HDFC Bank Ltd, India’s most valuable private sector lender is on its way back to delivering above-average balance sheet growth with pristine asset quality it is known for. That does not mean the lender would reach its destination without breaking a sweat.

HDFC Bank’s Q3FY22 was a mixed bag with core operating performance yet to reach its past prime. Net interest income growth remained around 14 percent, a decelerated expansion level post the pandemic. Operating expenses were up 14 percent sequentially which analysts believe has scope to reduce in the coming quarters. To be sure, the bank should be cut some slack here as the expenses were towards beefing up digital capabilities to capture growth. Given the expenses and more muted earnings, operating profit growth of 10.5 percent didn’t exactly elicit excitement. That said, the bank reported a healthy 18% net profit growth on a reduced provisioning level. The upshot is that the bottomline growth remained stable.

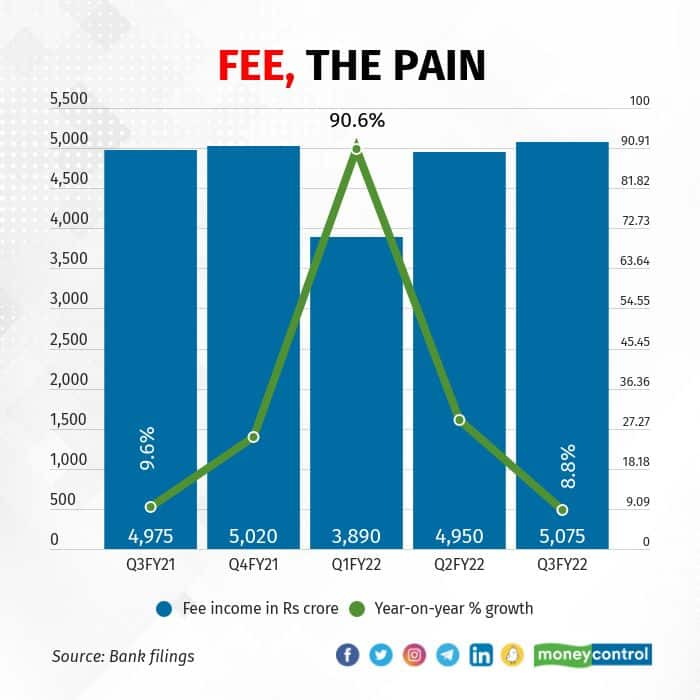

What has analysts worrying is the tepid fee income growth. This is where the lender is yet to alleviate all concerns. Fee income growth of 9 percent was disappointing for the December quarter, point out analysts. “We are a tad disappointed by just 9% YoY growth in fees that was dragged by lower credit card fees - especially lower revolver/ drawdown fees, but management expects growth to improve with improved card-usage following lifting of RBI's embargo,” wrote those at Jefferies India Pvt Ltd in a note.

Analysts at CLSA believe that the bank would be able to reverse this in the coming quarters. HDFC Bank gets about a quarter of its fee income from its credit card business. With the ban lifted in August by the regulator, the bank has seen a jump in its credit card issuances but spends are yet to improve significantly. For Q3FY22, credit card outstanding grew by 11 percent year-on-year and 8% sequentially. In short, the bank is getting customers but not big borrowers. What’s more, this is yet to show up on fees.

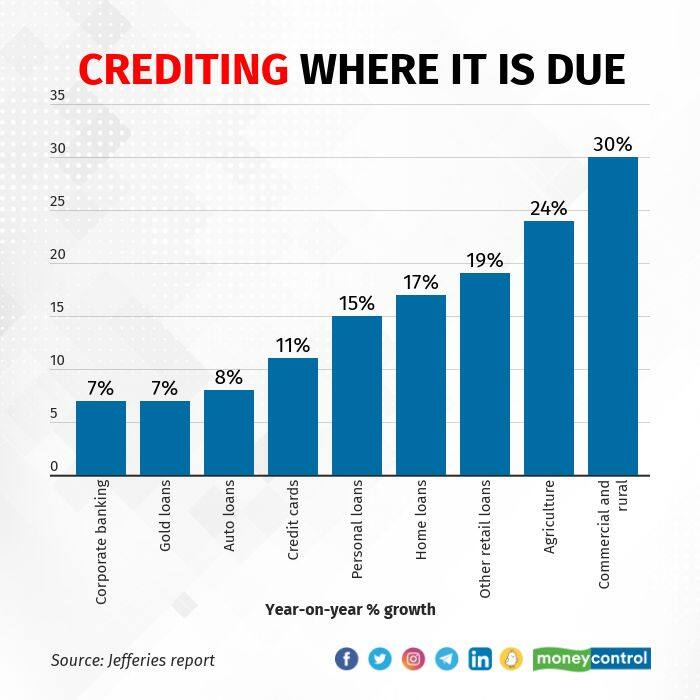

The outlook on card spends is unclear given the resurgence in COVID infections and the regional restrictions in activity. But that should not discourage the lender’s investors. Overall the loan book grew at a healthy 16 percent for Q3FY22 mostly driven by retail and small business loans. Notably, HDFC Bank saw its commercial banking segment growth jump to 30 percent. Indeed, the management commentary had enough enthusiasm to ward off worries over growth. Chief financial officer Srinivasan Vaidyanathan said that the bank foresees strong growth in almost all loan segments. “We will continue to capture market share,” he said on an analyst call on Saturday post the results.

True, HDFC Bank needs to fix its core and fee income growth but for now its loan book expansion has enough to cheer about. Further, buttressing profitability is its asset quality. Gross bad loans were down to 1.26 percent of loan book from 1.34 percent a year ago. The bank’s restructured loan pile fell 2.8 percent sequentially to Rs 17,500 crore. Lower stress entails lower provisions. That said, its provisioning coverage ratio stands in excess of 70 percent and analysts believe that along with contingency provisions, HDFC Bank is well insured against future risks.

HDFC Bank saw its premium tag chip away in 2021 because of the pandemic and a ban on the most lucrative credit card issuance. The lender is back on the card market but it still needs to look out for pandemic risks.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!