The past three months have been nothing short of chaotic for merchant payments and lending startup BharatPe.

Founder and former managing director Ashneer Grover’s exit, clouded by a war of words with him and his wife Madhuri Jain Grover on one side and Chairman Rajnish Kumar and CEO Suhail Sameer on the other, saw the incident turn into one of the most controversial corporate disputes of recent times.

The incident has left big questions hovering over BharatPe, particularly around corporate governance and investor sentiment. The company’s focus is now on retaining employees, changing the culture of the organisation to make it a more supportive one, and most importantly, taking steps to repair the company’s tattered corporate governance image.

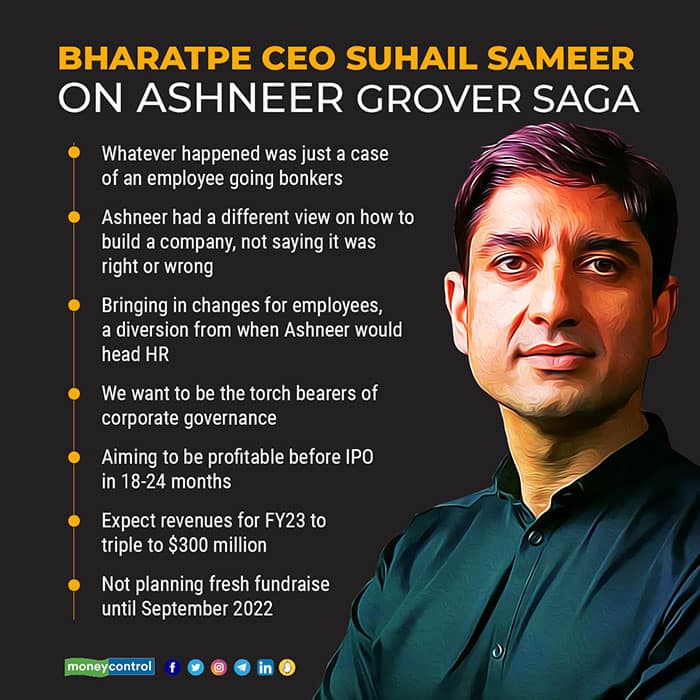

In an interview with Moneycontrol, CEO Suhail Sameer detailed BharaPe’s plans to change the company’s culture in a way that is different from Grover’s approach. Sameer said the company continues to focus on achieving $300 million in revenues by the end of FY23 and is aiming for an Initial Public Offering (IPO) in 18 to 24 months.

On Grover and the allegations against him and Madhuri for misappropriation of funds, Sameer said that the whole episode was a case of an employee going bonkers, which can happen in many companies. The startup is putting in place checks to ensure such incidents are not repeated, he said. Excerpts from the interaction:

To start with, tell us how things have changed in the past few months since Ashneer went on leave and then resigned. In terms of culture, how are employees viewing the organisation now?

That is a loaded question. Culture is not an overnight exercise. It takes time to change. First things first, our team continues to be excited about the business. Despite all the hullabaloo you have heard about the culture here, our attrition rates are one of the lowest in the industry. Part of that was probably driven by the beauty of the business and the excitement around it. That continues to remain high since our business is growing month on month.

Having said that, we do realise that obviously, we had to change a few things about how people perceive the organisation and how excited they are to come to work beyond the excitement of BharatPe as a company. We have taken a few tactical steps. To show that there is an intent to change, you make some small wins and then the whole organisation galvanises. We started by announcing that every employee in our company will be part of the Employee Stock Option Plan (ESOP), irrespective of designation.

As part of this review cycle, we are making everyone the owner. You want to keep on talking about ownership mindset, but then you have to also ensure that they are actual owners.

We have also incorporated basic hygiene things like including wellness, gym memberships, changes in insurance coverage etc. These are small things to drive trust. We have done a lot of interventions as well to crowdsource the culture we want to build and that will hopefully reflect over the next few days. A lot of people try to set culture top down, but that’s not what we want to create at BharatPe.

