Pay parity remains a distant dream in India Inc as chief executive officers (CEOs) get paid 130 times more than a regular employee, a report recently released by CRISIL says.

While that is much lower than the global average of 250-350x, companies surveyed for the report ranked the ratio of CEO pay-to-median pay (the wage disparity measure) as the fourth most difficult environmental, social and governance (ESG) target to meet.

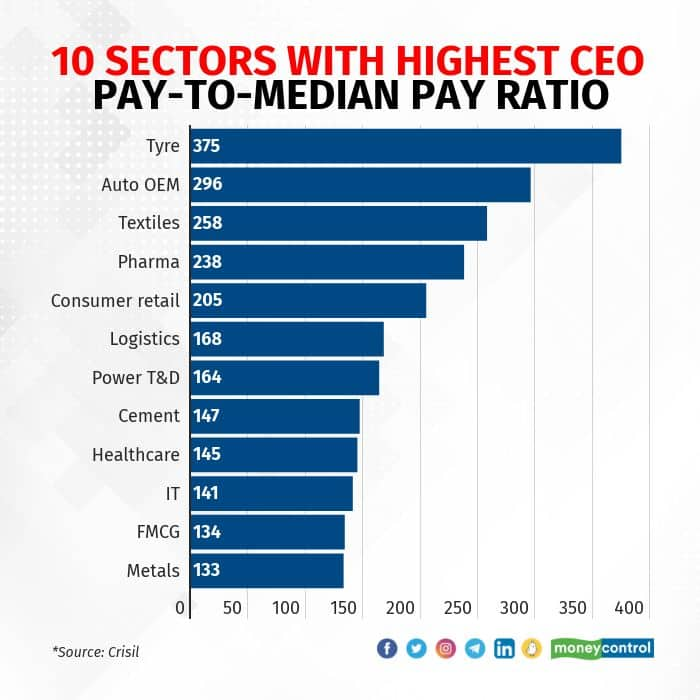

In private companies, CEOs get paid 137x more, with tyre, auto original equipment manufacturer (OEM) and textiles sectors showing the highest disparity–at 375x, 296x and 258x, respectively. FMCG and metals sectors showed the least–at 134x and 133x, respectively.

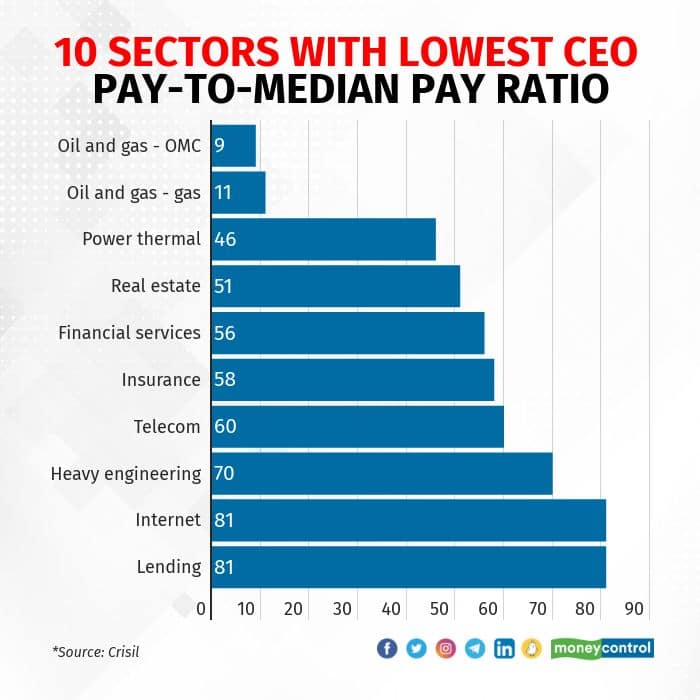

In PSUs, the picture is starkly different. Their chief executives get paid just 4.8 times more than the median pay.

“CEO pay in PSUs has been very low (historically) especially when compared to the private sector. Hence, the pay parity is better in PSUs. Ideally, CEO pay should be linked with growth of the company, adequately incentivising CEOs,” said Miren Lodha, director of CRISIL Research to Moneycontrol.

So why are some sectors paying their chief executives so highly? It’s largely because "it’s all in the family".

“In the top three sectors that had high pay disparity, the CEO/MD are promoters or related to the promoter,” said Lodha. A few of the companies in these sectors have also just recently appointed their CEO/MD, which is also why the pay is so disproportionately higher.

If you take out the promoter or promoter-related CEOs from the equation, then IT sector is the one with the highest pay disparity, said Lodha. A CEO gets paid 141x the median pay.

"Some of the reasons for this are stock options that are exercised during the year, newly appointed CEOs getting a one-time bonus, and high variable pay/commission/bonus," he said.

An extreme example of this could be Infosys CEO Salil Parekh's remuneration. His is 872x the company's median pay, when you include stock-based compensation, and 229x if you exclude the stock options.

Wage parity, according to Lodha, was poorer in sectors more dependent on contractual workers or temporary workers.

Five sectors that showed the least wage disparity–DFI, power renewable, power thermal, oil marketing (OMC) companies, and oil and gas exploration and production (E&P) companies–saw attrition averaging 5 percent, much lower than the overall attrition average of 10 percent.

“Attrition is lower here also because these are PSU-heavy sectors,” said Lodha.

In more than half the 586 companies–53 percent of them–growth in operating profit was found to be aligned with growth in CEO remuneration. “Of these, the operating profit of 59 percent companies outperformed the industry on CAGR basis, and for 11 percent, was in line with the industry average,” it said.

The majority of the companies–83 percent of them–haven’t linked ESG factors to executive compensation for the CEOs and KMP. Only 11 percent have done so, and only 6 percent have linked the compensation for CIO equities and head of research to ESG goals.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.