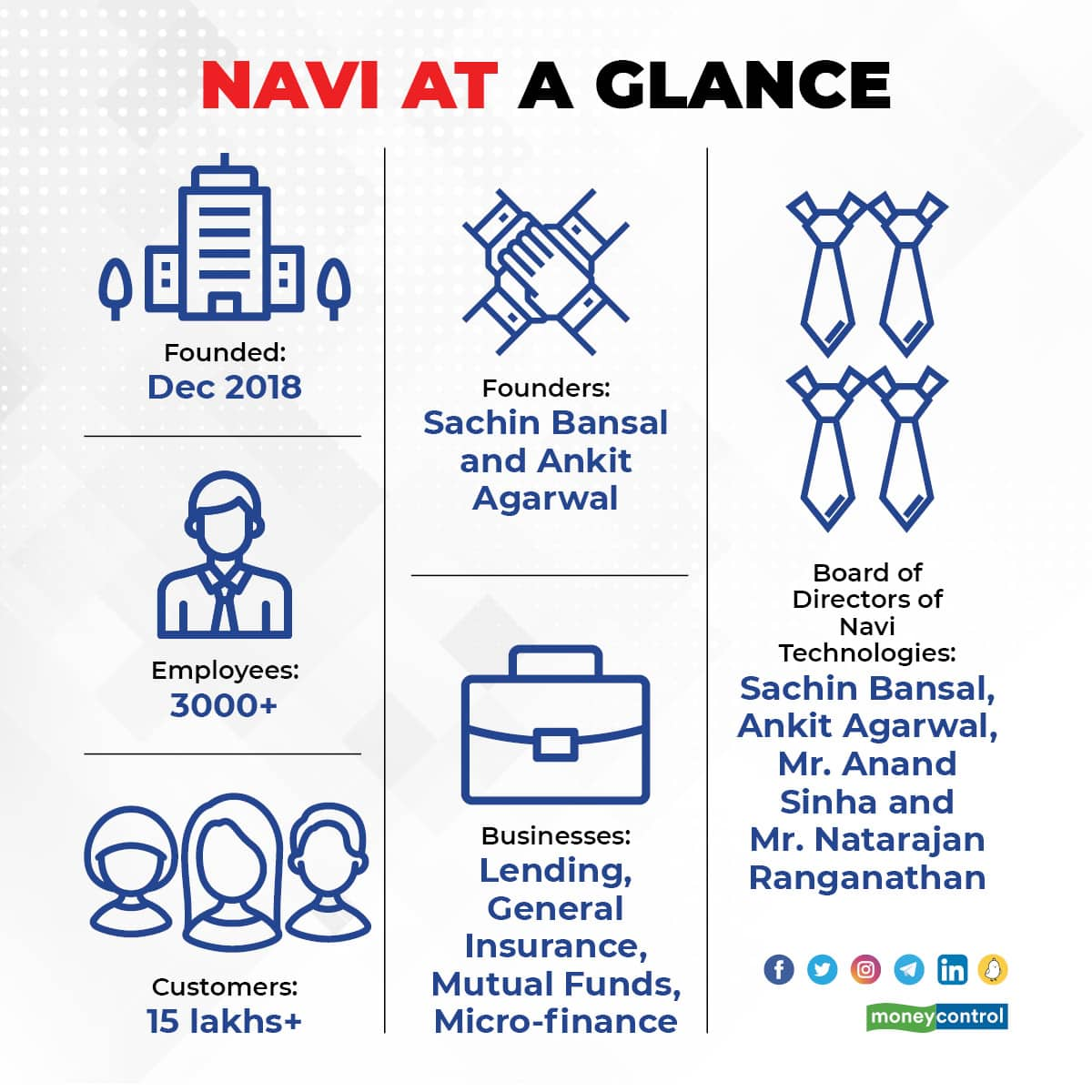

It is easy to miss Sachin Bansal, one of India's most well-known startup entrepreneurs, when you enter the new office of Navi Technologies, which he co-founded in December 2018 with his college friend Ankit Agarwal.

Sachin founded Navi Technologies just six months after quitting his first venture Flipkart, which Walmart bought for $16 Billion in the same year.

Sachin doesn't have a cabin, he sits hunched over his laptop amidst rows of employees, 60 percent of whom have returned to the office.

