to consider holding onto the company's shares despite potential short-term volatility and market risks. For those who were not allotted shares in the IPO, it is recommended to accumulate the stock if there are any dips post-listing, which could occur due to profit-booking activity. - Mehta Equities Research Analyst Sr VP Research Prashanth Tapse

-330

December 18, 2024· 09:50 IST

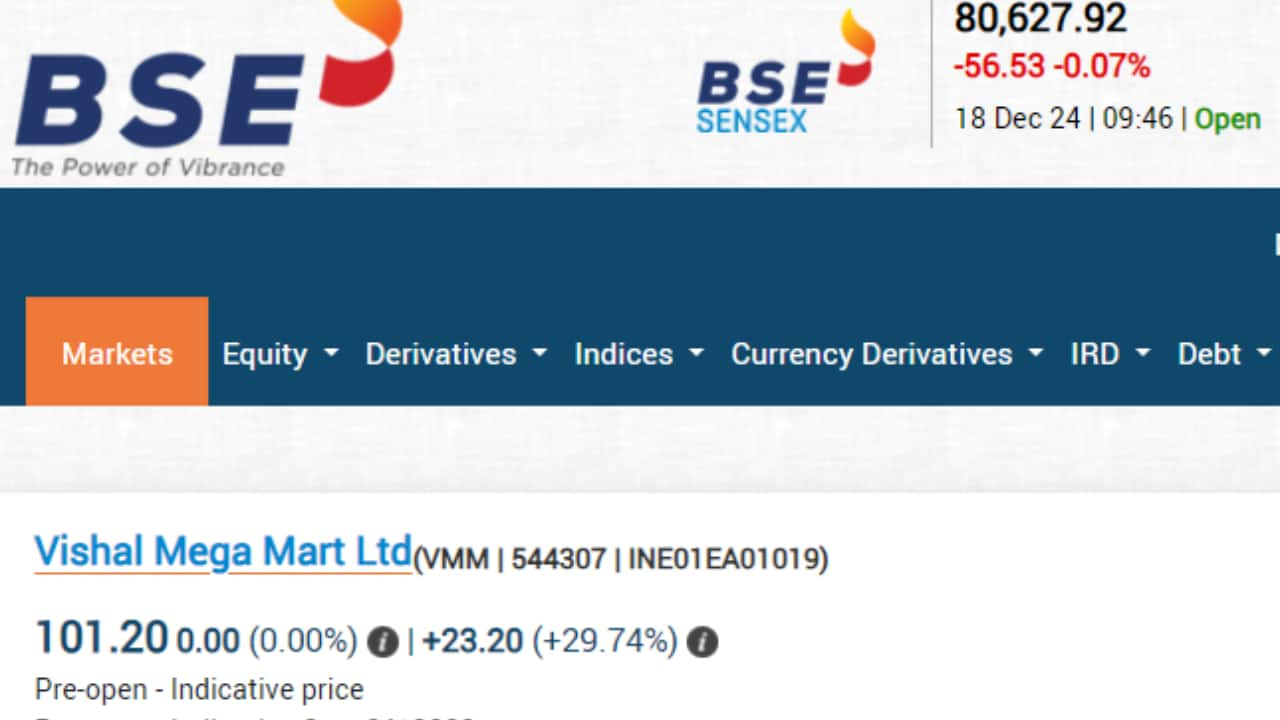

Vishal Mega Mart Share Price: What are the latest levels of pre-open trade

-330

December 18, 2024· 09:48 IST

Vishal Mega Mart Share Price: Know about D-Mart's IPO size and more? Key takeaways

- The public issue of Avenue Supermarts, which raised Rs 1,870 crore, received bids worth Rs 1.38 lakh crore, significantly oversubscribed by 104.59 times.

- The IPO was open for subscription from March 8-10, with a price band set between Rs 295 and Rs 299 per share.

- The Rs 1,870 crore IPO was the largest since PNB Housing Finance’s Rs 3,000 crore offer in October of the previous year.

-330

December 18, 2024· 09:34 IST

Vishal Mega Mart Share Price: What happened during 2017 listing of D-Mart? All you need to know

- Investors saw substantial returns on their investment in the IPO. A single lot of 50 shares, priced at Rs 299 per share, cost an investor Rs 14,950. At the listing price of Rs 610, the total value of the investment surged to Rs 30,500. This resulted in a solid profit of Rs 15,550 per lot (excluding brokerage charges).

