BUSINESS

GST Council tackling issues but major headaches remain

The GST Council's meeting on February 18 will leave it one short of a half century of meetings but the work ahead of it is arduous

BUSINESS

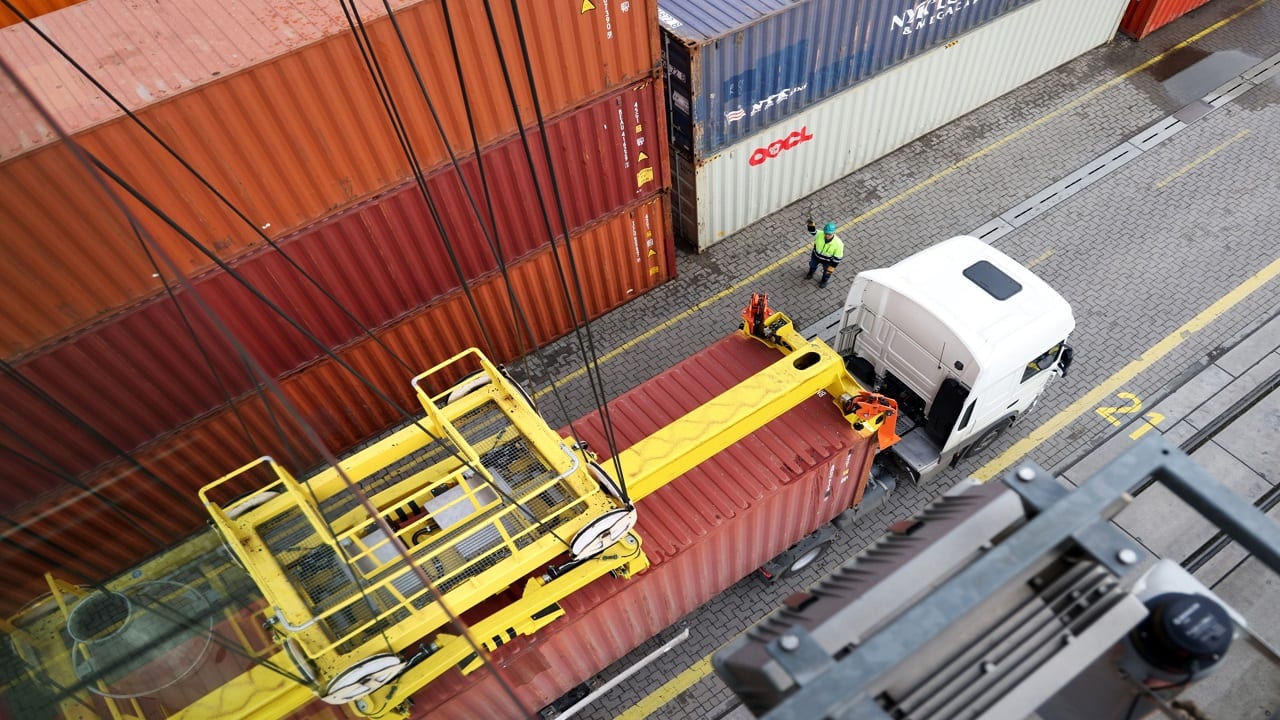

India's FY23 CAD now seen under $100 billion on services boost, import slump

In January, India's merchandise trade deficit fell to a 12-month low of $17.8 billion, while the services trade surplus surged to an all-time high

BUSINESS

No proposal to issue foreign currency govt bonds, says finance secretary

The overseas sovereign bond proposal died a quick death more than three years ago but speculation continues, given the lower borrowing costs abroad

BUSINESS

Cabinet nod to development plan for villages along China border, 7 more ITBP battalions

The Cabinet's decision to strengthen India's border villages and improve security comes in the aftermath of China announcing plans to construct a rail line to connect Tibet and Xinjiang

BUSINESS

Confusion over cereals index of CPI caused by free foodgrain provision under PDS

The Consumer Price Index data for January has caused confusion among economists, who see a divergence in the official index for cereals and that computed using the category's individual components

BUSINESS

Adani crisis: S&P says Indian banks may charge higher risk premia

According to Abhishek Dangra, a senior director at S&P Global Ratings, companies could be impacted indirectly by the reaction of banks to the Adani upheaval.

BUSINESS

January inflation shocker sparks fears of another RBI rate hike in April

India's headline inflation rate jumped by a massive 80 basis points last month — far more than economists had predicted

BUSINESS

UPI of governance – How the Single Nodal Agency model streamlined public finances

The Single Nodal Agency model is less than two years old but already has had a visible impact on public finances

BUSINESS

Retail inflation gallops to 6.52% in January, increases possibility of another rate hike

The latest inflation data comes days after the Reserve Bank of India raised the policy repo rate by 25 basis points to 6.5 percent. For 2023-24, the central bank has forecast an average inflation rate of 5.3 percent.

BUSINESS

Poll | CPI inflation may rise to 6.1% in January on unfavourable base, core pressures

The Ministry of Statistics and Programme Implementation will release retail inflation data for January at 5.30 pm on February 13.

