The prices of daily essential products have climbed unabated for almost a year now, adding to the woes of the common man who is already struggling with high fuel costs and unemployment. Unlike past instances, around inflation is being felt across consumer goods – whether it be food products or personal care items or household cleaning products.

This is owing to the rise in fuel prices, supply-chain constraints and global shortages of products due to the pandemic. Packaging, transportation and raw materials account for most of the cost of any consumer good. These all costs have risen. Read on to find out why.

Why has it become costlier to move consumer goods?

Fuel prices are rising. Brent crude, a type of crude oil extracted from the North Sea, has seen a doubling of prices in the last five years, according to data from HDFC Securities. Some analysts are now predicting Brent crude to reach as high as $150 a barrel as tensions escalate at the Ukrainian border. As it is, oil producers don’t have enough spare capacity to keep up with global demand.

As India imports about 85 percent of its crude oil needs, a supply crunch in the global market has a significant impact on the prices in the country. Manufacturers are spending more to procure raw materials as well as while transporting finished goods to distributors and retailers.

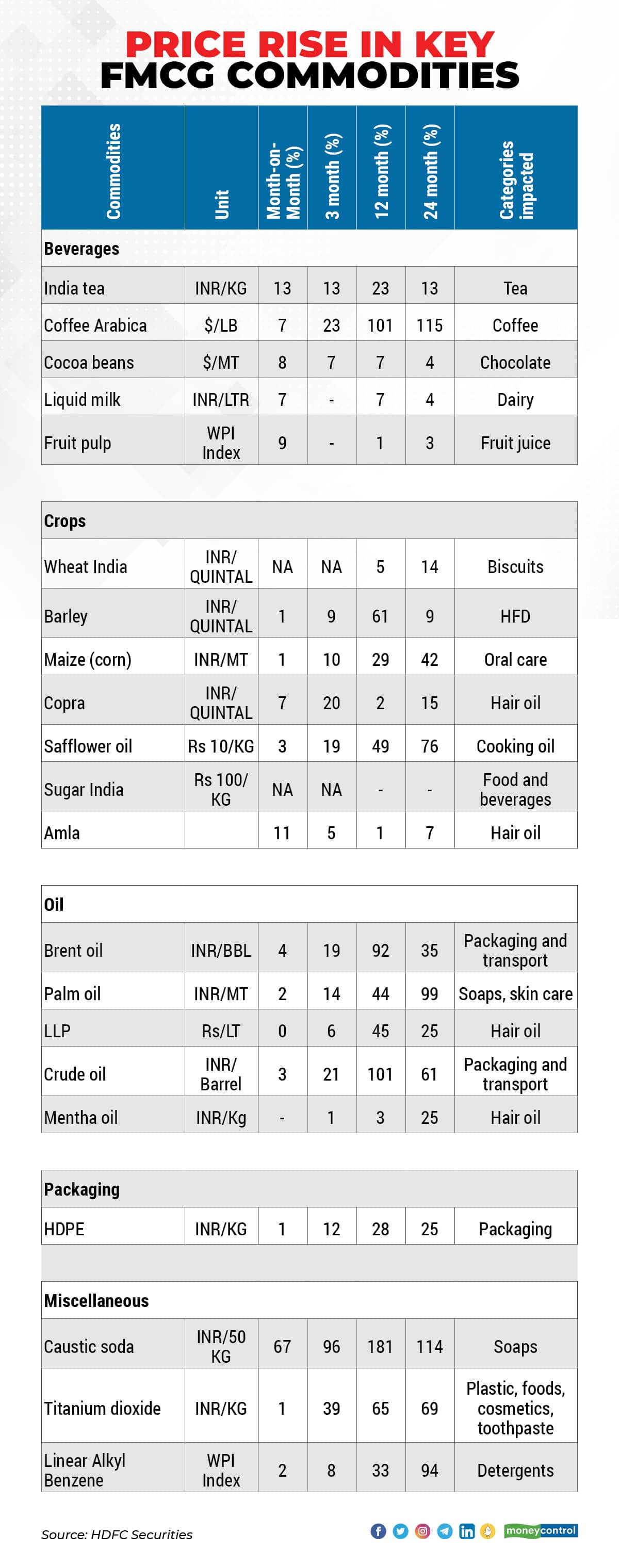

Packaging cost, too, is up due to higher fuel costs as well as a scarcity of raw materials such as scrap. The price of high-density polyethylene (HDPE), a key packaging material, has risen by 25 percent in the last two years. Fast moving consumer goods (FMCG) companies, on average, incur about 20-30 percent of input costs from packaging. The cost is higher for low-priced unit packs.