- During the day, the stock reached an intraday high of Rs 615, reflecting a gain of 105.68%, and a low of Rs 558.75, which was up by 86.87% from the issue price, highlighting the strong market debut and investor confidence.

-330

December 18, 2024· 09:31 IST

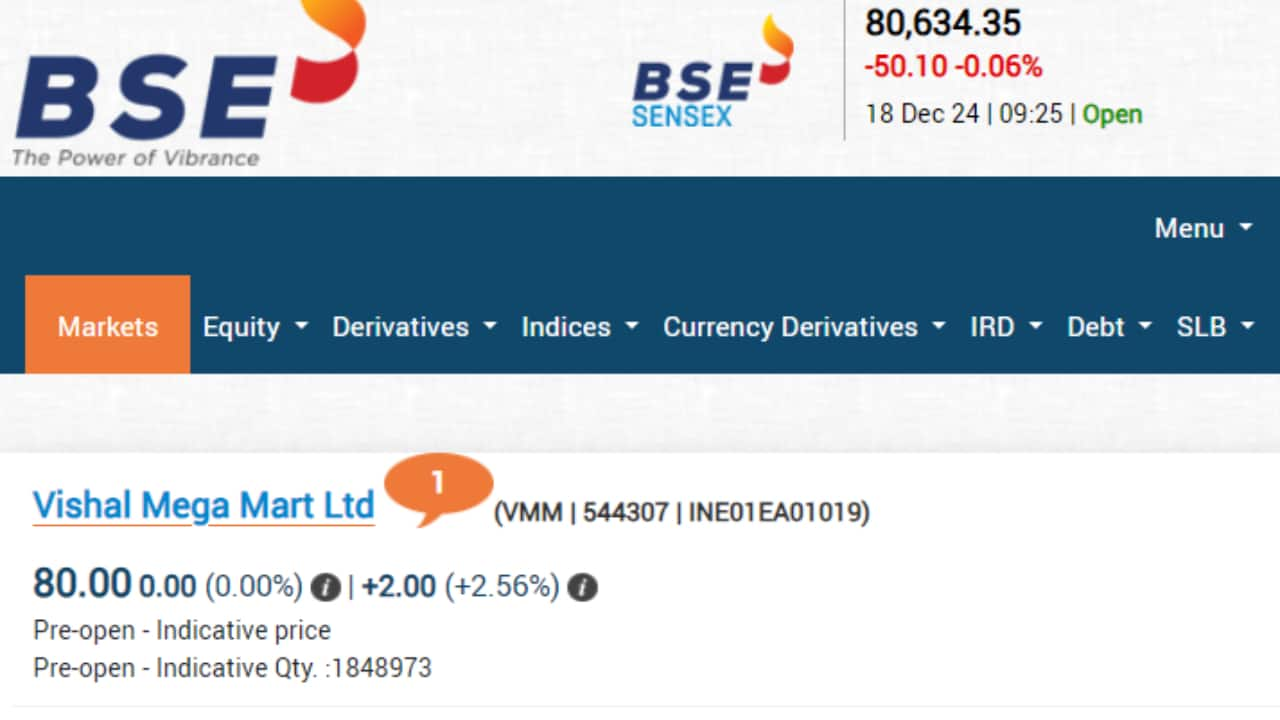

Vishal Mega Mart Share Price: Vishal Mega mart trades at Rs 80 on BSE in pre-open

- While the listing ceremony is underway, the shares of Vishal Mega Mart show a positive start in pre-open

- Trading at Rs 80, Vishal Mega Mart is likely to see a strong start. However, this is just an indicative level, which is subject to change

-330

December 18, 2024· 09:24 IST

- The listing ceremony of Vishal Mega Mart is being held at the National Stock Exchange.