BUSINESS

Sitharaman says new income tax regime lets people decide on consumption, saving

In her Budget presented on February 1, Sitharaman renewed the push for the new income tax system, which was introduced three years ago but didn't find many takers in the absence of exemptions and deductions

BUSINESS

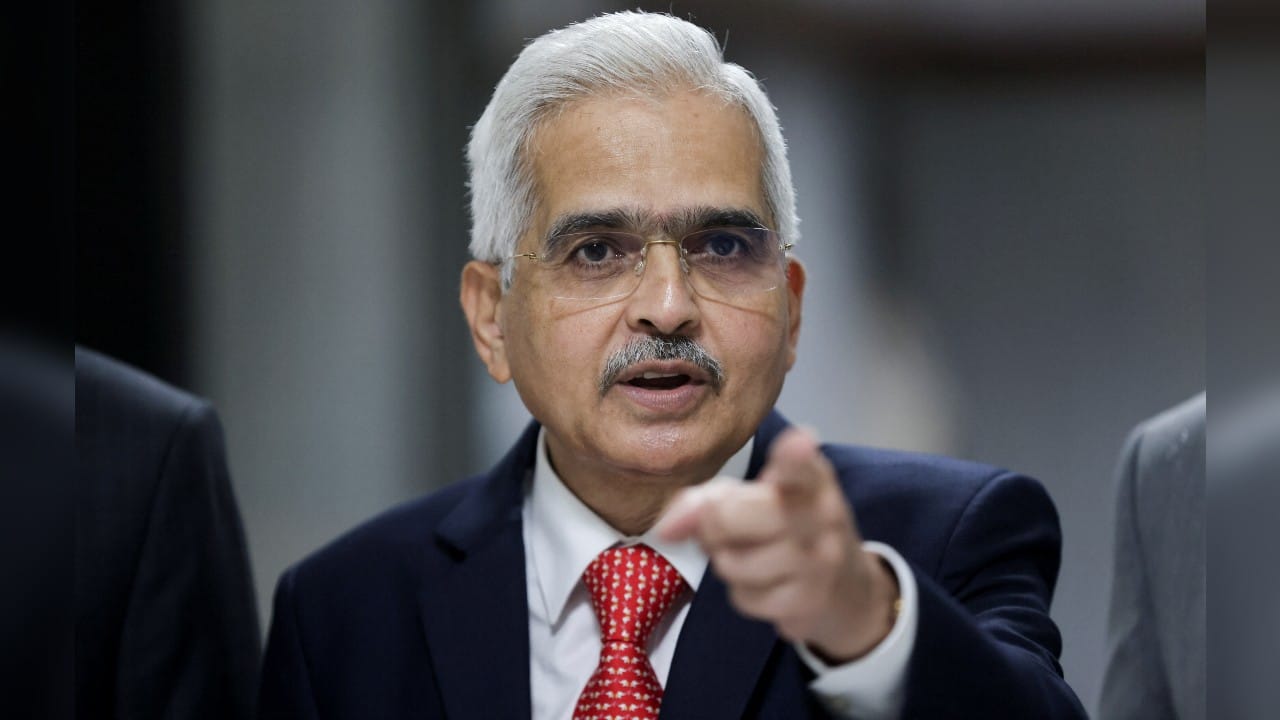

FY24 inflation forecast conservative, can benefit from low oil prices: Das

The Indian central bank has forecast that headline retail inflation may average 5.3 percent in 2023-24

BUSINESS

FM Sitharaman on Adani issue: India’s regulators very experienced, seized of the matter

The finance minister was speaking to the media after the conclusion of the meeting of the Reserve Bank of India’s central board of directors.

BUSINESS

RBI, not MPC, is dictating the stance. And it's not doing it well.

The RBI is responsible for modulating liquidity in line with the monetary policy stance adopted by the MPC. But what happened on February 8 is a further proof that it is the central bank that is dictating what the stance should be

BUSINESS

Is RBI's FY24 inflation forecast a bit too high?

The central bank's inflation forecast for the next year presents a huge drop from the current year. But a case can be made for it to have been lower, say economists

BUSINESS

RBI Policy | Jumping the gun by talking of open market bond buying: Deputy Governor Rabi Sankar

A record government borrowing programme amid tightening of liquidity conditions has led to talk of the need for the Reserve Bank to buy the bonds through open market operations in 2023-24

BUSINESS

In Charts | How economic indicators have moved since the last monetary policy decision on Dec 7

The Indian central bank looks at a variety of economic indicators before deciding on interest rates and other monetary policy matters. Moneycontrol takes a look at several key indicators which may influence the Monetary Policy Committee's decision on rates

BUSINESS

CEA Nageswaran defends Budget, says reforms can now only be incremental

The government's top economist was presenting the Centre's view in a post-Budget discussion with think tanks

BUSINESS

No off-Budget borrowing in FY24, says Finance Secretary TV Somanathan

The Budget for 2023-24 has estimated the Food Corporation of India’s Internal and Extra Budgetary Resources (IEBR) at Rs 1.45 lakh crore

BUSINESS

Lower prices take hold as businesses' inflation expectation hits 26-month low

Inflation expectations are keenly eyed by policymakers as anchoring them is critical to ensuring price stability

BUSINESS

Shift to exemption-free tax regime won't hurt India's savings: Revenue Secretary

The revenue secretary has looked to allay fears that the new, voluntary income tax regime - which has been given a decisive push by the Budget for 2023-24 - could hurt the level of savings in the country

BUSINESS

FM Sitharaman sees quick rollout of states' interest-free capex loan scheme in FY24

As per the Budget, states can get up to Rs 1.3 lakh crore as long-term, interest-free loans from the Centre in 2023-24 for capital expenditure purposes

BUSINESS

Budget 2023: Confident about numbers but can’t land Boeing 747 on a helipad, says Finance Secretary Somanathan

According to Somanathan, the Centre reiterating its commitment to the fiscal deficit target of 4.5 percent of GDP for 2025-26 should indicate that it has the means and the ability to reach it

BUSINESS

Budget 2023 | Centre confident of meeting Rs 10-lakh-cr capex target: Finance Secretary Somanathan

The Budget has set out a new record capital expenditure target for 2023-24 as the government continues its investment push to boost the economy