We are also moving our office from Malviya Nagar since it is quite a crowded location to the Gurugram Cyber Hub.

There is a lot more to be done. Culture takes years to build, especially for a new company. Half our team has joined in the last 12 months; we don’t have a common ground. We all come from different walks of life. In a way, create the culture.

Were these changes specifically done because of everything that happened? Was employee morale low? Or is this something that you wanted to do and thought this is the right time to implement it?

Parts of it were already in the works. But every new leader comes in and builds their own vision of the company based on what is important to them. Ashneer had a different view of this, and I am not saying what is right or what is wrong. You have to work towards your vision of the company. I want to create a workplace where everyone feels excited to come to work, where you have friends at the office, where you work incredibly hard, but you also enjoy your time beyond.

That, maybe, is a diversion from how we would operate when Ashneer used to head HR. But again, I’m not getting into whether it was right or not. A lot of these things are contextual, every leader tries to do the best for the company and I am sure Ashneer was trying to do the best for the company.

My belief is that giving compensation etc the bare minimum today’s world and everyone has more job offers. How much they enjoy working in the office is what distinguishes you.

Can you tell us about the outcome of the audits by Alvarez & Marsal and PwC?

It is not as controversial as everyone thought. I think whatever happened was basically an employee going slightly bonkers, which can happen to any company and happens in a lot of companies. We just took notice of the issue and solved it, and a lot of credit goes to the board and investors for also standing by us. The other thing is, there was no law broken.

Having said that, we are still doing a few things in the context of going public. Public companies go through a very different level of scrutiny and most startups scramble to put things in place in the last three months before the IPO. We want to be proactive and so we are doing a few things for that.

One, we want to strengthen our board, so we want to add more credible and independent board members. After the IPO, we need the board to have 50 percent independent members, so we might as well move in that direction now. We are also putting in place processes so that whatever breach happened doesn’t happen again. This is on the lines of vendor onboarding, procurement practices etc.

We are also putting in a code of conduct on everything from where you can invest, where you can have outside-of-business interests, where you can take board seats, what declarations to make if you have relatives in the company or as vendor-partners etc.

And, the last thing, we’re putting internal and external audit teams in place. This is not required by law, but we want to move from the place where issues happened to the place where we become the torchbearers of what good corporate governance in a private company should look like.

As you said, culture takes time to build. The BharatPe of a few months ago and the one you are looking to build - how long will it take to reach there?

Vision is a difficult journey. So, it is difficult to say where we will be in six months. It starts with creating a common vision, both short term and long term.

Over the last few weeks as we’ve done internal conversations, what has become clear is that we want to be a public company. We believe that true success is if the public markets also believe what we are building is unique. We have set forward a 24-month path to it. The second thing that that we have agreed on is that instead of launching a lot of incremental products that may or may not scale, we want to double down on what really our merchants come to us for, which is make an even better payments stack.

If I go back to the vision that BharatPe was started with, our thinking was that a merchant will pay you for two things: one is if you give him credit, because then he can deploy it into working capital, and second is if you send customers to their shop. Because they struggle with customer acquisition. I think we lost track on the second one; we never launched it because we were always launching incremental small things.

So, the focus of the organisation is moving from launching two new products a quarter to maybe launching only two or three products a year. But launching products that are really impactful for the consumer, help merchants and keep it narrow. We decided to not try to become a super app like some of our competitors but have three-four product offerings. There is a bit of product thinking change that has happened, which is like build less but build deeper and bigger.

What is the road ahead for Unity Small Finance Bank. How many depositors have received their money back?

I am not on the board, but as an investor I am aware that the money from the RBI’s Deposit Insurance and Credit Guarantee Corporation (DICGC) has come in and all those who were eligible for up to Rs 5 lakh have received their money. That is 97 percent of the depositors. The remaining 3 percent are banks, co-operatives, trusts etc.

Which products will you focus on launching first and what is the growth strategy for your existing products?

