Madhuchanda DeyMoneycontrol Research

HCL Technologies (HCLT) reported in-line performance in the second quarter of FY19. Margin improved a tad and the deal win momentum was healthy. The company maintained its FY19 guidance reiterating a strong outlook.

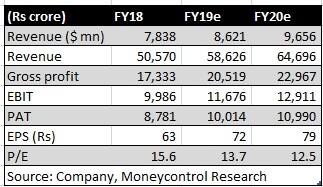

While the company continues to have a significant contribution from its inorganic moves, the traction from next-generation businesses (Mode 2 & Mode 3) is building up and management seems to have strategic clarity on the road ahead. We see little downside in the valuation of 12.5x FY20e (estimated) earnings. The stock, therefore, deserves a place in investors’ long-term portfolio.

Quarter at a glance

For the quarter ended September 2018, HCL Tech reported revenue of $2,098.6 million – a sequential (quarter-on-quarter) growth of 2.1 percent in reported currency and 3 percent in constant currency. Of this, close to 1 percentage came from the acquisition of Actian. The year-on-year (YoY) growth in revenue in constant currency was in double-digit at 10.5 percent.

After-tax profit for the quarter at Rs 2540 crore grew 5.7 percent sequentially.

Out of the seven industry verticals, four, namely, Retail & CPG, Public Services, Life Sciences & Healthcare as well as Technology & Services showed strong growth. The key vertical of financial services that exhibited good growth in FY18, was soft on account of two client specific issues in Europe.

In fact, the same impacted the performance of Europe as a geography. However, the market of the Americas and the rest of the world continued to show a strong growth.

Application services that still constitute close to 33 percent of the total revenue continues to grow at a sluggish pace. Business services and engineering & R&D, however, grew handsomely.

The company reported 20 basis points sequential improvement in margins in the quarter to 19.9 percent. While there were headwinds of 70 basis points from a wage increase, 50 basis points for sales expenses rise (SG&A) and 30 basis points due to seasonality, the same was offset by 80 basis points gains on account of efficiency improvement thanks to automation and better utilisation. Gains of close to 90 basis points came from currency depreciation.

Walking the right path

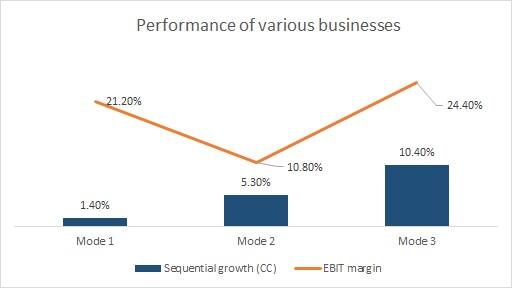

The key matrix to track for HCLT is its progress with what the company terms as Mode 2 services (which is essentially the digital offerings) and Mode 3 services (software IP led business).

The share of Mode 2 and Mode 3 in total revenue has increased from 23.4% in end FY18 to 28% in Q2 FY19 with a sequential growth of 7.1%.

Source: Company

While Mode 1 (core services in areas of Applications, Infrastructure, Engineering & R&D and Business Services) reported margin higher than the company average, the margin for Mode 2 was softer owing to company’s investment to strengthen its offering. The margin for Mode 3 was significantly higher and so was the revenue traction.

The company specified that spends in infrastructure are just shifting to next-gen and technology modernization, rather than declining. Enterprises are embracing the cloud to drive innovation and not just for cost efficiencies.

Strong outlook

The positivity in the operating environment was reiterated by the management of HCL Tech, similar to what we have heard from its larger peers. The company said it has won 17 transformational deals in the quarter and the deal wins in the quarter are higher than the average for the past four quarters.

Albeit the softness in financial services due to client issues, the management guided to a strong outlook for the vertical. The digital and analytics service is seeing strong demand from Financial Services, Retail & CPG as well as Life Sciences and Healthcare.

Guidance unchanged

Management maintained its full year revenue growth guidance at 9.5 percent to 11.5 percent in constant currency and operating margin in the range of 19.5 percent to 20.5 percent. It expects the revenue to be in the mid-point of the guided range.

However, unlike the expectations at the beginning of the year of 50 percent growth coming organically and the remaining through the inorganic route, the management now expects the organic growth to be higher.

While the new deals are expected to be margin accretive and rupee depreciation could provide a further tailwind, the management has decided to step up investments in talent and capability building to deliver a high level of transformation experience to clients. This perhaps explains the subdued outlook on margins as well.

Overall, the management outlook on the second half of FY19 is stronger than the first half. On the back of strong deal wins in the past and impact of H&D’s acquisition in the revenue in Q3, the management expects a strong Q3 despite the seasonal impact due to the lower number of working days and furloughs.

While the legacy business remains sluggish, we like the focus on new technology and company’s openness to go for an inorganic route to fill the gaps. The positive commentary coupled with heathy payout (pre-tax yield of close to 3.9 percent) limits downside. The undemanding valuation leaves room for upside should the strategy play out on expected lines.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!