On Tuesday, global markets were stunned by the Bank of Japan’s decision to increase its yield curve cap. What is the YCC, what does this move mean, and how will it impact the global trade setup? We spoke to Devina Mehra, founder, and chairperson of portfolio management services company First Global. Edited excerpts.

Give us a brief history of the yield curve cap.Japan has been the poster child for deflation and negative interest rates over the last decade or so. However, this wasn’t the case a few decades ago. In fact, from 1981 to 1995, Japan had positive real policy rates (that is, the BoJ’s overnight rate was higher than the spot inflation rate), in the range of 2-4 percentage points. Coupled with extreme dollar weakness on account of various historical events such as the Plaza Accord, Louvre Accord, and financial and fiscal regulation in Japan, the yen strengthened dramatically from about 230 per dollar in October 1981 to 84 per dollar by May 1995.

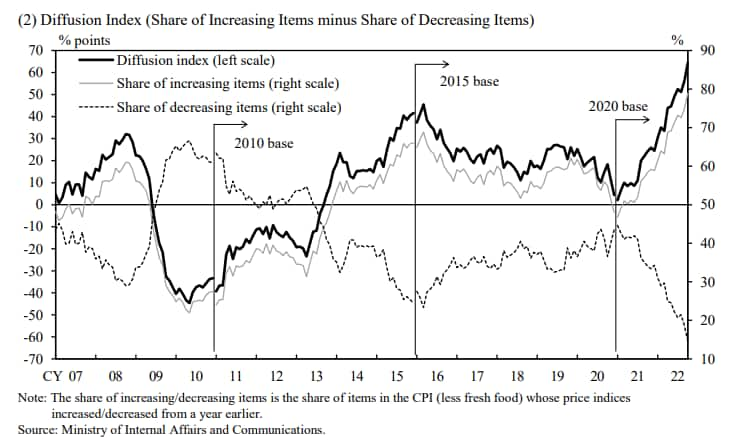

Additionally, the BoJ regulated markets until 1991 in order to end the asset market bubble that had formed over the prior decade. As a result, we saw the high inflation of 10%+ year-on-year in the 70s turn into deflation by early 1995, as inflation dropped below 0% and never rose materially above 2.5% year-on-year thereafter. This prompted the BoJ to initiate a Zero Interest Rate Policy (ZIRP) in 1999, which came to an early end due to the 2000s dotcom/IT bubble bursting.

The attempt to raise rates from 0% in 2006 to 0.5% also ended abruptly due to the global financial crisis of 2008. Since inflation remained stubbornly low along with the fact that interest rates were already at the lower bound (0%), the BoJ embarked on a bold experiment of Yield Curve Control (YCC) in 2016, after dipping its toes in Quantitative Easing (QE) earlier in 2013, where it purchased riskier assets like stocks and REITs as well. The BoJ targeted a 10-year government bond yield of 0% with a flexible band of +/- 0.25% around the target. The central bank would buy unlimited bonds at the upper bound. In the December 2022 meeting, the BoJ finally capitulated and widened the trading band to 0% +/- 50bps, saying that it was not a change in monetary policy stance but rather a decision taken to ensure the smooth functioning of financial markets.

Long before US rates fell to abysmally low levels, the yen carry trade powered risky assets across emerging markets. Will the change in the YCC cause a significant disruption in the carry trade?The yen carry trade was extremely popular in the 1990s on account of low interest rates and high liquidity. Daily turnover in the dollar versus the yen was in those days second only to the greenback versus the Deutsche Mark. However, it is well known that “carry trades”, i.e., borrowing in low yielding currencies to invest in higher yielding currencies (such as EMFX) is prone to “crash risks” and can at times be equivalent to picking pennies in front of a steamroller. A prime example of the same is the enormous single trading session $2 billion hit (about 9% of its AUM) taken by the hedge fund Tiger Management. In the past, it also happened at the time of the Asian crisis of the late ’90s, where currency rates changed suddenly, changing dynamics severely for cross-country borrowers and traders.

