Ruchi Agrawal

Moneycontrol Research

For yet another quarter, Hindustan oil exploration company (HOEC) exceeded our expectation and reported a stellar Q1 FY19. With multiple project in the monetisation phase, net profit increased eight fold year-on-year (YoY). Firm energy prices, rapidly ramping volumes and undemanding valuations make the stock an attractive pick.

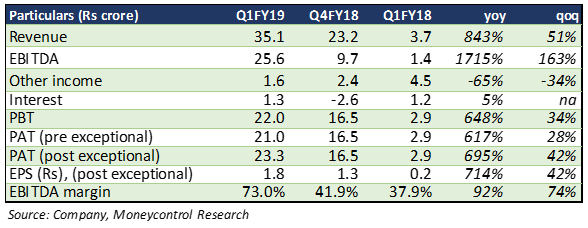

Q1 FY19 performance

Revenue improved 51 percent sequentially on the back of robust increase in production volumes. Realisations were further supported by higher crude oil prices. Earnings before interest, tax, depreciation and amortisation (EBITDA) margin saw a substantial improvement in line with the management’s guidance. Decline in other income was on account of lower income from mutual funds after liquidation of a portion to fund ongoing expansion and operating expenses.

After the ramping up of production from the Dirok block and fast paced revenue acceleration in the last quarter, the company is now at the cusp for the second round of re-rating with the completion of drilling work at PY1 basin and tick up in production from this block in July.

Production from Dirok

The Dirok block is now the most important asset for the company with majority revenue flowing in through this basin. With the installation and commissioning of 12 inch pipeline from April, production increased by almost 60 percent.

The company achieved average production of 29 million standard cubic feet per day (mmscfd) and 750 barrels of oil per day (bopd) in June, reaching 35 mmscfd of gas and 800 bopd of oil condensate. This level is close to HOEC’s target of 36 mmscfd and 1,000 bopd of oil condensate from the block. Given the upward momentum in crude prices and increasing demand, we expect gas prices to further improve in the next round of price revision. With a six monthly revision structure for HOEC’s contracts, we see gas realisations improving further.

PY1 in production now

The two well drilling project at the PY1 block in the Cauvery basin was complete last quarter and production started from mid-June, reaching 12 million standard cubic feet per day. HOEC has 100 percent stake in the block and production is expected to contribute significantly to incremental revenues. Moreover, total reserves in the basin are now believed to be much higher that initial projections, which would also work in favour of the company in the long term.

Production from Kharsang

The acquisition of Geopetrol in April gives HOEC 30 percent participating interest in the Kharsang block in Arunachal Pradesh. The block produced 800 barrels per day of crude during the quarter gone by and has started contributing towards group revenue, though consolidated numbers were not available.

The management is expediting expansion of this block with expectation of additional reserves. The block’s closeness to the Kharem (Arunachal Pradesh) field bodes well as it has already invested infrastructure which can be used in Kharsang. It also makes the company the largest private player in the northeast.

B80 following timeline

The field development plan for the B80 basin in Mumbai High was approved in December last year and block execution is on track. The management expects to commence production from the block from April 2020.

Outlook

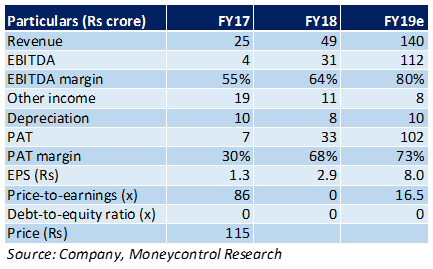

Most of HOEC’s assets are now entering the production phase and are quickly being monetised. With rapid ramping up of production, revenue and profits should see strong traction. With production ramping up as per plan, the company is now focusing on steady and sustainable offtake of the produce.

HOEC has a debt free balance sheet and has funded both capex and Geopetrol International’s acquisition through internal accruals. This leaves the company with scope for further expansion and leverage.

The stocks has run up 70 percent in the last 12 months and is currently 14 percent below its 52-week high. It is trading at a FY19e price-to-earnings of 16.5 times. The monetisation plan for discovered blocks has been moving as per plan. With production volumes ramping up, we see immense scope for re-rating in this growing business. HOEC is a growth stock. Investors with a penchant for investing in high growth businesses should look to add this on any weakness in the current market volatility.

Follow @RuchiagrawalFor more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.