Highlights- Above estimate performance in seasonally weak quarter

- Higher occupancy drives revenue growth

- Room rates decline

- Revival signs for domestic segment

- Strong pipeline a big positive

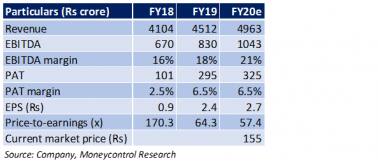

Indian Hotels Company Limited's (IHCL) (CMP: Rs 155; mcap: Rs 18,433 crore) estimate beating performance for July-September came during a seasonally weak quarter.

A healthy growth in RevPAR (revenue per available room) stood out, driven by higher occupancy. Its international business was impacted by one-off write-offs even as the domestic operations showed shoots of revival.

The stock has been inching up over the past few weeks. While we are convinced about the company’s growth story, we find current prices a tad on the higher side and would recommend to enter on correction.

Key Highlights

Revenue for the quarter grew a decent 4.4 percent from a year ago, backed by an uptick in occupancy. Post a muted show in the previous quarter, the domestic business looked up, with revenue growing at 5 percent YoY (year-on-year). Lower revenue from Sri Lanka cast a shadow on its international performance.

RevPAR (revenue per available room) registered a growth of 3.9 percent during the quarter, driven mainly by a 4 percent expansion in occupancy. Occupancy for the period under review came in at 68.2 percent. However, the ARR (average room rate) was down 4.5 percent YoY.

While the corporate segment lay low, retail was in the driver’s seat. The management fee went up by 6 percent in H1 FY20.

Changes in GST (goods and services tax) slabs have turned favourable for the company. Going forward, IHCL looks to improve its rate structure.

With expenses largely under control, EBITDA (earnings before interest, tax, depreciation and amortization) margin expanded 564 basis points. Deferred tax reversal boosted net profit for the said quarter.

The hospitality major, which owns the Taj hotels, expects losses in Pierre, the luxury property in New York, to be around Rs 60 crore for 2019-20.

IHCL is focussed on expanding rapidly and the management has plans to open at least 1 new hotel every month and close to 15 per year. With a pipeline of nearly 5,000 rooms, IHCL has already opened 765 rooms (four hotels) since the beginning of the year.

Outlook

First half is generally a weaker half for the hotel business. Despite that, the company has posted a decent performance. We believe that this show will go on for the coming quarters.

Thanks to the turnaround in the international operations, expansion through the asset light management contract model and growing domestic demand, we stay convinced about the growth story of the company. Given the favourable demand supply industry dynamics, chances are the hotel major’s performance will further improve in the second half.

The hotel industry is highly cyclical. Though tailwinds remain, aggressive pipelines by other big hotel chains and the overall slowdown may change this scenario.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!