What’s the quantum of rise in raw material costs?

The prices of several key commodities such as palm oil, titanium dioxide, and copra are at their highest in a decade. Palm oil, for instance, a key ingredient in soaps, skin care products and packaged foods, has seen a 99 percent jump in prices in the last 24 months. As per ICRA, palm oil accounts for about 40 percent of total oil consumption in India and 60 percent of imports. Almost all of India’s palm oil requirement is met from Indonesia and Malaysia and a supply shortage in these countries has led to inflated prices.

Palm oil supply has fallen because of labour shortage in Malaysia, the world’s second-largest producer. Similarly, in Indonesia and Malaysia, local biofuel mandates, which increase the amount of vegetable oils mixed in fuel, has increased domestic consumption, leaving a lower exportable surplus.

The price of other edible oils, too, has been on an upward climb since the onset of the pandemic. Safflower oil has become 105 percent steeper in the last five years.

This rise has happened “despite a reduction in import duty by the government,” said Shambhavi Priya, Associate Economist, Care Ratings.

“Moreover, Indonesia, which is the world's top producer and exporter of palm oil has recently planned mandatory sales in the domestic market to ease off domestic pricing concerns starting January 2022. This policy measure may lead to inflationary concerns for key importers like India,” she added.

Inflation in crude oil has not only increased the freight cost of FMCG firms but has also added to input costs of detergent makers as several crude-linked commodities are used in manufacturing of FMCG products. LLP or Liquid Paraffin for instance is a key raw material for hair oil.

Staples such as wheat, barley, maize also have become expensive as the pandemic disrupted the crop season coupled with a global rise in prices.

How FMCG companies have reacted?

