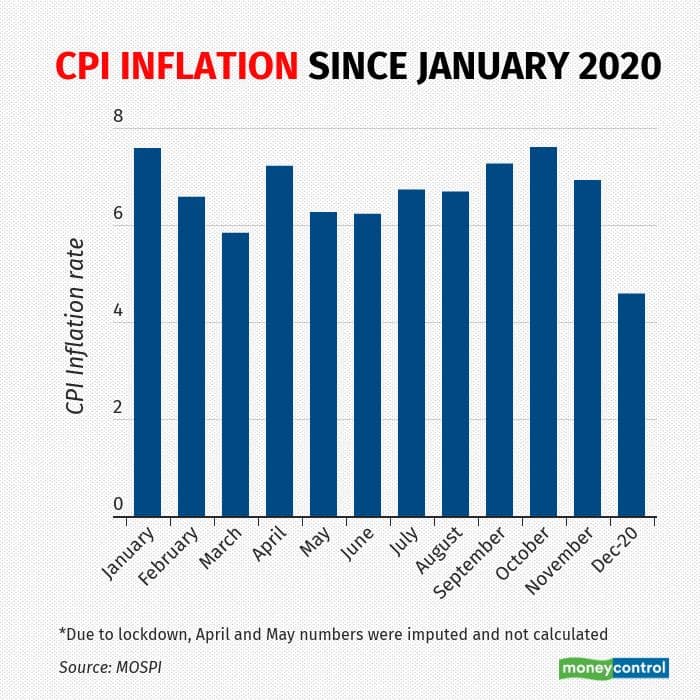

The consumer price index (CPI) inflation fell sharply in December to 4.59 percent from 6.93 in November. The fall was primarily due to a decline in food prices. The monetary policy committee (MPC) is required to keep the retail inflation within the 2 per cent-6 percent band targeting the middle point of 4 percent. It is after around three quarters, the CPI inflation has slipped below the 6 percent mark.

Does this mean that the MPC will go for a rate cut in the near future?

Most economists believe that possibility is unlikely for now. The MPC is likely to stay on hold in the near-term and would prefer to watch the incoming data for a few more months to confirm the price trend, they believe. That is because inflation worries can return if food prices spike in the approaching months.

“With the CPI inflation expected to continue to exceed the MPC’s 4 percent target during FY2022, we do not expect any more rate cuts in this cycle, despite the sharp slackening in the headline inflation rate in December 2020,” said Aditi Nayar, Principal Economist, ICRA Ltd.

”We continue to expect the stance of the Monetary Policy to be changed to neutral from accommodative in the August 2021 Policy review or later, only after there is greater certainty on the durability of the awaited economic revival,” Nayar said.

Madan Sabnavis, chief economist of CARE rating agency too said the steep fall in CPI inflation came as a “shocker” as against the expectation of around 6 percent. Still, Sabnavis also doesn’t expect any change in policy stance for now.

The fact that CPI inflation has been persistently above the comfort level of the MPC for several months has been a major concern for the policymakers. The MPC members have acknowledged the inflation risks time and again.

Yet, the latest MPC minutes showed the panel’s deepening worries on growth.

“Elevated inflation has checked in and may be here to stay. With retailers striving to recover lost incomes,” said Michael Debabrata Patra, in the MPC minutes. Governor Shaktikanta Das, too, has noted that inflationary pressures have continued unabated, posing challenges for monetary policy.

Clearly, growth remains the biggest worry as MPC members’ comments suggest. “It will take at least a year to reach the earlier peak GDP level and more to recover lost growth. Jobs have been lost, some voluntary and some involuntary, especially in the lower middle class. The turnaround needs policy support until it is well established,” Ashima Goyal wrote, one of the MPC members, wrote in her comments.

MPC is undoubtedly left with no choice on its policy priority—to support growth and rightly so. For the next one year or so, until growth recovers hopefully aided by the Covid-vaccine, the stance will likely remain so. But, the strength of the measures MPC can deploy will depend on the inflation trajectory.

In this context, the decline in the December CPI print offers some comfort for the policymakers. But the question is if this trend will sustain giving room for rate cuts. The consensus among the economists is that MPC will wait for a quarter or so and study the inflation pattern before deciding the future course on rate action.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!