India’s banks double up as direct sales agents of a host of financial products, and life insurance needs their support more than any other. With the country’s largest life insurer Life Insurance Corporation of India becoming serious about bancassurance, the biggest growth-driving distribution channel is also set to become an area of intense competition.

In media interactions, LIC chairman MR Kumar has stressed that he would focus on bancassurance tie-ups and improve the contribution of the channel to overall growth. The share of bancassurance must go up to 8-10 percent from the current 3 percent, Kumar said in a recent interview to Business Standard.

Eventually, LIC is aiming for 15 percent of its premium to come from this channel.

What does this mean for competitors? Before answering this question, it pays to look at the status of the bancassurance channel.

Banca is slowing

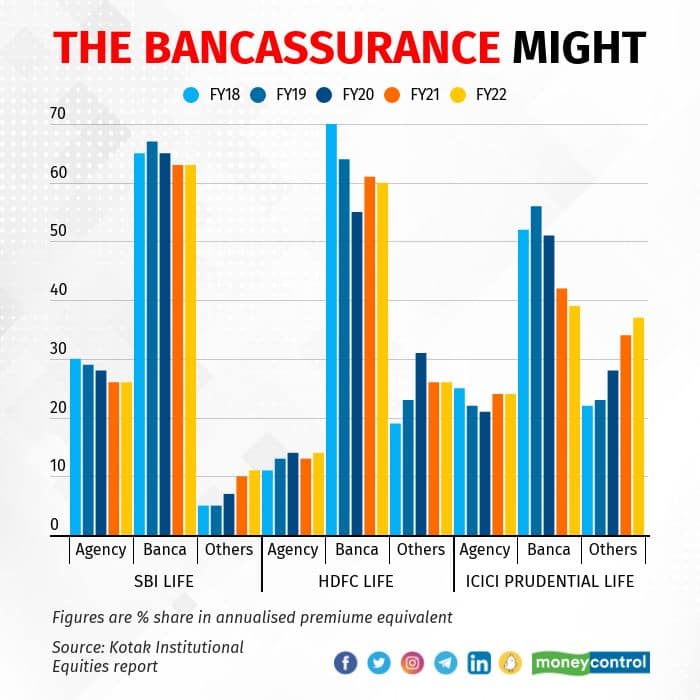

Bancassurance remains the biggest contributor to growth but its share in the overall business has come down. As the adjoining chart shows, private life insurers HDFC Life Insurance Company, ICICI Prudential Life Insurance Company and SBI Life Insurance Company all depend heavily on bank branches of their parent companies for growth.

But the share of the channel in retail premium has declined over time. In FY18, about 65 percent of SBI Life’s premiums used to come from policies sold by branches of parent State Bank of India. This has fallen to 63 percent in FY22.

For ICICI Prudential Life, the share of parent ICICI Bank’s branches in overall premiums has fallen to 39 percent in FY22 from 52 percent in FY18. Analysts said banks will remain the bedrock of business for life insurers.

“The fall in banca’s share is mostly because some of these life insurers were looking to diversify their channels. These entities were looking to decrease their reliance on bancassurance for diversification purposes,” said Sahil Idani, assistant vice president at ICRA Ltd.

Indeed, private sector life insurers have indicated their intentions to diversify their channel mix to avoid dependence on one channel for business. Sangramjit Sarangi, president & chief financial officer of SBI Life believes that most banks are being nimble and innovating which would keep the bancassurance channel relevant to life insurers. The biggest advantage is cost.

"The Banca and agency channel differ significantly in terms of acquisition cost incurred because of the absence of substantial infrastructure and the associated costs related to the acquisition of business in the former," he said in an email response.

Indeed, even for standalone life insurers such as Bajaj Allianz Life Insurance Company and Birla Sun Life, the share of bancassurance is high. As Sandeep Mishra, chief distribution officer-partnerships and group business at Bharti Axa Life Insurance Company puts it, insurance is an affinity product and the need for a helping hand in making decisions is done by the banking and agency channel more than digital. “Insurance is an affinity sale. So the bancassurance channel is definitely going to be there,” he said.

It shouldn’t be surprising that LIC is getting serious about leveraging its otherwise slumberous tie-ups with banks.

Elephant in the branch

Bancassurance brings in only 3 percent of LIC’s business – the majority is brought in by its unrivalled network of agents. After its listing, though, LIC has faced flak from investors over its high-cost agent-dominant business.

That may be about to change now as a sharper focus on profitability would mean that LIC will need to leverage its legacy tie-ups with banks. This focus on profitability has also meant that LIC wants to ramp up its non-participatory policies. This sits well with the bancassurance model as non-par products sell well in bank branches due to their simplicity. Sarangi pointed out that market-linked products and non-par policies drive the volume in bancassurance.

The company has indicated that it would explore more tie-ups but until now it hasn’t gotten more bang out of its buck from the 62,000 odd outlets.

The slow moving insurance elephant doesn’t seem to bother private life insurers.

“LIC is still a public sector unit and swift movement is not in its DNA. Even if they leverage bancassurance, private sector players are far ahead. More importantly, the digital edge too lies with them,” said an analyst requesting anonymity.

Also, competition is limited to the extent banks choose to have an open architecture. The banking regulator allows a bank to hawk products of up to three life insurers. But banks such as ICICI Bank and State Bank of India opt to have exclusive arrangements that distribute only products of their respective insurance companies.

HDFC Bank on the other hand has an open architecture and can sell products of life insurers other than HDFC Life. LIC is keen to join hands with such banks.

Notwithstanding LIC’s history of being slow to adapt, private life insurers will find tough competition given the brand recall of LIC.

“They (LIC) have a big brand recall. If they seriously pursue bancassurance distribution, then they can definitely challenge the rest of us here. But where they would get challenged is the aggression and agility of private sector players and that matters when it comes to customer focus,” said Mishra.

Bank branches may slowly turn into a battleground for life insurance profitability, if they are not one already. Growth and market share gains have been on the side of private insurers so far. LIC would need the second wheel of bancassurance in addition to its formidable agent network to gain speed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!