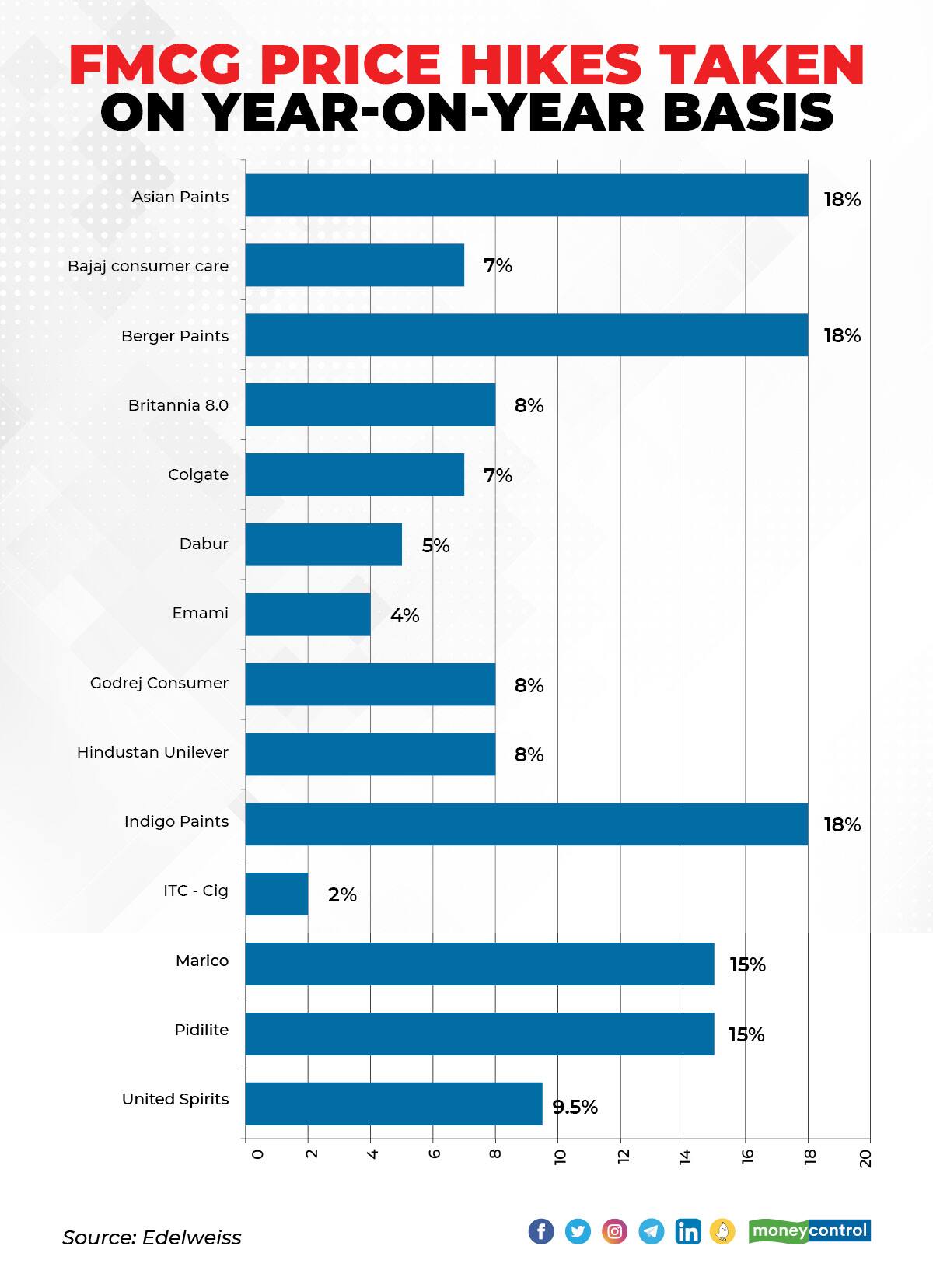

Hindustan Unilever, ITC Marico, Dabur, and Parle Products have passed on increasing costs to consumers. According to a report by Edelweiss, with demand in a recovery phase after the second Covid wave, most companies have passed on, at best, 75 percent of inflation to consumers.

“Input costs have gone up significantly in the last 6 to 12 months, and because of this we had to go for a price hike of 5-7 percent in the last quarter (Q3). Costs of raw materials such as edible oil, wheat, sugar, etc. have all increased with edible oil costing almost 50-60 percent more than last year, cost of packaging material has gone up by 20 percent,” said Mayank Shah, senior category head at Parle Products.

Asian Paints’ products prices jumped 18 percent year-on-year in the quarter-ended December (Q3), according to Edelweiss, while prices of HUL product was up 8 percent YoY in Q3. (As shown below)

When can we expect inflation to ebb?

The prices of most daily essential products are at their highest but it seems we have not seen the peak. Crude oil prices, for instances, could climb further if Russia invades Ukraine.

Also, remember that pump prices have not increased despite the rise in crude oil prices. Analysts believe that oil companies will raise petrol and diesel prices once the state elections are over.

Most industry stakeholders believe that inflation will continue unabated for at least the next two quarters and relief is expected only in the second half of the year.

“We are seeing unprecedented inflation; something we have not seen for at least last 30 years. And this is not demand-led but supply-led because of disruptions across the world. I believe, that hopefully in the second half of the year, we should see some moderation in inflation,” said Sanjiv Mehta, chairman and managing director, HUL, in January.

Read here: FMCG companies indicate more product price increases ahead

Several consumer goods companies have indicated that they will hike prices going ahead as they grapple with inflation.

“It is difficult for any company to pass on this kind of price hike to the consumers in one go and hence, most companies opt for staggered price hikes. This quarter we are planning on taking another 5-7 percent price hike which will pass on about 60-65 percent of the (costs) hike to the consumers,” said Shah of Parle Products.

Other companies such as Dabur and Britannia, too, have indicated that another round of product price increases is imminent as they expect the rise in the cost of commodities and raw materials to persist for at least another quarter.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!