He also looks different: no spectacles, no jacket, no branded sweatshirt. He wears a plain black t-shirt paired with jeans and is 25 kgs lighter. "I took to working out during the lockdown. I used to be a 100 kgs before," he says.

Navi is headquartered in Koramangala, the same Bengaluru suburb where Sachin Bansal and Binny Bansal co-founded Flipkart nearly 15 years ago, a startup that would go on to become India's leading e-commerce player and inspire a generation of entrepreneurs. Sachin says he never imagined he would leave Flipkart and now plans to build Navi into a financial services behemoth over the next two decades.

Its businesses now include lending, general insurance, mutual funds, and microfinance, even as it awaits regulatory nod for a universal banking license. While it made a series of acquisitions to enter segments such as microfinance, insurance, and mutual funds, it wants to build a bank from the ground up, with the technology stack built in-house. A bank that can serve a billion Indians, according to Bansal.

Bansal spoke to Moneycontrol about the performance of Navi's businesses, how his bank will be different, his evolution as an entrepreneur, key learnings from Flipkart, and why India will become the talent factory of the world.

EDITED EXCERPTS:How have you been, Sachin?As of now, I am very upbeat. The technology transformation essentially got accelerated by 2-3 years. People like my parents for example started using online payments. Companies would have gotten there eventually but that has got accelerated by a couple of years. I’m very excited about that because a similar transformation can happen in financial services.

We are seeing a lot of digital adoption in lending and insurance. For example, in-home loans, there are no physical signatures, it is all digital signatures and we are talking about people in remote areas. Physical paperwork is not completely gone but we have reduced it to almost a third of what it used to be with other tools. General awareness of tech and trust in using tech has gone up. We see that even in microfinance - people are using Phone Pe and Google Pay for payments.

So, Navi...It's Navi. It is short for the word navigator. We are your financial navigator because financial services are too complicated and you need a navigator.

You started with microfinance, then personal loans, home loans, mutual funds and health insurance. How are each of these products doing and how have you made technology central to everything?Businesses are picking up. We have a few lakh customers, it is not in crores or at a Flipkart scale yet. It is early days right now. We are building all the tech in-house. That is the big difference we are creating. We could have used vendors like the other players but that will not be transformative, a lot of those tech solutions were built for the offline world. If you are serious about tech, you should write your own stacks.

When you say it is different, give us a few examples. For instance, I read that you use AI and ML to underwrite loans.Yes, in our app there is no manual intervention. The end-to-end process for a loan is completely digital in a 20-minute cycle. That is a big difference from what others have done. Most players will have partially digital journeys. It reduces cost for the customer, the cost-saving can be passed on to our users. Again, we are very early in our journey and have a long way to go.

When you speak to traditional lenders, they say lending is easy but collections are the challenge, and for that, despite tech, you need some level of physical underwriting to be able to assess a borrower’s profile. Don't you think tech has limitations?Microfinance, a lot of it is still physical, we are in the process of making it digital. But in the non-micro finance pool, things can be a lot more automated, I don’t think people have pushed the boundaries. A lot of times it is also fear of the unknown. We are taking a long-term view, we want to build a very large scalable business, which basically runs through machines and systems. We do a lot of small experiments and learn from them. For personal loans, we believe things can be hundred percent automated, even for home loans we are getting there. There is some manual process involved because of automation and physical verification of properties but even that can be a fully digital journey.

But how are you controlling the quality of your loan book, with technology central to the way you generate loans? Can you give us a sense of collections, because many digital lenders have come under stress in the last year with bad loans going up?There was some increase but it was expected and nothing out of the ordinary. From a risk perspective, if you remove the COVID impact we have been fine. Now with things coming back to normal, our collections are at the best ever. In microfinance and the other businesses, we are in…

Any numbers you can share?Our target is to keep it (NPAs or non-performing assets) at a low single-digit. There is proof every day that you can get there in pure digital means - secured and unsecured loans

What is the current size of your loan book? I think you were aiming for Rs 4200 crore by March 2022. Are you on track?We have disbursed more than 900 crores in new loans and microfinance is much bigger, about 200 crores a month. Overall size of the book - microfinance will be 1500 crore and non-microfinance will be 600 Crore if you remove all the collections. Overall put together, we will be 350 crores a month if you add microfinance and new lending products.

