Madhuchanda DeyMoneycontrol Research

Key among the areas of disagreement between the RBI and the government is the reserves held by the central bank. The government feels RBI has more capital than is needed and could pass on some of it in the form of a special dividend.

The question here is: why does the government need this capital?

Short answer: To meet the fiscal deficit target of 3.3 percent in FY19 as tax collection and divestment receipts are way short of estimates.

Why the central bank’s capital is important

Firstly, while central banks and private firms are incorporated within a similar legal structure and use similar accounting principles, there are major differences. Central banks are set up to achieve policy objectives rather than to maximise profits. A negative net worth (or capital) at a central bank does not imply that the bank will go bankrupt and cease to operate.

Most modern central banks hold capital as insurance against political interference. Inadequate capital could undermine their independence while framing policies.

An important determinant of the desirable level of central bank capital is the size of the shocks to which monetary policy is expected to react to. Larger the shocks more will be the capital required.

The area of responsibility of the central bank is a second factor. Broader those areas, the larger the recommended level of capital. Since in developing countries, the central bank likely has broader responsibilities to manage foreign exchange reserves and/or regulate the financial system, the capital requirement will be higher.

Thirdly, greater the government’s tendency to create deficits, more important it is for the central bank to ensure that things don’t go out of control in the economy.

Fourthly, the institutional arrangements between the government and the central bank matters. If the central bank is expected to be the sole defender of the currency, it should have higher capital.

Central banks with larger fractions of foreign exchange-denominated assets (RBI, for instance, holds close to 73 percent foreign assets) should have higher capital. A comparison of the past levels of central bank capital in the US, and Hong Kong, as representatives of extreme types of central banks, is consistent with the view that central banks actually follow this principle. Prior to the financial crisis, the Fed’s capital was less than one quarter of one percent of GDP, while the ratio of the capital of Hong Kong’s monetary authority to its GDP was more than one hundred times greater than this.

The level of the central bank’s capital may also affect the credibility of the central bank in its goal to keep inflation low. A low level of capital may induce an increase in inflationary expectations and reduce credibility. This may occur even if the bank enjoys high legal independence.

As far as the RBI is concerned, most of the above-mentioned factors call for a high level of the capital buffer.

RBI’s Balance Sheet

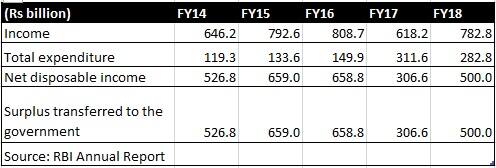

A glance at RBI’s Profit and Loss account suggests the RBI is transferring the bulk of its income to the government. As a consequence of secular growth and the associated increase in the demand for money, central banks accumulate positive amounts of seignorage which are normally substantially higher than the operating expenses.

In addition, as the RBI’s balance sheet suggests, it also holds government bonds (Rs 6297.45 billion in FY18) on its books through open market purchase which is an indirect lending to the government.

The figure of particular relevance in the balance sheet is the contingency fund – after all expenses and transfer to the government the retained earnings go to the contingency fund.

The foreign currency assets and rupee bonds that RBI holds are subject to revaluation gains or losses. Such gains from revaluation do not pass through RBI’s income statement, they are taken directly to the balance sheet under revaluation reserve. Cumulative losses from revaluation are netted off from contingency funds.

The contingency fund in FY18 was 6.4 percent of total assets, low compared to the target of maintaining a contingency fund at around 8-12 percent. However, if we include revaluation reserve as well for the capital buffer – the same stands at 25.5 percent of its balance sheet.

Does the capital position warrant a blanket transfer to the government?

RBI could sell a portion of its foreign bonds, but that would result in a decline on RBI’s foreign currency reserve. Assuming total imports of close to $600 billion, our reserves are close to eight months of imports. This buffer can decline if oil prices surge, thereby increasing our external vulnerability.

Finally, the capital position itself deserves a close look. If we add the contingency and revaluation reserve, then the total capital is close to Rs 930,482 crore. But RBI has already lent to the government to the tune of Rs 629,745 crore, so the net effective capital is Rs 300,737 crore which is 10 percent of the net balance sheet.

What is even more relevant is that the capital is 1.8 percent of GDP which is certainly not a large number. Levels of central bank capital amounting to about 3 percent of GDP are not uncommon. In some extreme cases, like Hong Kong, Switzerland and Malaysia, this proportion is at least 10 per cent of GDP.

There is little doubt that clear rules for the allocation of central bank profits between the government and the central bank constitute a good practice. However, such rules should also take into consideration the long term macro challenges that a country like India could face.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!