The Ministry of Corporate Affairs (MCA) is of the view that the Serious Fraud Investigation Office (SFIO) should examine whether nominee directors of crisis-ridden IL&FS adhered to their fiduciary duty and informed the companies they represented about mismanagement in IL&FS.

A source told Moneycontrol that the MCA may take a view on this even as the SFIO is already looking into charges of mismanagement at IL&FS.

The IL&FS crisis has put roughly Rs 30,000 crore loans at risk and nearly developed into a contagion, which recently threatened to spread to wider financial markets.

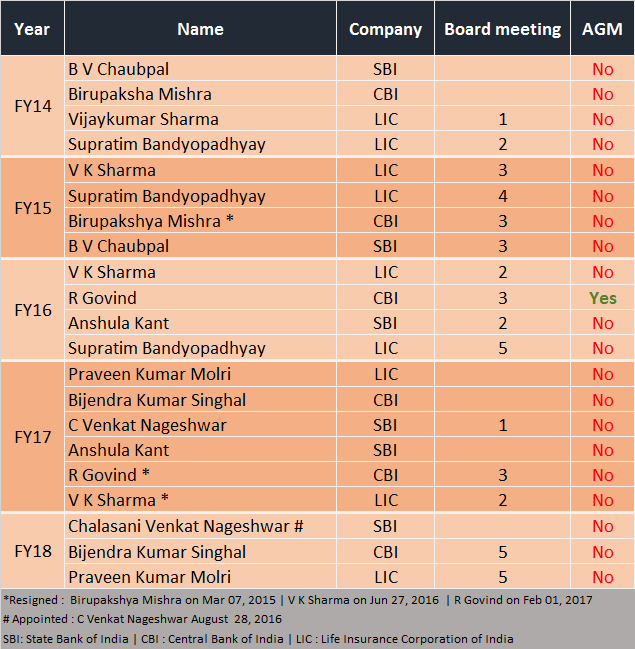

IL&FS has nominees of two public sector bank and a nominee from Life Insurance Corporation. LIC holds a major stake in IL&FS with a 25.34 percent shareholding, Central Bank of India (CBI) has 7.67 percent while State Bank of India (SBI) holds 6.42 percent stake.

With this stake, PSU banks and LIC appointed their nominees on the board. Nominees who have previously been on the IL&FS board include VK Sharma, the current chairman of LIC, and Anshula Kant, currently the Managing Director of SBI.

"Prima facie, the ministry has not found any communication from nominee directors to their respective companies about the apparent mismanagement in the group companies of IL&FS," another source told Moneycontrol.

Moneycontrol also analysed the nominee directors' attendance pattern at IL&FS board meetings and AGMs for the last four years. It appears that there were some years -- such as FY2017 -- when attendance was thin. Board members from the companies attended an AGM only once in the last four years.

We wrote to LIC, SBI, CBI and LIC for their comment on whether they were apprised of any potential mismanagement at IL&FS. However, Moneycontrol has not received their reply till the time story was published.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!