Dharmesh Bhatia

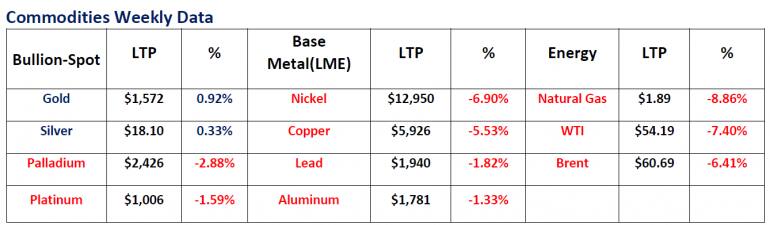

Precious metal prices surged and ended marginally on Friday due to the newly found virus, which has spread in various nations and might impact the global economy.

West Texas Intermediate fell by the worst weekly decline in a year on concerns of the Coronavirus outbreak crippling the demand.

The S&P 500 eradicated its early gains, giving up its worst weekly performance and closing at 3295.

The British pound rose to 1.31 before closing at 1.3078 on Friday after the U.K. PMI data rose to its highest level since January 2018.

The dollar index surged and closed at 97.85 on Friday due sell offs in EURO, in wake of the ECB meeting.

Base metals ended the week in negative territory as prices were pressurized after the new virus outbreak in China could hit economic growth in the world's top metals consumer, China and dent the demand prospects for industrial metals.

US Treasury Secretary Steven Mnuchin said that he was optimistic the United States and Britain would strike a trade deal this year and that he had discussed it with Britain’s finance minister on Saturday.

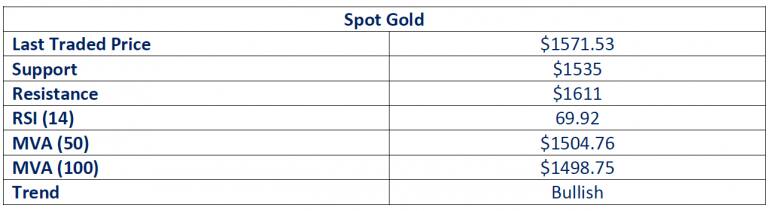

Gold

Gold prices, last week, marginally and ended the week at $1571.53. The coronavirus outbreak in China might impact the global economy which supported the safe haven asset, Gold. However, US Treasury Secretary Steve Mnuchin stated that the fresh trade deals with China, Mexico and Canada could help the US economy and helped the US Dollar recover in turn pressurizing the yellow metal prices.

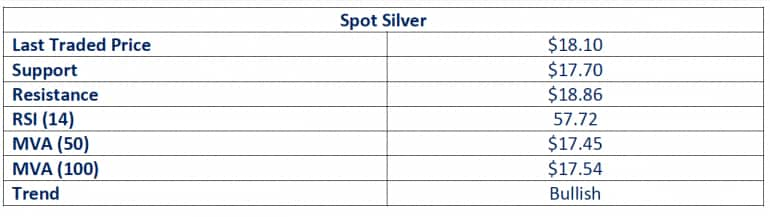

Silver

Silver prices traded in range through the week and ended the session at $18.10 on Friday. The price is just shy of what it was at the beginning of the session on Monday. The pressure on silver is interesting based on what gold has been doing. The ratio between gold and silver continues to widen and currently stands at 86. However, next week, analysts are keeping a close eye on the Federal Reserve interest rate decision on Wednesday and the possibility of any new geopolitical tensions to anticipate further direction on the prices.

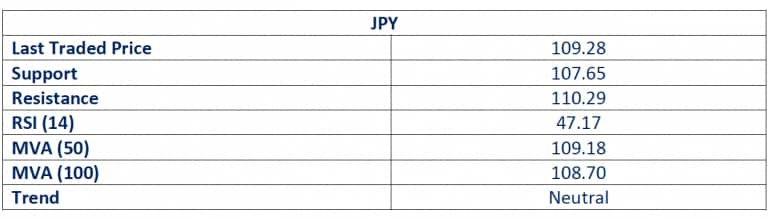

Japanese Yen

The USD/JPY pair, on Friday, dropped to a two week low at 109.28. The greenback gathered strength after the data published by the IHS Markit showed that the economic activity in the private sector continued to expand. Although the Japanese inflation data was upbeat, it didn’t help the JPY build ground. The BOJ agreed to continue easing consistently, reiterating from the bias. However, risk aversion in equities due to the coronavirus scare might provide some ground for the pair to make some gains.

