Inox India, a manufacturer of cryogenic storage tanks, is hitting the primary market with its initial public offering (IPO) to raise Rs 1,459 crore. The IPO comprises only an offer for sale (OFS) of over 2 crore equity shares and will open for subscription on December 14, a day after the launch of the public issues of Doms Industries and India Shelter Finance Corporation. The anchor book of the offer will open for a day on December 13, while the last day for subscription to the IPO will be December 18.

It must be highlighted that there is no listed company in India or overseas that is of comparable size, from the same industry and with a similar business model.

Moneycontrol parsed through its red herring prospectus and sums up the company’s management, finances and pitch in five charts.

The company’s financials

The company’s financials

The company’s financials

Inox India stands as a debt-free entity, although it experienced a slower revenue growth in fiscal year 2023 compared to the preceding year. The company has consistently maintained profit margins at approximately 15-16 percent. Additionally, it has successfully established a robust international customer network, currently exporting products and delivering services to 66 countries.

Return ratios

Return ratios

Return ratios

The company closed financial year 2023 with a robust net cash position of Rs 301.5 crore and maintains a healthy balance sheet. It has consistently funded its capital expenditures and working capital needs internally. Notably, both financial ratios have shown improvement from FY21 to FY23, reflecting the company's strengthening financial performance.

Other key indicators

Other key indicators

Other key indicators

The company has achieved steady revenue and profitability growth through organic business development. Notably, it holds the distinction of being the first Indian company to produce a trailer-mounted hydrogen transport tank, developed in collaboration with the Indian Space Research Organisation.

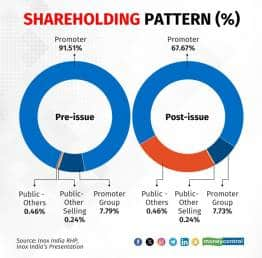

Shareholding pattern

Shareholding pattern

Shareholding pattern

The company's promoters include Pavan Kumar Jain, Nayantara Jain, Siddharth Jain and Ishita Jain. In the IPO, 2.21 crore shares will be offered solely through an OFS without any fresh issue. In this OFS, shares will be offloaded by individuals - the Jains and Lata Rungta, among others.

Orderbook composition

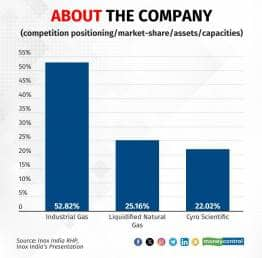

About the company

About the company

The company had a robust order book of Rs 1,036.61 crore as on September 30, 2023. Its industrial gases division specialises in designing, manufacturing and supplying vacuum-insulated cryogenic storage tanks and systems for industrial gas storage and transportation. Additionally, the LNG division offers standard and engineered solutions for LNG needs, including various storage capacities, transport trailers, marine fuel tanks, and more. Further, the cryo scientific division focuses on technology-intensive industrial equipment and comprehensive solutions for scientific research involving cryogenic applications.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.