We have entered an era where supply constraints are the driving force of inflation rather than excess demand, a January 2022 report by BlackRock has determined. It found that this trend will “likely bring more macro volatility and force policymakers to live with higher inflation”.

A “new and unusual market regime” is reinforced by a macro-economic landscape where supply constraint is shaping inflation, found in the report title ‘A world shaped by supply’.

“Limits on supply have driven the surge in inflation over the past year: a profound change from the decades-long dominance of demand drivers. This fundamentally changes how we should think about the macro environment and the market implications,” the report said.

It added that the key to understanding muted response to inflation from central banks is “not the timeframe, but its cause: supply”, which much debate in 2021 ignored.

It said that even though economic activity has not fully recovered, economy-wide and sector-specific supply constraints are pushing inflation higher.

Inflation in the restart

The BlackRock report states that the “new era” of supply-driven inflation has been ushered due to shutdowns amid the COVID-19 pandemic and the restart that followed, where production was unable to get back online as quickly.

The restart witnessed more sector-specific supply problems due to a “sharp shift” in consumer spending away from services towards goods, and this caused bottle-necks in goods-producing sectors as they struggled to keep pace. In fact, inflationary pressures have seen the largest prices rises. (See chart below)

Major spending shift - US goods vs. services inflation and spending, 2005-2021 (Source: BlackRock)

Major spending shift - US goods vs. services inflation and spending, 2005-2021 (Source: BlackRock)

The report did not see fiscal spending as the primary cause of inflation, but a contributing factor since overall demand in the economy is unusually high.

“Fiscal policy cannot explain why inflation is so high when economic activity has yet to fully recover. The fundamental constraint is that supply capacity is unusually low. This is yet another way in which this restart differs from a normal cyclical recovery. The way to deal with this inflation, in our view, is not to destroy demand, but to increase supply capacity and promote the movement of resources across sectors,” it added.

A drawn-out restart

The BlackRock report believes that the current economic restart provides a glimpse of what is to come in terms of sector-specific needs and resource reallocation.

For example the transition to net-zero emissions will be “akin to a drawn-out restart with both economy-wide supply limits and big shifts across sectors creating supply bottlenecks”. It added that an “orderly transition to net-zero is the least inflationary path” because climate change will increase inflation — whether carbon emissions are reduced or not.

Another example is “a rewiring of globalisation and China’s aging population” — which will shift supply for imports from China to developed markets and raise costs, further causing resource reallocations in those markets and thus stressing supply constraints.

Further, data from the IMF suggests that more than 2 percent of employment will “ultimately need to change sector to meet demands”, because a mismatch between reallocation and requirement could push overall inflation higher. (See chart below).

Labor shifts needed for transition - Net employment change, 2020 vs. 2052 (Source: BlackRock)

Labor shifts needed for transition - Net employment change, 2020 vs. 2052 (Source: BlackRock)

“The most effective way to contain inflation during the transition, in our view, is to ensure the transition is gradual and orderly, so that supply can keep pace with shifting demand across sectors and higher energy costs can be absorbed over time. A transition left too late may keep inflation down in the short term but risks a much greater overall impact later on,” it noted.

More volatility expected

There is no way around more macroeconomic volatility in a world shaped by supply constraints as policy cannot stabilise both growth and inflation and has to choose between them. It expects the sum total of rate hikes in this cycle to be low, with the removal of stimulus enough to fight inflation.

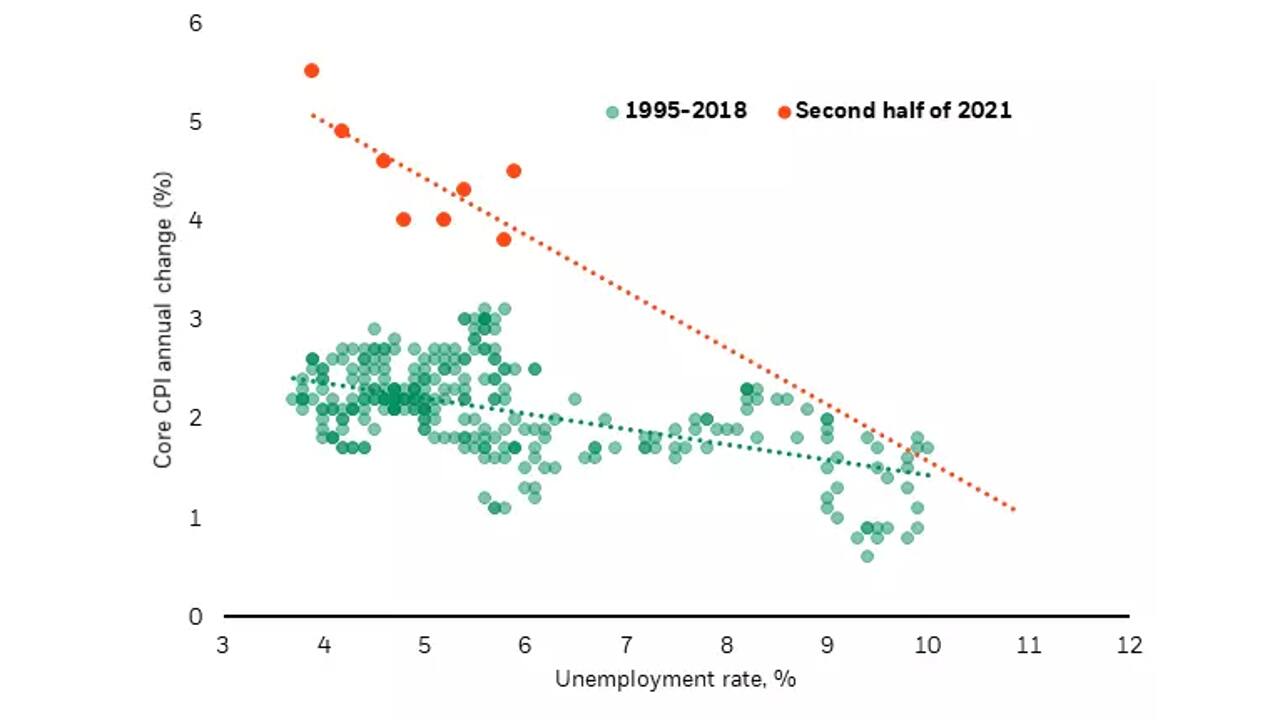

It also noted that given the historical relationship between unemployment and inflation, if central banks had sought to keep inflation close to 2 percent amid the supply constraints experienced in the restart, this would likely have meant needing to drive the unemployment rate up to nearly double digits. (See chart below)

High cost of pushing inflation down - US unemployment rate and CPI inflation, 1995-2021 (Source: BlackRock)

High cost of pushing inflation down - US unemployment rate and CPI inflation, 1995-2021 (Source: BlackRock)

“We think central banks should live with supply-driven inflation, rather than destroy demand and economic activity – provided inflation expectations remain anchored … Insisting on stabilising inflation would lead to an over-tightening of monetary policy, more activity sacrificed and a slowing down of the needed sectoral reallocation,” it said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!