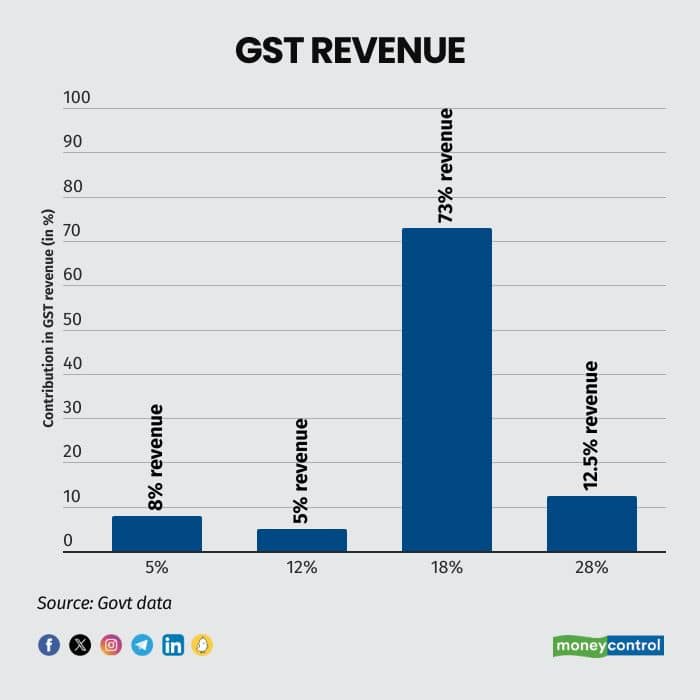

The 12 percent Goods and Services Tax (GST) slab contributes only 5 percent to India’s total GST revenue, making it the lowest revenue generator among the four primary tax slabs, according to sources. In contrast, the 18 percent slab dominates collections, accounting for a massive 73 percent of the overall revenue, while the 28 percent slab brings in 12.5 percent share of the GST revenue.

The Group of Ministers (GoM) on GST rate rationalisation is likely to review food items, textiles and footwears that are bracketed as essentials for the common man that attract 12 percent levy in its October 20 meeting, sources said.

The GST, a comprehensive indirect tax on the supply of goods and services that makes a robust source of revenue for both the central and state governments, is structured into four primary slabs: 5 percent, 12 percent, 18 percent, and 28 percent. The contributions from these slabs to the overall GST revenue vary significantly, with the 12 percent slab contributing the least. The lowest 5 percent slab forms 8 percent of the total revenue.

“The 12 percent slab, which garners the lowest revenue, may be gradually made redundant by moving items from it to other GST tax slabs,” one of the sources told Moneycontrol.

This data highlights the disparity in contributions across GST rates, as other mechanisms like cess on luxury goods and Integrated GST (IGST) also play a crucial role in boosting the overall tax collections.

Breaking down GST slab contributions

12 percent slab: Contributes only about 5 percent of the total GST revenue. This slab typically covers items like butter, cheese, fruit juice, packed coconut water, Ayurvedic medicines, sewing machines, hand sanitisers, paints and packaged dry fruits.

5 percent slab: Accounts for approximately 8 percent of the revenue, covering essential items like household necessities, grains, footwear up to Rs 1,000, incense sticks, milk powder, yogurt, biscuits priced below Rs 100 a kilo, frozen vegetables and medical supplies.

18 percent slab: Contributes 73 percent, and includes a wide range of goods and services such as consumer electronics, restaurants, smartphones, telecom services, clothing and footwear above Rs 1,000, IT services, financial services, beauty products, industrial machinery and many other services.

28 percent slab: The highest slab contributes around 12.5 percent to the GST revenue, mostly targeting luxury goods, automobiles, aerated drinks, private jets, yachts, movie tickets above Rs 100, premium motorbikes, SUVs, fireworks and sin products.

Other revenue sources in GST framework

Besides the direct contribution from these tax slabs, GST revenue is supplemented by a host of other sources.

Cess: A compensation cess is levied on luxury items and sin goods like tobacco, aerated drinks, and automobiles. This cess is intended to compensate states for any revenue loss due to GST implementation, over and above the 28 percent slab.

Integrated GST (IGST): IGST is charged on inter-state transactions and imports. The revenue collected is shared between the central and state governments, further boosting overall GST collections.

Reverse Charge Mechanism (RCM): Under this mechanism, the responsibility for paying GST shifts from the supplier to the recipient of goods and services. This approach applies to specific transactions and adds to the revenue pool.

Interest and Penalties: Delays in GST payments incur interest, and non-compliance results in penalties, which also contribute to the GST revenue.

Advance Rulings: Businesses often seek clarity on GST-related matters through advance rulings. The fees charged for these rulings contribute to the overall GST collection.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!