- You can watch the ceremony updates here with our live coverage or check the direct link

Listing ceremony of Vishal Mega Mart Limited will be starting soon at our Exchange @NSEIndia. Watch the ceremony live!https://t.co/7ILJmBgrd1#NSE #NSEIndia #listing #IPO #StockMarket #ShareMarket #VishalMegaMartLimited @ashishchauhan

— NSE India (@NSEIndia) December 18, 2024

-330

December 18, 2024· 09:16 IST

Vishal Mega Mart Share Price: What's the latest GMP for Vishal Mega Mart IPO?

According to Investorgain.com, a site that tracks grey market premiums (GMP), the latest grey market premium for Vishal Mega Mart's IPO stands at Rs 22. This indicates that the shares are expected to list at a premium of Rs 22 above the upper price band of the IPO, which was set at Rs 78 per share. The grey market premium is an informal indicator, based on speculative trading of shares before the official listing. While it reflects the demand for the stock in the unofficial market, it does not guarantee the exact listing price on the stock exchanges. Nevertheless, a positive GMP suggests strong investor sentiment and anticipation for a favorable market debut.

-330

December 18, 2024· 09:02 IST

Vishal Mega Mart Share Price: Throwback to D-Mart's stellar listing

In 2017, Avenue Supermarts, the operator of the D-Mart supermarket retail chain, saw its stock more than double on its debut. The shares listed at Rs 604.4 on the Bombay Stock Exchange, reflecting a remarkable 102 percent gain over the issue price of Rs 299.

-330

December 18, 2024· 08:47 IST

Vishal Mega Mart Share Price: Swastika Investmart says Vishal mega Mart is suitable for high-risk investors

In its report, Swastika Investmart stated that the Vishal Mega Mart IPO is suitable for high-risk investors looking to gain exposure to the retail sector. The brokerage highlighted that Vishal Mega Mart, as one of India’s leading offline retailers, holds a strong market position. They also noted that the IPO’s valuation is reasonable, making it an attractive investment option for those willing to take on higher risk in anticipation of long-term growth in the retail industry.

-330

December 18, 2024· 08:41 IST

Vishal Mega Mart Share Price: Bajaj Broking recommends subscribing to Vishal Mega Mart's IPO with a long-term perspective

- Analysts at Bajaj Broking have recommended subscribing to Vishal Mega Mart's IPO with a long-term perspective. In their research note, they pointed out that the issue is priced at a price-to-book value (P/BV) of 5.94, based on the company's net asset value (NAV) of Rs 13.14 as of September 30, 2024, and the post-IPO NAV.

- The analysts further noted that if FY25 annualized earnings are attributed to the post-IPO fully diluted equity capital, the IPO’s asking price corresponds to a price-to-earnings (P/E) ratio of 69.03. Based on FY24 earnings, the P/E ratio stands at 75.73, suggesting that the issue is priced aggressively.

-330

December 18, 2024· 08:32 IST

Vishal Mega Mart Share Price: Master Capital gives 'SUBSCRIBE' for long-term tag

- Analysts at Master Capital have recommended that investors subscribe to Vishal Mega Mart's public offering with a long-term outlook. They emphasized that the company, as a key retail player serving middle and lower-middle-income consumers, is well-placed to seize significant growth opportunities in the market.

- The analysts also noted that Vishal Mega Mart plans to drive same-store sales growth through several strategic initiatives. These initiatives include expanding its product offerings, introducing hyperlocal products tailored to regional demands, utilizing technology and data from its loyalty programs, and improving the in-store shopping experience. These efforts are expected to enhance the company's competitive position and contribute to sustained growth in the retail sector.

-330

December 18, 2024· 08:23 IST

Vishal Mega Mart Share Price: AUM Capita recommends 'SUBSCRIBE'

- Analysts at AUM Capital have advised investors to subscribe to Vishal Mega Mart's public offering with a long-term perspective. In their research report, they highlighted that the growing disposable income and increasing consumer preference for quality and hygienic products give established players like Vishal Mega Mart a competitive edge over the unorganized sector. This also positions the company well against other branded retail chains such as Spencer’s and Reliance Smart Bazaar.

- Additionally, the analysts noted the company’s strong financials and debt-free status, which further strengthen its investment appeal and provide a solid foundation for sustained growth in the retail sector.