We are now comparing ourselves with banks and NBFCs. That’s why I don’t call ourselves a fintech company. That is why we describe ourselves as a financial services company that happens to be good in technology. I don’t like the word fintech, lot of fintech don’t have their own books.

So not a fintech?Yes, fintech sounds a little less serious

So who is your role model here- a Bajaj Finserv and Bajaj Finance, an ICICI or the HDFC group?I don’t think we have a clear parallel. I think HDFC will come close but they haven’t yet combined everything, except for the brand name which is common. What we are trying to do is unique. If the HDFC group would be reimagined today with in-house technology, what would it be?

Navi?Maybe.

Our focus is completely on passive funds. Customers understand index funds very easily, we want to sell something where customers can make a decision without advisors. Index funds are more simple. We believe it will scale because it is simple to understand.

What other adjacencies do you see at this point?We have our hands full right now. Within insurance, we see a lot of scope.

What is the update on your application for a universal banking license? Where do things stand now?RBI has been very proactive in reaching out to us, so it is also under process.

Are you worried that the recent ED notice to you and Flipkart on the alleged FEMA violations might cast a shadow on that? Especially when RBI evaluates you based on a promoter’s fit and proper criteria.I can’t comment on behalf of RBI.

But a comment from your end?I think we will clear RBI’s fit and proper criteria, I don’t think that will be a concern.

There is a lot of inbound interest, we are in talks with a few. But we are not in a rush because we have enough capital. The bank will require capital, we have already committed 1500 crore in our application. We want to create a big bank.

How are you visualising the bank? You’ve said in the past that you want to reach a billion customers. So how will Navi bank be different?We are not a neo bank, I think neo banks are a customer funnel for some big banks. That is not a very attractive proposition for us. We are trying to work backwards and see what a bank for a billion people looks like. It has to be a lot more automated, things have to be a lot more simple, users should be able to help themselves. Banking should be as easy as going on Swiggy and ordering food. We want to reimagine the boundaries and I don’t think any bank can reach a billion people without being super automated. We have some thoughts on what it will look like, which we will reveal as we go along…

So the focus will be on retail…The focus will be mostly retail, which is where the largest underserved segment is.

But you don’t think this is a saturated space already- with PSUs, private banks, and neo banks…But the service is poor…

So there is white space?Yes, in terms of trying to get a home loan, opening a fixed deposit.

But now you can do that (open an FD) on Google Pay.But I think banks can do a much better job than what they have, I don’t think they are designed to serve a billion people.

Will Navi bank have branches at all?Some branches yes but these will be customer service points.

And plans for stockbroking?We have a license but we haven’t yet started, we are still thinking about that

It is also interesting that you stayed away from payments. That’s typically been used as a customer acquisition funnel…I think payments is a full-time job. I was at Flipkart and I saw PhonePe. You can’t do lending and financial services as a part-time activity. It is a specialist job, if we start doing payments we will be super distracted. You can build an independent customer funnel and a brand, payments on their own don’t make money.

A key challenge that every founder talks about these days is talent. Salaries have shot up, there are companies offering BMW bikes. How difficult has it been for you to hire tech talent?I have seen enough cycles of talent shortage. In fact, Flipkart was creating a talent shortage at some point in time, when we hired almost every engineer from the market in 2013-14. What I am very excited to see is the talent that is coming from not-so-obvious colleges, the depth of talent in India is increasing exponentially.

There is a revolution happening. The quality of talent coming from tier 2 and tier 3 colleges is excellent, apart from the IITs and NITs. Because Internet has become such a rich source of knowledge, the amount of free stuff available to train yourself is if you are really driven. They teach themselves using YouTube. I taught myself finance and accounting online. I’m doing an 80-20 in terms of hiring: eighty percent young, raw talent, and 20 percent from the financial services industry…

Are you getting them without crazy incentives?There is some inflation that affects us also, it is fine. But the productivity of the talent has gone up. The same engineer who could do X is now doing 2x, 3x. They are able to deliver more with the tools available. Tech Productivity is an unreported story in India that is mind-blowing and India will be a talent factory for the rest of the world.

How did your interest in financial services begin? Was there a lightbulb moment? For instance, you had a huge interest in gaming, you didn’t start a venture there. Did you evaluate a number of sectors before deciding on banking and financial services?I moved away from gaming a long time ago. I took six months off after quitting Flipkart to see what is happening. I had no idea what was happening in the rest of the world when I was in Flipkart because I was so focused on Flipkart. It was an incident in 2018 when a big bank’s app was down for four days.

