Sachin Pal

Moneycontrol Research

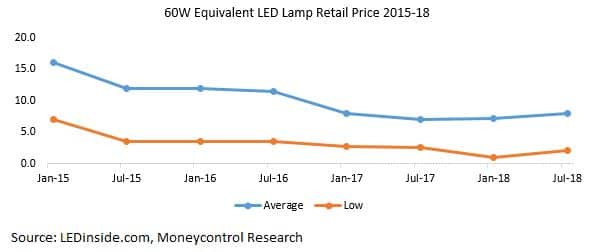

The lighting market has been dynamic over the past few years. The prices of light-emitting diode (LED) have corrected steeply since the introduction of the Ujala scheme in 2015 aimed at promoting energy-efficient lighting. Reduced carbon emissions and better energy efficiency have led LEDs to replace the halogen and compact fluorescent lamps (CFL) bulbs in recent years and have also made them more affordable in recent times.

Philips is the market leader

Philips & Surya Roshni are leading players in the Indian LED lighting market with a combined share of around 30 percent. Crompton Greaves Consumer Electricals and Havells India, the two leading consumer durable companies, also have a sizeable presence in this segment and generate revenues in excess of Rs 250 crores from the lighting and fixtures business.

LEDs gaining traction

LEDs continue to gain traction at a global level as seen by the increase in the share of LED-based sales of Philips Lighting to 65 percent from 55 percent of the total.

In India too, Surya Roshni achieved a strong volume growth of 30 percent in LED lightings during Q1FY19. Its turnover for the segment, however, declined to Rs 304 crores from Rs 314 crores mainly on account of prices erosion in the LED lights.

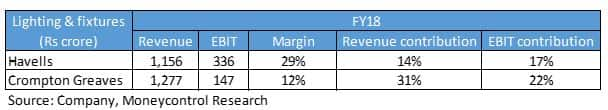

Lighting and fixtures contribute around 23-25 percent to Crompton’s overall revenues. In comparison, this segment contributes only 10 percent to Havells revenues as the acquisition of Lloyds’ business had broad-based its revenue base. The margins in the segment are considerably higher for Havells compared to Crompton Greaves.

Crompton’s revenue and margins of lighting & fixtures in Q1 were subdued as the non-LED business declined 30 percent year-on-year (YoY). The LED business which accounts for 75-80 percent of lighting & fixtures segment continued to witness good traction and grew at a healthy rate of 40 percent YoY. The share of LED business within this segment could increase to 90 percent by FY20.

Margin pressure due to price erosion

All the major players in the market have reported strong double-digit volume growth in the LED business in Q1 but this was partly offset by price erosion. In a recent development, Syska undertook a 10 percent downward price revision in the LED segment and this has forced the industry players to follow suit as the major players - Philips, Bajaj Electrical, Eveready and Crompton and Wipro have priced their products at par with Syska. In contrast, Bajaj Electricals and Surya Roshni have priced their products comparatively cheaper and also offer a 2-year manufacturer warranty compared to a 1-year warranty offered by a majority of the players.

Price erosion in lighting products is a regular phenomenon with multiple instances over the business cycles due to market acceptance and technological obsolescence. With low entry barriers, competitive intensity in the LED business increased with several new players entering the market during 2015-16 resulting in a steep price correction. However, the fall had been arrested and prices have been more or less stable in the past 12-18 months.

Potential impact on earnings

The recent price cuts would have a bearing on the profitability as the companies are already facing input costs pressures. The continued fall in the rupee against the dollar will add to input costs of imported raw materials.

While the volumes will continue to grow at a healthy pace due to shorter replacement cycles (reduction in warranty period) and deeper market penetration, the margins will certainly suffer on account of reduction in selling prices.

Based on our estimates, the 10 percent price cut in the LED business will have a significant impact on the earnings of the overall business. We estimate a negative EPS impact of ~Rs 0.3 for Havells and ~Rs 0.5 for Crompton on FY19 estimates. This translates to an earnings downgrade of 2 percent and 8 percent for Havells and Crompton, respectively.

A subsequent price cut cannot be ruled out and hence we undertook a scenario analysis to understand the potential impact on the overall profitability of the business. The impact could be greater if the companies enter into a price war.

The stock prices of both Crompton and Havells have taken cognisance of this development and have corrected 10-12 percent from their highs to factor in the earnings downgrade. The stock price of Havells (CMP: 681) witnessed a sharp surge post its Q1 numbers and is now trading at nearly 50 times FY19 earnings and seems priced to perfection.

The correction has been much deeper in Crompton Greaves (CMP: 216) and it now trades nearly at 38 times FY19 earnings. We advise long-term investors to accumulate this stock on any further correction as the company enjoys a strong product portfolio, healthy return ratios and remains well positioned to grow in an improving demand environment.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!