Betting big on the growing sentiment around pharmaceutical stocks, drugmaker Concord Biotech is gearing up for a debut on Dalal Street. The company is backed by late big bull Rakesh Jhunjhunwala's investment firm RARE Trusts, which has sparked the Street's interest in the listing.

The company’s initial public offering (IPO), for which bidding opens on August 4, has gotten investors amped up thanks to marquee names such as Helix Investment Holdings (operated by Quadria Capital Fund LP, a healthcare-focused private equity fund) and Ontario Fund being associated with it. But does Concord Biotech have the ingredients needed to stage a blockbuster listing?

Concord Biotech specialises in producing specific fermentation-based Active Pharmaceutical Ingredients (APIs) within the fields of immunosuppressants and oncology, and commands a significant market share. The company has a diverse portfolio, with a strong global footprint, that boasts of a presence in over 70 countries, a fact that excites analysts.

In 2022, Concord Biotech commanded a market share of over 20 percent by volume for identified fermentation-based API products. Another jewel in Concord's crown that provides further cushioning for investors is its impressive financials. The company recorded a 37.2 percent on-year increase in net profit in FY23 at Rs 240 crore over the previous year. This growth was primarily driven by its strong performance in both topline and operating metrics. The topline grew 20 percent year-on-year to Rs 853.2 crore during the same period.

Source: RHP, Axis Capital

Source: RHP, Axis Capital

On the operating front, Concord Biotech’s EBITDA (earnings before interest, tax, depreciation, and amortisation) grew 25.6 percent, reaching Rs 343.3 crore. The company's operating profit margin for FY23 also expanded by 190 basis points to 40.2 percent.

In addition, the tailwinds in the API segment are another positive that may lure investors hoping to bet on its growth prospects. However, there is more to Concord Biotech than what meets the eye, and investors should analyse some of the underlying risks before getting in.

Do the valuations leave scope for an upside?

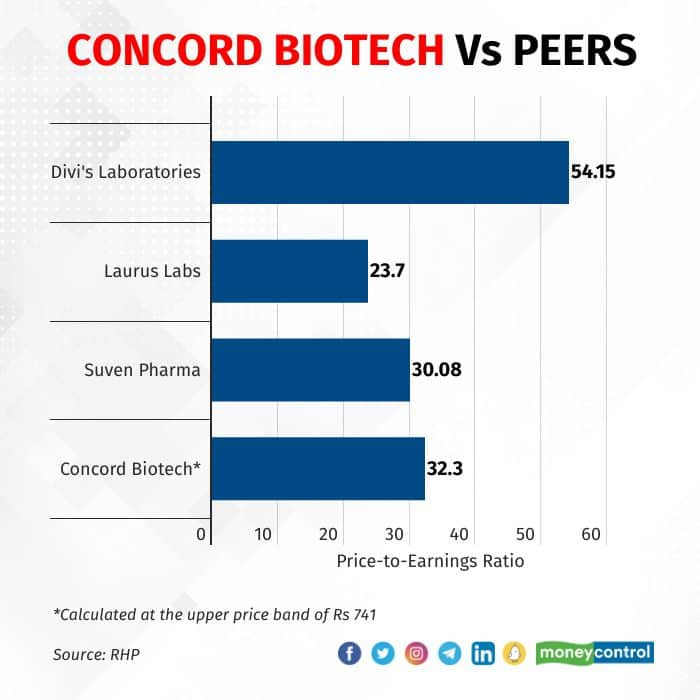

The price band for Concord Biotech's Rs 1,550.59 crore public offer has been fixed at Rs 705-741 per share. This takes the drugmaker's price-to-earnings (P/E) ratio to 32.3 times its FY23 financials.

In comparison, its peer Divis Laboratories trades at a P/E of 54.15 times. Suven Pharmaceuticals is at 30.08 times and Laurus Labs at 23.70 times. However, another interesting fact here is that though Concord Biotech's PE is higher than most peers, its return on equity is also better than its rivals.

Concord's return on equity (RoE) improved remarkably year-on-year, rising to 26.55 percent in FY23 from 16.64 percent in FY22. Similarly, the return on capital employed (RoCE) also showed progress, moving higher at 28.54 percent in FY23 from 20.55 percent during the year-ago period.

Despite that, some market participants feel the company's RoCE and RoE profiles are still lower for its strong operating metrics. An analyst explained, on condition of anonymity, that the subdued RoE and RoCE profiles are due to the company's lower utilisation at current levels. The analyst sees a huge scope of an increase in the RoE and RoCE profile of Concord, which is already at a premium to its peers, as its utilisation moves higher.

Regardless, most analysts feel that the company's valuation at the current level factors in much of its near-term upside potential. “Assuming the current financials at the upper price band of Rs 741, the issue appears to be fully priced in, discounting near-term triggers,” analysts at Mehta Securities highlighted.

Kranthi Bathini, Director, Equity strategy, at WealthMills Securities, also shared a similar view and believes that upcoming investors should look at subscribing to the public offer with a long-term perspective.

What about growth prospects?

Bathini also believes Concord's higher P/E valuations are justifiable when one compares their product mix against other peers in the segment. Concord's product mix tilts heavily towards the oncology segment, a space within the global pharma universe that is buzzing with expectations of strong growth in the coming time. While other pharma players are slowly turning their heads towards this segment, Concord has already established a name for itself here, which leaves greater room for long-term growth.

Bathini also highlighted the strong API pipeline of Concord Biotech, which also supports his expectations of the company being set on a path of robust growth.

As for the listing pop, analysts at Mehta Securities believe the upbeat market sentiment for pharma stocks may push the stock higher on debut, and suggest short-term investors book profits in case listing gains surpass the 25 percent mark.

Strong legacy and management pedigree

The growth of a company is heavily reliant on its top brass and Concord Biotech's management presents a strong case here. Bathini also backed this view as he believes the fact that ace investor Utpal Sheth being a director in Concord Biotech provides much comfort to investors. Sheth is also the CEO of Rakesh Jhunjhwala's investment firm, Rare Enterprises, which is an investor in Concord.

Another analyst also showed faith in the top management as it has managed to deliver a CAGR (compound annual growth rate) of 15-20 percent for Concord Biotech in recent years.

Rounding that up, subscribing to the public offer may suit investors looking for a long-term investment, while those searching for blockbuster returns like Mankind Pharma should probably lower their expectations. Or sit this one out.

Also Read | Concord Biotech IPO opens tomorrow: 10 things to know before bid for the issue

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!