-330

December 18, 2024· 08:17 IST

Vishal Mega Mart Share Price: Who are the promoters of Vishal Mega Mart

Samayat Services LLP and Kedaara Capital Fund II LLP serve as the promoters of the company. These entities play a key role in driving the company’s strategic direction and growth initiatives. Samayat Services LLP has been instrumental in supporting the company's operations and management, while Kedaara Capital Fund II LLP, a private equity firm, brings significant financial expertise and backing.

-330

December 18, 2024· 07:39 IST

Vishal Mega Mart Share Price: What is anchor investor round?

The anchor investment round is typically held a day before the public offering opens, and it plays a crucial role in ensuring the IPO's success by attracting high-profile institutional investors. In this case, Vishal Mega Mart was able to attract significant participation from prominent institutional investors, which further boosted confidence in the company’s prospects. This anchor investment, combined with the strong market response, underscores the positive outlook for Vishal Mega Mart as it prepares to list on the stock exchanges. The IPO is designed to raise capital to fund the company’s growth and expansion, particularly as it aims to strengthen its presence in the highly competitive retail sector in India.

-330

December 18, 2024· 07:31 IST

Vishal Mega Mart Share Price: How much money Vishal Mega Mart raised from anchor investors

Vishal Mega Mart's IPO successfully raised Rs 2,400 crore from anchor investors, securing strong institutional backing ahead of the public offering. The anchor investors placed their bids on December 10, 2024, marking a significant step before the IPO’s official subscription period. The allocation to anchor investors was an important part of the process, as it provided early support for the offering and helped generate interest among other investors.

-330

December 18, 2024· 07:27 IST

Vishal Mega Mart Share Price: Why this brokerage firm has given 'SUBSCRIBE' tag to Vishal mega Mart IPO

In its report, brokerage firm Choice has advised investors to subscribe to the Vishal Mega Mart IPO with a long-term perspective. The firm highlighted that the company has shown consistent growth in both its top and bottom lines over the years. Vishal Mega Mart’s primary focus is on Tier-2 cities, which are expected to experience a 32 percent compound annual growth rate (CAGR) in their diversified retail sector between CY23 and CY28, presenting significant growth opportunities. At the upper end of the price range, the brokerage noted that Vishal Mega Mart is commanding an EV/Sales multiple of 3.8x, which appears fully priced. However, the firm pointed out that the company’s steady revenue growth, driven by an expanding store network and the success of its private label sales, has positively impacted margins. Additionally, the company's strong inventory and working capital management strategies provide a solid foundation for a sustainable long-term outlook.

-330

December 18, 2024· 07:15 IST

Vishal Mega Mart Share Price: What's the latest GMP for Vishal Mega Mart IPO

According to Investorgain and IPO Watch, which monitor grey market premium (GMP) trends, the GMP for Vishal Mega Mart shares has surged to 28 percent. This indicates that the stock could potentially list at a premium of Rs 19-20 above its IPO price. The price band for the IPO was set between Rs 74 and Rs 78 per share, with the allotment being made at the upper end of Rs 78 per share.

-330

December 18, 2024· 07:03 IST

Vishal Mega Mart Share Price: How many stores Vishal Mega Mart operate across India

The Rs 8,000 crore public issue of Vishal Mega Mart, which operates a widespread network of 645 stores across India, saw an overwhelming response, with the issue being oversubscribed by 27 times. Investors placed bids for a staggering 2,064 crore shares, compared to the 75.67 crore shares available for subscription.

-330

December 18, 2024· 06:53 IST

Vishal Mega Mart Share Price: Vishal Mega Mart's positioning in highly competitive retail sector

Vishal Mega Mart, recognized for its affordable offerings such as clothing starting at Rs 99 and a wide range of groceries, operates in India’s highly competitive $600 billion grocery and supermarket sector, where it competes with major retail chains like DMart and Tata Group's Star Bazaar. Despite the challenges faced by its competitors—such as the pressures of high inflation and the rise of quick-commerce companies—Vishal Mega Mart appears to be relatively insulated. According to analysts quoted by Reuters, approximately 70 percent of the company’s stores are situated in smaller cities, where quick-commerce has yet to gain significant traction. This strategic positioning in less urbanised areas gives Vishal Mega Mart an edge, as it faces less direct competition from rapid delivery services that are more prevalent in larger metropolitan markets.

