India’s largest paint manufacturer, Asian Paints, will likely report muted earnings for the quarter ended March, as volumes remained subdued amid an ongoing slowdown in overall consumption.

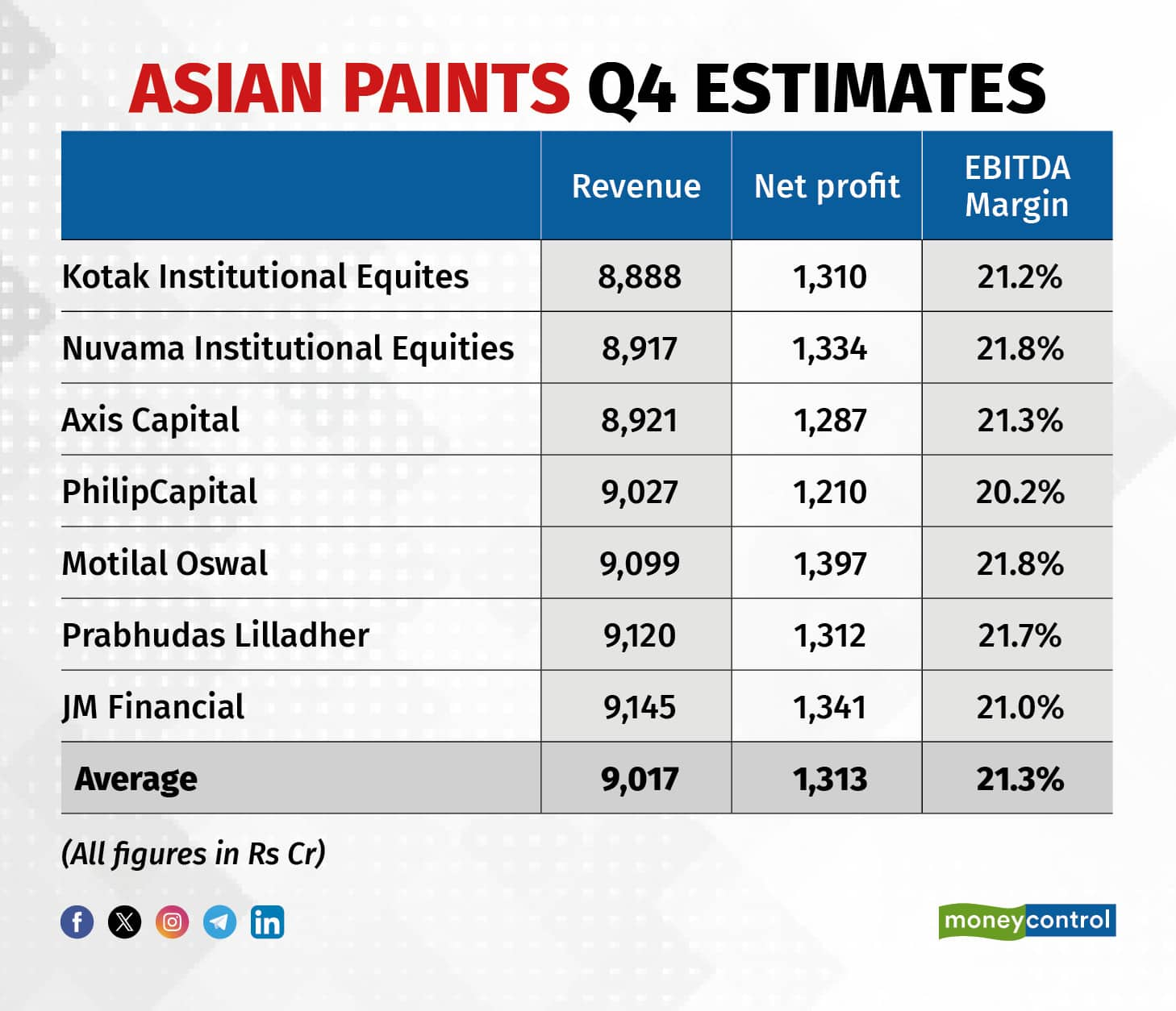

The topline is expected to come in at Rs 9,017 crore for the quarter gone by, according to a Moneycontrol poll of seven brokerages, inching up 2.6 percent on-year from Rs 8,787 crore in the same quarter in the year-ago period.

The EBITDA margin will see a marginal uptick of 10 basis points to 21.3 percent YoY, but moderate 130 basis points on a sequential basis from 22.6 percent in the quarter ended December.

Profit after tax will come in around Rs 1,313 crore for the March quarter, up 4.4 percent YoY from Rs 1,258 crore.

To boost demand, Asian Paints implemented price cuts of around 3 percent. However, this failed to meaningfully increase sales and will weigh on revenue growth for the quarter.

Also Read | Asian Paints gains as subsidiary signs agreements with GCPL to set up facility

Brokerages expect volume growth to moderate as a result of the increased competitive intensity and slowdown in overall consumption. “Despite implementing price cuts in 4Q, volume has not recovered. We believe that demand remained subdued throughout the quarter,” Motilal Oswal noted.

As the cost of raw materials moderates, the gross margin is set to see an expansion. Asian Paints reported an improvement in its formulation efficiencies, which will be partially offset by the recent price correction undertaken across the product portfolio.

However, EBITDA margin expansion will remain stable, despite the gross margin expansion on account of higher ad-spends and opex.

In the decorative segment, overall demand trends for the industry were muted after a decent Q3, which was aided by festival and marriage demand, said Nuvama Institutional Equities.

Some of the key factors to monitor will be the demand outlook in Tier 2 and 3 towns, the outlook for raw materials, pricing actions and the rise in competitive intensity.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!