India's market capitalisation dropped nearly 8 percent in October so far, primarily driven by heavy foreign investor sell-offs. This is the steepest decline since the pandemic.

The country’s market cap fell by 7.6 percent, losing $37 billion to settle at $4.53 trillion from $4.90 trillion the previous month, making this the fifth-largest decline globally after Belgium, Portugal, Venezuela and the Netherlands, whose markets saw their valuations drop over 11 percent, 10 percent, 8.6 percent and 8.4 percent respectively, as per Bloomberg data.

Both Sensex and Nifty lost over 4.7 percent and 5.7 percent respectively in October while broader BSE Midcap and BSE Smallcap indices declined over 6.7 percent each.

Meanwhile, FIIs net sold around $10 billion worth of equities in October, comprising $11.7 billion in secondary market outflows partially offset by $1.7 billion in inflows in the primary market. On the other hand, domestic institutional investors (DIIs) purchased $11.6 billion in equities, supported by high cash reserves and likely sustained strong inflows into domestic equity mutual funds.

The huge selling from FIIs was due to weak market sentiment from escalating Middle East tensions and uncertainties surrounding the upcoming US presidential election. Also, weak September quarter earnings, high valuations, and China’s economic stimulus dampened sentiments.

Further, despite significant corrections in headline indices and specific stocks, analysts find limited value across most market segments. High valuations persist among large-cap and quality mid-cap stocks, even as prices have adjusted following earnings downgrades. Furthermore, valuations in high-narrative stocks, though reduced from extreme levels, still suggest ample room for correction.

Recently, Indian markets have received downgrades from both global and domestic brokerages, with reductions to Sensex and Nifty targets. Goldman Sachs shifted its rating on Indian stocks from "overweight" to "neutral" in its Asia/emerging market portfolio, attributing the downgrade to slowing economic growth and weaker corporate profits. The brokerage revised its 12-month Nifty target from 27,500 to 27,000. Similarly, InCred Equities cut its Nifty target by 3 percent, anticipating that the correction phase could persist through Q4 2024 as high valuations continue to elevate risk.

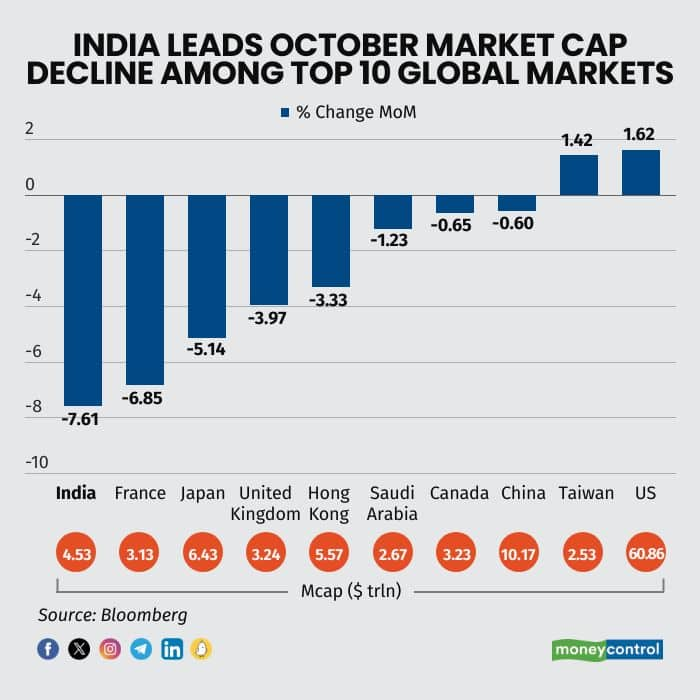

Meanwhile, among the top 10 largest markets in terms of valuations, the US and Taiwan led gains, rising around 1.6 percent and 1.4 percent, respectively.

Other global markets, however, experienced notable corrections. Following India, France declined by 7 percent, Japan by 5.1 percent, the UK by 4 percent, and Hong Kong by 3.3 percent. Saudi Arabia fell 1.2 percent, while China and Canada each saw declines of 0.7 percent. In contrast, Pakistan recorded the highest gain, up over 10 percent, followed by Kenya at 9 percent and Sri Lanka at 8.2 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.