I was super frustrated as a customer. I wanted to do some transactions and the app was down. At the same time, incidentally, I was also exploring financial services. So I went deeper and understood what is happening in the space, in terms of things like credit to GDP ratio. It’s still hard for creditworthy people to get a loan in India, same for health insurance. Capital market participation is low.

How did you rope in your cofounder Ankit Agarwal? You were friends from IIT but his career path was different, he worked in multinational banks.He went to IIM for his MBA. We were in touch on and off. After Flipkart, I got in touch with a bunch of my old friends and he was one of them. I realised he was also looking to do something new. His understanding of credit and banking is very strong.

Is it easier to build a big internet business today compared to before, you have 650-700 million Internet users in India now compared to a fraction when you started Flipkart. The GDP per capita has improved. But you are also in a highly regulated space compared to before….I think regulation-wise, it has been a bit slow but it has been okay, it is faster than what I expected. The regulators are open, they want new players. They were very encouraging, they have their own process which is okay. I think definitely the market is much better- in terms of talent, capital but competition is also high.

How have you changed as an entrepreneur? If there is a Sachin Bansal 2.0 vs Sachin Bansal 1.0?(Laughs) I hope it is completely different and I am wiser. I hope I have learnt from the crazy amount of mistakes we made. I am surprised we survived, forget about being successful after so much stupidity.

Why stupidity? You guys also set benchmarks right - in terms of payments, logistics, fashionBut it was a lot of pain, a lot of learning, a lot of redoing which is fine because we were also doing it for the first time. I’m very excited that I’m able to apply my learnings from Flipkart and take it to the next level.

What would the key learnings be?Thinking big. Pick a big problem because small problems don’t give you space to experiment. The second is to build great teams, I’m very proud of the teams we created at Flipkart. Also at Flipkart, we distributed a lot of stock, something that I will do here too.

That helped in creating a Flipkart mafia, I think over 150 startups have roots in FlipkartWe rewarded them on performance but they earned their success. I would also add it is very important to keep a high bar for talent - it is important that people are excited to come to work every day. To think and believe they are working with the best, improves performance. It may cost more but that is fine.

Does it also require you temperamentally to be different - a banker vs an Internet entrepreneur?I’ve seen bold entrepreneurs in financial services too- Aditya Puri, Deepak Parekh, etc. Of course, you have to be careful because you are dealing with other people’s money. I think if you have the right intent and team, things will be fine. We are thinking long term, even Flipkart I never wanted to sell, I never imagined I would not be in Flipkart. But I think I want to do this for the long term, I’m here for the next 20 years at least…

Is that why you went all in, putting a significant amount of your personal wealth into the venture?The only way I know to do things is to go all in.

It’s also a very interesting time for the startup ecosystem in India. 25 unicorns, over $20 billion invested so far.. What do you make of the current market?Some of it is also driven by low interest rates, the stock markets are also doing well. I don’t think it is going away. The market opportunity of India is very strong, valuations are a reflection of the future earnings, consumer base, and tech penetration. A billion internet users of 5G, with a $5 trillion economy, globally connected and tech productivity - the opportunity this opens up. Tech is transforming everything.

Do you miss angel investing, especially in a market like this?I did a lot of angel investing but I didn’t enjoy it as much. I love being an operator.

Is it also tough for you to decide between Ola electric and Ather energy? I mean you’re an investor in both, so will you have both their scooters?(Laughs) I have an Ather, I booked an Ola S1 as well.

Do you get time to catch up with Bhavish,(Ola founder Bhavish Aggarwal), he’s just a building away on the same campus?We have chai in the garden below sometimes, we did meet last week.

Who do you look up to for advice?Many people. Nandan Nilekani has been a great adviser, Manish Sabharwal, Anand Sinha, Nachiket Mor, Paresh Sukhtankar.

Have you become more philosophical as a person in the last couple of years? Going by your posts on social media, books you read? You recently said you read Awareness by Anthony De MelloI was always into reading. It’s very varied, I picked up a calculus book recently.

Anything else you want to add?I think at Navi we are very new, still early but very excited if we are given the opportunity to build a bank by RBI. We will do a tremendous job, of building something completely new that the world has never seen. India is the place for this.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.