On the merchant side, I want to only launch two products in the next one year. One is auto loans and secondly we want to help merchants acquire customers. And we can provide that since we have 100 million customers on PayBack, plus on PostPe. We are looking at how we can cross-sell and send consumers from PayBack and PostPe to transact with our merchants. We also need to scale up our existing gold loan product.

We also want to launch an e-commerce play; I’m not going to get into delivery and logistics but think of it as a brand store. I want to allow customers to use their PostPe credit limits to buy from these stores and get them exclusive offers.

On the overall business, we have had a good run. We exited March at around $16 billion in annualised Total Payment Values (TPVs) annualised PPV on the payment side. In FY23 we want to double that to $30 billion. We want to increase the number of loans we facilitate and have a view of tripling that number. Currently we facilitate loans worth around Rs 700 crore a month. We want to take that to Rs 2,000 crore a month by next March. It seems tough but if I’m able to increase the traffic transaction TPV on the platform by 2x, I should be able to drive monetisation by 3x. That will mean that the revenue at the end of next year will be around $300 million. We exited March with around $100 million in revenue.

On the consumer side, PostPe saw TPVs of $50 million in FY22, which makes us the third largest Buy Now Pay Later (BNPL) player in the country after Slice and Paytm Postpaid. We want to grow that to $200 million by the end of FY23.

SME as well as consumer lending and BNPL have a lot of players now. Do you worry that the controversies of the past few months have set you back against competition?

No at all. Plus my competition is actually payments and not lending.

But payments such as UPI has no revenue…

Yes, but it’s a (customer acquisition) funnel. It’s a very weird business, where none of us makes any revenue… and that is exactly what we are fighting for. Because the use cases for all apps are very different. Paytm is a bit in our space and a bit in the consumer space, so maybe I can call them competition. But others are not.

Having said that, we know a lot of people are coming into lending. But there is still a $500 billion credit gap in the country. Even if I get 5 percent of it, that accounts to $25 billion every year. So, yeah, competition is there but this is not a winner-takes-all market.

What are your funding plans and how has that gotten impacted after the controversy of the past few months?

We don’t need funding. I still do two calls a day with investors but these are more like relationship building calls. We are incredibly well capitalised. I have $400 million in the bank. My monthly burn is $4 million. You can do the math. And this is the case today, as we scale the business, we will turn profitable. We want to go for the IPO with a profitable P&L. I don’t believe in spending 25 percent of the money I have in the bank to become profitable.

But we also have to think from the IPO point of view, who are the investors we want on our captable when we go public. Because a lot of early-stage funds typically exit at an IPO. So, if a credible investor comes in, who is more a public market investor and wants to come in pre-IPO, that will be a good thing. But even that, we will probably start thinking about in six to nine months… on who we should onboard and start proactively speaking to. But as of now, we are not doing any rounds before September.

Do you have any aspirational valuation in mind to achieve before going public?

No, not at all. The valuation metric is such a stupid metric people chase. When does it matter? It only matters when you’re selling your shares. But I will not be selling for a few years after the listing.

In fact, I believe you should leave 25-30 percent value to the incoming investors at the time of the IPO. If you continue growing your business post listing, the stock is likely to go up. So, if the merchant bankers value us at $10 billion, for example, I will say we should do the IPO at $7.5 billion.

Where has the company reached in terms of its search for a new CFO? Have any names been shortlisted?

We have started our search, we think it will take 4-5 months at least. We have met with a number of candidates and like a few of them. Hopefully we will be able to narrow down to a few people in the next few weeks and hope that it works for them as well. But nothing is done in hiring until it is done.

What happens to Ashneer’s stake in the company? How long will his relationship as a shareholder continue?

Always.

So are you saying he will not exit? Are he and the company okay with that?

I am not saying this personally. It is not my call anyway, it is the board’s call. The board has been heavily focused on ensuring business continues to grow and on making employees feel comfortable. Ashneer is out of the picture from a company operating point of view. That’s all I care about. Whatever he wants to do with his equity, what investors want to do with his equity…my job is to keep the business running and take it to IPO.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!