The country’s largest insurer and institutional investor Life Insurance Corporation of India (LIC) has been on a selling spree in the banking sector.

This could be because of the IDBI Bank deal in which the insurer is close to taking a 51 percent stake. Moneycontrol had reported earlier that once the IDBI-LIC deal is completed, the life insurer will be required to pare down its stake in other banks.

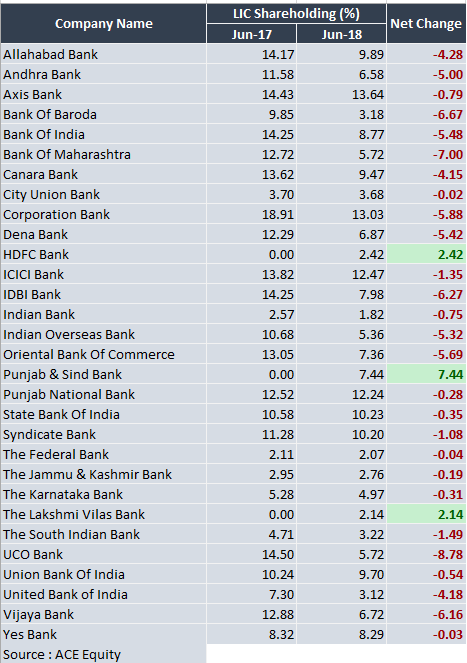

LIC reduced its stake in 27 of 30 banks in the one-year period between June 2017 and June 2018, according to shareholding data compiled by Moneycontrol.

In this period, LIC aggressively reduced its stake in majority of the banks while buying shares only in HDFC Bank, Punjab and Sind Bank, and Lakshmi Vilas Bank. Any entity holding more than 1 percent stake in a listed entity is required to report this information on a quarterly basis to the stock exchanges.

Sources said that at a time when the life insurer would be a majority shareholder in a large public sector bank, the key was to not have a very high exposure in other banks.

“A life insurer can hold upto 25 percent in the banking and financial services (BFSI) sector. Our endeavour is to not breach that limit while looking at investment opportunities during market movements,” said a senior official.

The Bank Nifty return from July 2017 to 29th June 2018 was 13.3 percent. Unlike other players in the equity markets, LIC takes a contrarian view on stocks. This means that when the other players are selling during a falling market, LIC buys equity during that period. It sells during a rising market.

Concentration risk?

LIC holds equity stakes in several other banks, including Axis Bank, Corporation Bank, ICICI Bank, State Bank of India and Punjab National Bank among others. While the life insurer was either closer to or held more than 15 percent stake, it has brought it down significantly over the past one year period.

According to investment rules of the Insurance Regulatory and Development Authority of India (IRDAI), an insurance company cannot hold more than 15 percent equity stake in one single company. This is to prevent concentration risks and spread the corpus across the companies on offer.

However, LIC was given a special dispensation by IRDAI for investing into IDBI Bank. Once the complete deal structure is finalised, they will have to get an approval from the Reserve Bank of India as well.

LIC did not respond to a query sent by Moneycontrol.

Sources told Moneycontrol that the IDBI Bank-LIC deal was on the works for almost four months since May 2018. The idea was to have a simplified deal structure in order to have quicker regulatory approvals. A final nod from Reserve Bank of India and IRDAI will be given once the finer points of the deal are in place.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!