While the Indian economy has continued to show resilience in the face of global economic headwinds, earnings growth is expected to be moderate and the broader markets is expected to trade sideways in the near future. In such a scenario, investors might be inclined to focus on companies that have robust cash flows and the potential to offer consistent returns even during relatively volatile market conditions.

One way to identify such companies is to use the dividend yield metric, but selecting individual high dividend-yield stocks to invest in from the entire universe of listed companies would require significant effort and be a time consuming task. This is where the Axis Max Life BSE 500 Dividend Leaders 50 Index Fund can emerge as an excellent investment option.

What is the Axis Max Life BSE 500 Dividend Leaders 50 Index Fund?

The Axis Max Life BSE 500 Dividend Leaders 50 Index Fund is a passively managed fund that will track the composition and performance of the BSE 500 Dividend Leaders 50 Index. The broad-based BSE 500 Index will serve as the stock universe for this fund and selection of stocks will based on the dividend yield factor.

Returns of the Fund

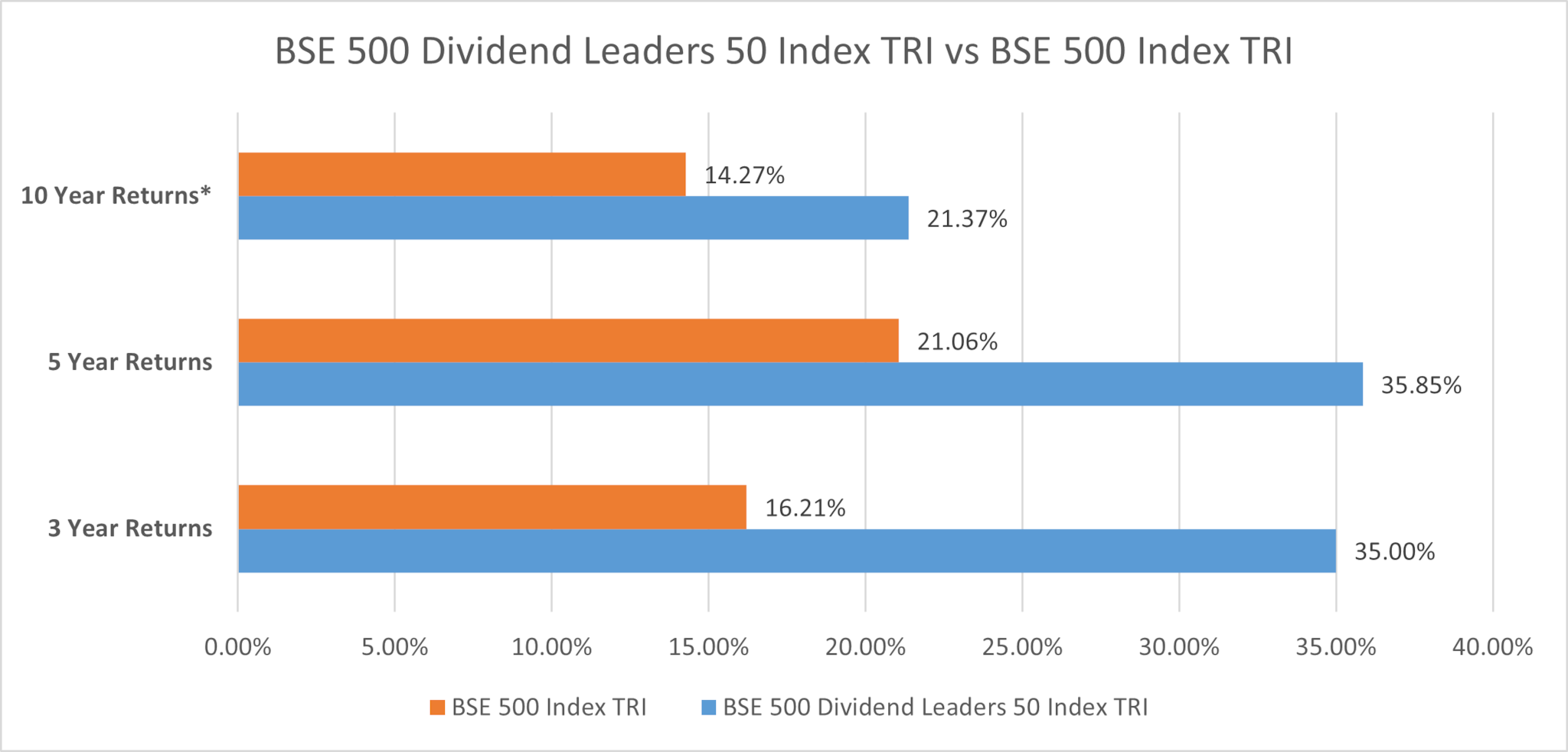

In order to get a better idea of how well this fund can potentially perform versus broader markets over various time periods, let’s take a closer look at the performance of the underlying index, BSE 500 Dividend Leader 50 Index verses the broad-based BSE 500 Index as of 31 October, 2025:

Note: Returns data as of October 31, 2025. 3 year, 5 year and 10 year returns data are CAGR returns for the respective indices based on back-tested returns data. The Total Returns variant for each index has been considered for returns calculation. Historical returns do not guarantee future performance. *The 10 year returns data in the above table are for a period of 9 years and 8 months.

As you can see, from the above back-tested data, the returns of the dividend-yield based index has been significantly better than the broader index over the medium and long-term period. Even though there is no guarantee that the same level of performance will be maintained in the future, this indicates that those who stay invested in the long term would potentially benefit from the superior performance of this fund in comparison to the broader markets.

Key Features of the Fund

