Earlier this month, the International Monetary Fund (IMF) warned it would be announcing a raft of growth downgrades in its July edition of the World Economic Outlook report, with "increased risk of recession" visible.

A couple of weeks prior to that statement, data showed the US economy contracted by 1.6 percent in January-March. With the US Federal Reserve having kick-started its journey to raise interest rates sharply to combat high inflation, the world's largest economy is expected to have contracted again in April-June. The Federal Reserve Bank of Atlanta's famed 'GDPNow' forecast has estimated US GDP likely shrunk by 1.5 percent last quarter. Others, too, have predicted a contraction in April-June, sparking speculation of a recession.

Talk of a recession has also crept into the Indian discourse, with a question on the same being asked in Lok Sabha on the first day of the Monsoon Session of Parliament (external link, PDF).

But what exactly is a recession?

Recession definition

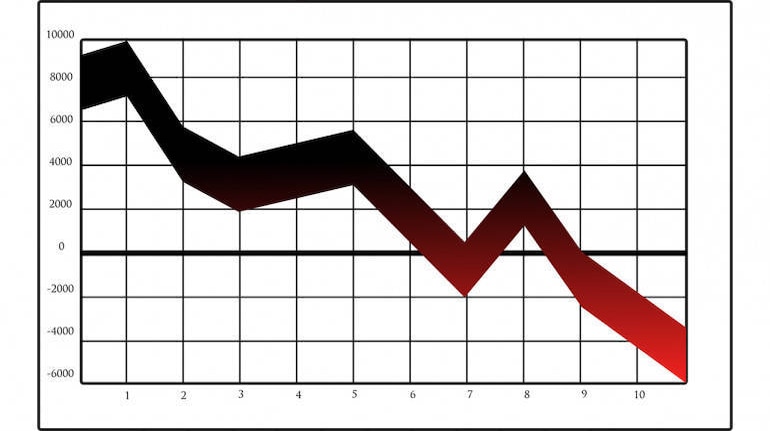

A recession is usually defined as two consecutive quarters of year-on-year (YoY) contraction in GDP. This definition is widely called a 'technical recession' and used most often in the media. As per this definition, India entered a recession in 2020, with the GDP having contracted in April-June 2020 and July-September 2020.

However, this definition is only what can be called colloquial. In theory, a recession is not as straightforward to identify.

The US' National Bureau of Economic Research, or NBER, defines a recession as "a significant decline in economic activity spread across the economy, lasting more than a few months". This, clearly, is not as precise as the two-consecutive-quarters-of-contraction thumb rule. However, the NBER argues a concept such as recession requires a more nuanced assessment.

Business cycles

Recessions, as identified by the NBER, are deemed official not just because of its rigour but the fact that it is an academic organisation, and not a government one. The final decision is made by its Business Cycle Dating Committee, whose past members include the likes of former Federal Reserve Chair Ben Bernanke.

The NBER looks at the phase of the business cycle and decides where the US economy stands. A recession, for instance, is the period after economic activity peaks and until the following low point, or trough.

In the Bureau's own words, "there is no fixed rule" when it comes to the indicators it looks at. However, some of the data it considers include real personal consumption expenditure, inflation-adjusted wholesale and retail sales, and industrial production. In recent decades, the two indicators the NBER has focused most on are real personal income minus transfers and non-farm payroll employment.

Source: National Bureau of Economic Research

Source: National Bureau of Economic Research

The variety of indicators examined by the NBER means most of the recessions it identifies end up seeing two consecutive quarters of contraction in GDP. However, there are instances of periods it has named as a recession which don't comply with the two-consecutive-quarters-of-contraction thumb rule.

Why it matters now?

With the US economy widely expected to contract for a second quarter in a row in April-June, going by the more causal definition would mean it would enter a recession. But apart from the change in real GDP, there is precious little which says the US economy is doing badly – non-farm payrolls increased by 3.72 lakh in June, with the unemployment rate unchanged at 3.6 percent.

But Americans are not doing well. Inflation is at 40-year highs and the Federal Reserve has already embarked on a rate-tightening spree. Recession fears have also led to a fall in global commodity prices.

While India is unlikely to face another technical recession in the foreseeable future, the Reserve Bank of India (RBI) sees growth cooling to 7.2 percent in FY23 from 8.7 percent. However, economists are steadily lowering their forecasts due to the impact of the Russia-Ukraine war and the tightening of financial conditions by the RBI to lower inflation. Last week, Nomura cut its growth forecast for 2023 to 4.7 percent from 5.4 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!