-330

December 18, 2024· 06:33 IST

Vishal Mega Mart Share Price: When is the listing of the Vishal Mega Mart IPO- time slot

As per the rule, the shares of Vishal Mega Mart will begin trading from 10:00 am. However, there will be levels during the pre-open trade as well. This may change till the listing is done. We will bring you the latest pre-open levels.

-330

December 18, 2024· 06:03 IST

Vishal Mega Mart Share Price: A look at strong demand from the investors - understanding the bidding

- The IPO of Vishal Mega Mart witnessed an extraordinary response from investors, reflecting the immense interest in the Gurugram-based retail giant. The issue attracted bids for a staggering 2,064 crore shares, significantly exceeding the 75.67 crore shares that were made available for subscription. This resulted in the IPO being oversubscribed by an impressive 27.28 times, underscoring the strong demand among investors across categories.

- In terms of monetary value, investors collectively placed bids worth a whopping Rs 1.6 lakh crore, an amount far surpassing the Rs 8,000 crore issue size. This overwhelming level of participation highlights the confidence of the investing community in Vishal Mega Mart’s business model, market position, and future growth potential. The remarkable oversubscription also places the IPO among the most sought-after public offerings in recent times, solidifying the company’s stature in the retail sector and the broader market.

-330

December 18, 2024· 06:01 IST

Vishal Mega Mart Share Price: How investors were able to check their allotment for Vishal mega Mart's IPO

- Investors who participated in the highly anticipated IPO of Gurugram-based retail giant Vishal Mega Mart had the opportunity to check the allotment status of their shares through the official website of the registrar, KFin Technologies Limited. This platform provided a straightforward and secure method for investors to confirm whether they had been allotted shares in the mega issue.

- Additionally, the finalised share allotment details were also made available on the official websites of the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). These platforms ensured transparency and ease of access for investors to verify their allotments, reflecting the company’s commitment to maintaining efficient and investor-friendly processes during the IPO.

-330

December 18, 2024· 05:59 IST

Vishal Mega Mart Share Price: Vishal mega Mart's IPO - An overview

- The Rs 8,000 crore Initial Public Offering (IPO) of Vishal Mega Mart was structured entirely as an Offer For Sale (OFS). In this format, the existing shareholders of the company divested a portion of their holdings by selling their shares to new investors. As a result, no fresh capital was raised by the company, and the proceeds from the IPO went directly to the selling shareholders rather than to Vishal Mega Mart itself.

- The price band for the IPO was set between Rs 74 and Rs 78 per share, reflecting the valuation determined by the company and its advisors. This pricing strategy aimed to attract a wide range of investors, ensuring robust participation while aligning with market expectations. The Offer For Sale structure highlights the existing shareholders’ intent to monetize their investment while providing an opportunity for the public to become part of Vishal Mega Mart’s growth journey.

-330

December 18, 2024· 05:58 IST

Vishal Mega Mart Share Price: Vishal mega Mart's latest grey market premium and health warning

According to current reports, Vishal Mega Mart’s shares are trading at a Grey Market Premium (GMP) of Rs 19. This suggests that the stock could potentially list at Rs 97 per share, a notable increase from its IPO price of ₹78. The Grey Market Premium reflects the enthusiasm and optimism among investors ahead of the listing. However, it is important to emphasize that the GMP is an informal and speculative indicator that does not have any direct correlation with the actual listing price on the stock exchanges. Market conditions, investor sentiment, and broader economic factors ultimately determine the listing price, making the GMP an unreliable predictor of the final outcome.

-330

December 18, 2024· 05:57 IST

Vishal Mega Mart Share Price: Vishal mega Mart listing today

Vishal Mega Mart, one of the leading supermarket chains in the country with a wide national presence, is all set to make its stock market debut on the bourses today. The company recently concluded its highly anticipated Initial Public Offering (IPO), which aimed to raise Rs 8,000 crore. The IPO witnessed an extraordinary response from investors, with the issue being oversubscribed more than 27 times. During the three-day subscription period, investors placed bids totaling an impressive Rs 1.6 lakh crore, reflecting significant interest and confidence in the company’s growth potential. This strong demand highlights the anticipation surrounding Vishal Mega Mart’s entry into the stock market and sets the stage for a closely watched listing.