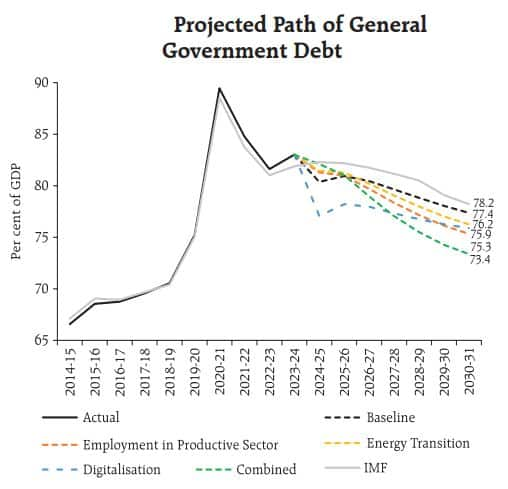

India's debt-to-GDP ratio could decline to 73.4 percent by 2030-31 from an estimated 81.6 percent in 2023-24, the Reserve Bank of India's (RBI) monthly bulletin said, thus rejecting the International Monetary Fund's (IMF) warning that it could exceed 100 percent in the coming years.

"Our simulations reveal that the general government debt-GDP ratio swerves below the projected path set out by the IMF in its latest Article IV consultation report for India," said an article titled 'The Shape of Growth Compatible Fiscal Consolidation' and released on February 20 as part of the central bank's monthly bulletin.

Also Read: IMF, India cross swords over fisc consolidation, FX intervention

"It is in this context that we reject the IMF's contention that if historical shocks materialise, India's general government debt would exceed 100 percent of GDP in the medium-term and hence further fiscal tightening is needed," it added.

The article, which counts RBI Deputy Governor Michael Patra among its authors, does not represent the views of the central bank.

The IMF, in its Article IV consultations staff report released on December 19, had called on the Indian government to embark on an "ambitious fiscal consolidation path" to re-build its buffers and reduce debt in a sustainable manner, with its contention that the debt-to-GDP ratio could cross 100 percent in the medium-term attracting criticism from New Delhi.

In their analysis, the RBI economists examined how India's general government debt – the debt of the central government and the states – would move as a percentage of the national GDP under four different scenarios assuming annual real GDP growth of 7.3 percent and headline retail inflation of 4.3 percent.

Scenario 1: Employment in 'relatively productive sectors' – chemicals and chemical products, financial services, business services, electricity, gas and water supply, and transport equipment – increases by 5 percent.

Scenario 2: Improved energy efficiency

Scenario 3: Increased developmental expenditure of the government resulting in greater digitalisation of the economy

The fourth scenario combines the aforementioned three scenarios simultaneously.

Source: RBI Bulletin

Source: RBI Bulletin

While India's debt-to-GDP ratio falls to 75.3 percent by 2030-31 under the first scenario, it declines to 76.2 percent under the second scenario and 75.9 percent under the third scenario. The combination of all three, or the fourth scenario, results in the debt declining to 73.4 percent of the GDP by 2030-31.

"This is noteworthy as the debt-GDP ratio is projected to rise from 112.1 percent in 2023 to 116.3 percent in 2028 for advanced economies and from 68.3 percent to 78.1 percent for emerging and middle-income countries," the RBI Bulletin noted.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!