While it is difficult to get precise data on the share of the Japanese Yen specifically in carry trades, the basic structure involves using low yielding currencies such as the Japanese Yen, Swiss Franc and later even the Euro, as it entered the negative rate era, thus it’s reasonable to assume the Yen was one of the top contenders for carry trades over the last decade or so. Additionally, corporates, especially in emerging markets like India, borrowing in JPY or CHF to lower interest costs without much of a revenue stream in the funding currency are effectively engaging in carry trades, which could have repercussions (if not hedged), at the wrong time, as these low yielding currencies are usually safe haven currencies and tend to appreciate sharply during crisis periods such as in 1999, 2008 and 2020, which could lead to snowball effect due to the high amount of leverage and crowding involved in these trades.

Is this the end of an era for the Japanese rate cycle? Or would you call it a reversal in the rate cycle?It may not necessarily be the end of an era. However, it could be read as a reversal in the rate cycle for Japan (other central banks are well ahead already). At the end of November, the BoJ released its measures of underlying inflation for October. All the indicators were by far the highest since the BoJ started to release the data in 2001, be it trimmed mean or weighted median year-over-year change in prices. Thus, the risk-reward favoured sticking to short Japanese government bonds and long yen going into Q1 next year, as a tweak in the YCC band and later even abandonment of the yield target altogether seemed more like a timing issue rather than anything else.

The impact of the latest move by the BoJ on Rest of the World (RoW) bonds, especially those of developed markets such as the US and EU, needs to be assessed from two angles.

Positioning : The move by the BoJ was well anticipated and a lot of hedge funds had been building up shorts in JGBs (Japanese government bonds) over the last few months. Data indicated that the odds were stacked against BoJ governor Haruhiko Kuroda’s obsession with YCC amidst a global surge in inflation (be it headline or core). The only question was when and not if. It was the “when” that took the market by surprise because it was earlier than expected, the BoJ announcing a tweak in the YCC band on 20th December. However, given the evidence around inflation and global hawkishness, be it from the Fed or the ECB, the markets are not buying Governor Kuroda’s statement that the central bank’s action was motivated by market functioning issues and does not indicate a change in its monetary policy stance of easing.

Implied forward yields: When Japanese investors look at non-JPY bonds such as those in the US and EU, they need to consider the currency-hedged yields of those countries and not just the nominal spread between the two currencies’ bonds. The Japanese investors may consider shifting a decent portion of their foreign holdings to domestic bonds only if the currency hedged yields in the EU and US fall below those of JGBs or the premium is small enough to make them avoid taking the risk. Thus, currency hedged yields are something to keep an eye on, as JGB yields rise along with JPY appreciation. Although, it does seem like the reversal of flows from US treasuries (UST) and German bunds is being overstated. In a normal year, this would be big. In a year when we've seen record USTs dumped by Japanese life insurance companies, it matters a bit less.

Meanwhile, a rise in JGB yields will have to be managed carefully by the BoJ since large domestic investors such as Japanese life insurance companies can rake up significant losses from a sudden surge in government bond yields, especially at the long end of the curve. Thus, it may not be entirely speculative to assume that these companies/institutions may need to sell some financial assets (domestic or international) in order to meet margin calls, if any.

Will this largely impact only yen/dollar or global flows, too?On account of the war in Ukraine and the subsequent surge in commodity prices, especially energy, Japan’s terms of trade (ToT) have collapsed — that is, the price Japan receives for its exports versus what it pays for its imports. As a result, over the last 12 months, the country’s trade surplus has swung to a 6 trillion yen deficit on higher energy bills, which made it hard to justify its famed “safe haven currency” title. Meanwhile, the gap between policy rates in most developed countries versus that of Japan’s has widened materially.

Japan: Monthly Trade Balance

As a result, the yen witnessed a rapid depreciation of up to 30% YTD by 20th October 2022, when it hit the 150 per dollar level, which soon prompted an FX intervention by the BoJ and marked a local top in USD/JPY. Since then it has rallied to 132.62 per dollar (as of 20th December) but still remains 15% in the red for the year versus the US dollar. Thus, if the winds blow in favour of the yen — that is, lower energy and commodity prices coupled with lower treasury yields — there could be ample room for the yen to continue to rally further against the USD and G10 carry currencies like the AUD. This may not necessarily imply any large impact on global trade per se, as the US dollar still remains king in that context.

Harsh Shivlani also contributed to the interview

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.