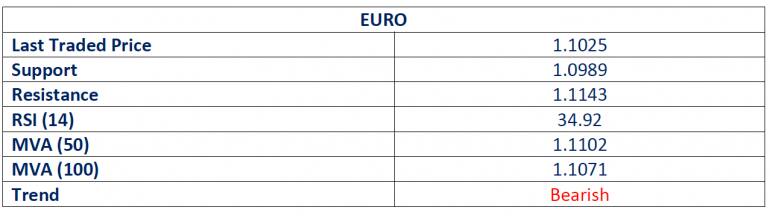

EURO

The EUR/USD pair remained under pressure throughout the week before closing at 1.1025, the lowest level since early December. The manufacturing PMI of the Eurozone failed to help pair make gains as s the Services PMI dropped. On the other hand, The European Central Bank left its policy unchanged and announced a strategic review, as expected. President Christine Lagarde's lackluster comments on the latest data and her inclusion of climate considerations weighed on the common currency. Further, the US Dollar Index rose to its highest level in more than seven weeks at 97.85 supported by the latest PMI figures.

WTI Crude

Crude oil prices fell to a two month low of $54.19, marking this as the third week of lows in a row. The downtrend came in response to oversupply fears and was particularly influenced by the outbreak of the coronavirus in China, clouding prospects for the demand of the commodity in the second world importer. Adding to the fall in prices was the EIA’s report on Thursday mentioning a 405,000 barrels drop during the past week, coming in short of the previous estimates. Also, API showed a heavy 1.6Mbpd increase in US crude oil stocks.

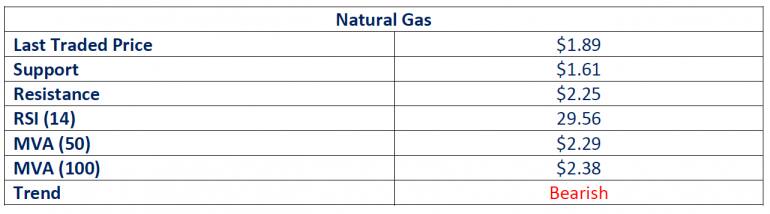

Natural Gas

Natural gas prices declined further and closed below $1.90, plummeting it to the lowest level since May 2016. The weather is expected to be warmer than normal for the next 6-10 and 8-14 days according to the last forecast from NOAA. Also, the US Energy Information Administration forecasts that US natural gas exports will exceed natural gas imports by an average of 7.3 billion cubic feet per day. Supply rose in the last week with the average total supply of natural gas rising by 1% compared with the previous week.

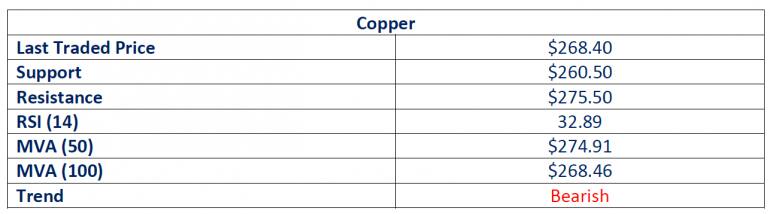

Copper

Copper prices, on Friday, ended the week in negative at $268.40. Prices were pressurized after the new virus outbreak in China is anticipated to hit economic growth in the world's top metals consumer and dent the demand prospects for industrial metals. Furthermore, the interim trade deal between US & China was the first step to end the prolonged trade and tariff war which underpinned the demand prospects for industrial metals. However, with most of the tariffs still on the table the demand prospects for the industrial metals still remain under cloud.

(The author is Associate Vice President, FX and Commodities, Emirates NBD)

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!