Pharmaceutical major Cipla Ltd is expected to report a healthy Q4 results, with revenue boosted by steady US sales, and profit growing over the previous year’s low base. The drugmaker is due to report its fiscal fourth quarter results on May 10.

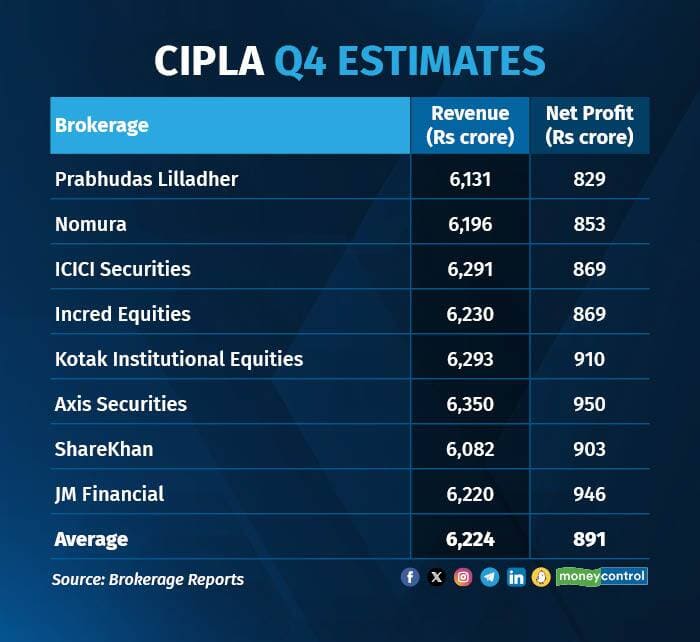

According to a poll of eight brokerages collated by Moneycontrol, Cipla’s Q4 FY24 net profit is likely to grow around 65 percent on-year to Rs 891 crore. In the previous year (base period) Cipla's net profit was impacted by one-time impairment charges worth Rs 182.42 crore due to an acquisition in Uganda and its assets in Yemen. Adjusted for the same, Cipla's bottomline is likely to grow 28 percent on-year.

CIPLA Q4 FY24 PREVIEW

CIPLA Q4 FY24 PREVIEW

Revenue is expected to grow 8.4 percent year-on-year to Rs 6,224 crore for the January-March quarter.

The drugmaker's operating margins are also expected to remain steady and meet the management's guidance of 24 percent, both for Q4 and full FY24.

Among the brokerages polled by Moneycontrol, Kotak Institutional Equities issued the most bullish estimates for Cipla while Prabhudas Lilladher estimated the lowest growth.

Steady US sales

The company's US business is expected to aid its growth in Q4. The surge in US sales will be driven by the contribution from blockbuster cancer drug Revlimid, along with a stable market share in Albuterol (respiratory drug) and an expansion in Lanreotide (hormonal drug) and Brovana (inhalation drug). Axis Securities expects Cipla's base sales in the US business to come around $225 million (Rs 1,880 crore), primarily driven by these drugs.

Brokerage firm Kotak Institutional Equities estimates Revlimid's contribution for Cipla to rise marginally to $28 million from $25 million in the previous quarter.

Also Read | Cipla, Glenmark recall drugs from US market: USFDA

Other markets

Meanwhile, the company's domestic business growth would likely be limited to high-single-digit or even low-double-digit due to weak seasonality. Nomura believes the drugmaker's acquisitions in the domestic market will aid its on-year growth in Q4.

Meanwhile, the brokerage also estimated 3 percent year-on-year South Africa sales growth in constant currency terms, aided by the acquisition of Actor Pharma, to some extent. However, revenue growth from the segment in rupee terms will be lower due to the depreciation of South African Rand against the Indian rupee in the past year.

That aside, investors will watch management's outlook for new drug launches, especially since two of the drugmaker's major launches -- respiratory drug Advair and chemotherapy drug Abraxane -- are delayed due to regulatory headwinds.

On May 9 at 12:15 pm, Cipla's shares on BSE were trading 0.7 percent lower at Rs 1,375 apiece. The stock has gained nearly 10 percent since January this year, and about 47 percent in the last one year, outperforming benchmark Nifty index.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!