Being an equity fund, a minimum equity allocation of 70% must be maintained at all times. As the BSE 500 Index serves as the stock universe for this fund, the equities chosen for inclusion are expected to be well-diversified across multiple sectors and market capitalisations. The fund will however retain the flexibility to maintain up to 30% portfolio allocation towards potentially less volatile investments such as cash, money market instruments, Government securities and corporate bonds.

New and existing policyholders of Axis Max Life ULIP products will be able to invest in this fund through various ULIP offering such as – Flexi Wealth Advantage Plan (FWAP) and Online Savings Plan (OSP). This will enable policyholders to receive the dual benefit of factor-based equity investments and life cover through a single solution.

How will the Axis Max Life BSE 500 Dividend Leaders 50 Index Fund Choose its Investments?

The Axis Max Life BSE 500 Dividend Leaders 50 Index Fund will attempt to replicate the composition of the BSE 500 Dividend Leaders 50 Index. As a result, the fund’s stock selection process will closely match that of the index being tracked. Below are some key steps in the stock selection process of this fund:

Step 1. Only BSE 500 listed stocks that have consistently paid dividends for the past 10 years and have a listing history of at least 5 years are considered eligible for inclusion.

Step 2. Next the below 4 data points for each of the stocks qualifying in the above criteria are calculated:

Dividend Yield = Dividend Per Share/Market Price per Share

A high dividend yield shows that a company is distributing a large proportion of its earnings to shareholders. This typically implies strong cash flow generation or undervaluation of the stock. For investors this factor may help identify and select investments that have the potential to deliver consistent performance even during periods of volatility in broader markets.

Step 3. The 50 companies with the highest Z score calculated in the previous step are considered eligible for inclusion into the index subject to additional criteria such as:

Since the Axis Max Life BSE 500 Dividend Yield 50 Index Fund will mirror the composition of the index being tracked, the stock selection process of the fund will be transparent and free of potential fund manager bias. Now that you have better understanding of the stock selection process for this index fund, let’s take a closer look at the key stocks and sectors that the fund will potentially include in its portfolio.

What will the Axis Max Life BSE 500 Dividend Leaders 50 Index Fund Invest in?

Since the Axis Max Life BSE 500 Dividend Leaders 50 Index Fund will track the composition of the underlying index, the fund’s portfolio will feature the same 50 stocks as the index along with their individual weights. The top 5 stocks and their individual weight on the BSE 500 Dividend 50 Index as of October 31, 2025 are as below:

| Stock Name | Weight on Index |

| Hindustan Petroleum Corporation | 4.58% |

| Indian Oil Corporation Ltd. | 4.43% |

| Bharat Petroleum Corporation | 4.31% |

| Vedanta Limited | 4.26% |

| Oil and Natural Gas Corporation Ltd. | 4.26% |

Key sectors that the Axis Max Life BSE 500 Dividend Leaders 50 Index Fund will feature in its portfolio can be illustrated by taking a closer look at the sectoral composition of the underlying index. Below table shows the key sectors that were featured on the index as of October 31, 2025:

| Sector | Weight on Index |

| Energy | 30.15% |

| Information Technology | 18.20% |

| Commodities | 17.40% |

| Utilities | 10.99% |

| Financial Services | 10.40% |

As you can see from above, the Axis Max Life BSE 500 Dividend Leader 50 Index is highly diversified and provides exposure to wide range of sectors ranging from energy and information technology to commodities, ultilities and financial services. Since the Axis Max Life BSE 500 Dividend Leader 50 Index Fund will replicate the underlying index, investors can get exposure to diverse industries through this fund. This will help minimise the potential concentration risk in the fund portfolio.

Who Should Invest in the Axis Max Life BSE 500 Dividend Leaders 50 Index Fund?

The Axis Max Life BSE 500 Dividend Leaders 50 Index Fund is an equity fund that invests in market-linked instruments. So it is subject to various risks commonly associated with equities such as market risk, liquidity risk, concentration risk, etc. As a result, this fund might not be suitable for the needs of all policyholders. Some key groups of individuals who may benefit from investments made into this fund include the below:

How to Invest in the Axis Max Life BSE 500 Dividend Leaders 50 Index Fund?

Both new as well as existing policyholders of Axis Max Life ULIP products can get access to the Axis Max Life BSE 500 Dividend Leaders 50 Index Fund. During the NFO period, this index fund will be accessible through the below ULIP offerings of Axis Max Life:

Post completion of the NFO period, policyholders can invest in this fund through the below Axis Max Life Unit Linked Insurance Plans:

Investment Objective:

The fund will invest in a basket of stocks drawn from the constituents of BSE 500 Dividend Leaders 50 Index. The fund will invest in companies with similar weights as in the index and generate returns as closely as possible, subject to tracking error.

Stock Universe: BSE 500 Index

Benchmark Index: BSE 500 Dividend Leaders 50 Index

Risk Profile: Very High

Asset Allocation of Fund:

| Asset Type | Portfolio Weight (%) |

| Equity | 70% - 100% |

| Government Securities & Debt | 0 - 30% |

| Cash and Money market instruments | 0 - 30% |

| Corporate Bonds | 0 - 30% |

NFO Period @ Rs. 10 per unit from 10 November 2025 to 20 November 2025

Other Factor-Based Passive Funds From Axis Max Life Insurance

Other factor-based passive funds launched by Axis Max Life Insurance previously include the below:

BSE 500 Value 50 Index Fund

This is a passively managed equity fund that uses the value score factor to select stocks from the broad-based BSE 500 Index. The fund’s portfolio consists of 50 stocks and replicates the weight and composition of the BSE 500 Value 50 Index constituents. As per fund mandate, minimum 80% equity exposure is mandatory for the fund, while the remaining up to 20% of the fund portfolio may be invested in money market instruments and cash/cash equivalents.

Nifty 500 Multifactor 50 Index Fund

This is a passively managed fund that tracks the composition and performance of the Nifty 500 Multifactor MQVLv 50 Index, subject to tracking error. The 50 stocks that are included in the fund portfolio are equities that feature the highest composite score based on 4 factors – Momentum, Quality, Value and Low Volatility. This equity fund must maintain minimum equity exposure of 80% at all times, while retaining the flexibility to invest the remaining up to 20% of the fund’s investible assets in money market instruments and cash/cash equivalents.

Sustainable Wealth 50 Index Fund

This index fund tracks the proprietary Axis Max Life Sustainable Yield Index, which is managed by the NSE. The portfolio of this passively managed equity fund comprises 50 stocks that feature the highest percentile score of free cash flow (FCF) yield for non-financial companies and dividend yield for financial companies. As per mandate, the equity allocation in this fund’s portfolio cannot be less than 80% at any time. Meanwhile, cumulative exposure of the fund towards cash/cash equivalents and money market instruments can be up to 20% of the fund portfolio.

Moneycontrol Journalists are not involved in creation of this article.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!