The bears remained in control of D-Street on Wednesday as the index breached its crucial support level of 50-day exponential moving average (DEMA) on the downside and went below 10,100 intraday.

More than the technical factors it was shaky macros which weighed on sentiments. Setbacks like widening in the trade deficit, a slowdown in factory output and hike in crude oil prices impacted the market which was already trading at a premium valuation, suggest experts.

The index recorded a bearish candle for the third consecutive session in a row on Wednesday. Although the index managed to close slightly above its 50-DEMA, the outlook still remains cautious.

The Nifty, which opened at 10,171.95, rose marginally to 10,175.45. But, bears took control of D-Street and pushed the index below its 50-DEMA to hit an intraday low of 10,094. It closed 68 points lower at 10,118.

“It was a third consecutive day while almost a continuous bearish momentum is in play from 10,490-mark as Nifty eroded around 400 points in Just 7 days. Nifty has breached very crucial support in recent terms which were established over last few weeks as it also closed below 10,170 mark,” Mustafa Nadeem, CEO, Epic Research told Moneycontrol.

Nadeem added that in the short term, he expects 10,100-10,000 levels to be held as it is crucial along with some momentum being given from 50-day SMA.

We have collated top ten data points to help you spot profitable trade:

Key Support & Resistance Level for Nifty

The Nifty closed at 10,118 on Wednesday. According to Pivot charts, the key support level is placed at 10,082.83, followed by 10,047.67. If the index starts to move higher, key resistance levels to watch out are 10,164.33 and 10,210.67.

Nifty Bank

The Nifty Bank closed at 25,218.90 on Wednesday, down 0.26 percent. Important Pivot level, which will act as crucial support for the index, is placed at 25,150.76, followed by 25,082.63. On the upside, key resistance level is 25,302.56, followed by 25,386.23.

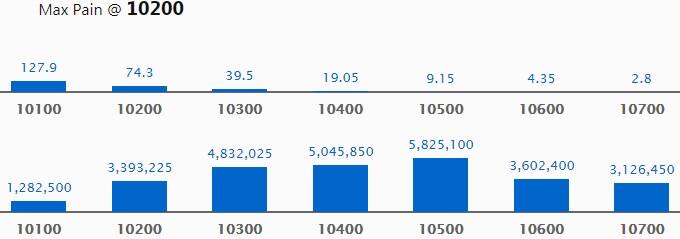

Call Options Data

Maximum Call open interest (OI) of 58.25 lakh contracts was seen at strike price 10,500 which will act as a crucial resistance for the index in November series, followed by 10,400, which has accumulated 50.45 lakh contracts in open interest, and 10,300, which now holds 48.32 lakh contracts in open interest.

Call writing was seen at strike price of 10,300, which saw the addition of 17.59 lakh contracts, along with 10,300, which saw the addition of 4.56 lakh contracts, and 10,100, which saw the addition of 4.06 lakh contracts.

Call unwinding was seen at strike price of 10,700, which saw shedding of 4.13 lakh shares.

Put Options Data

Maximum Put open interest (OI) of 45.45 lakh contracts was seen at a strike price 10,200, which will act as a crucial base level for the index in the November series, followed by 10,000, which now holds 43.56 lakh contracts in open interest, and 10,100, which has accumulated 32.55 lakh contracts in OI.

Put writing was seen at a strike price of 9,800, which saw addition of 2.45 lakh contracts, followed by 10,100 (added 2.32 lakh contracts).

Put unwinding was seen at strike prices 10,300 (9.48 lakh contracts were shed); followed by 10,400, which saw shedding of 1.79 lakh contracts and 10,000 (0.75 lakh contracts were shed).

FII & DII Data

The foreign institutional investors (FIIs) sold shares worth Rs 381.42 crore, while domestic institutional investors bought Rs 869.09 crore worth of shares in the Indian equity market on Wednesday, as per data available with the NSE.

Stocks with high delivery percentage

High delivery percentage suggests that investors are accepting the delivery of the stock which means that investors are bullish on the stock.

10 stocks saw long buildup

36 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

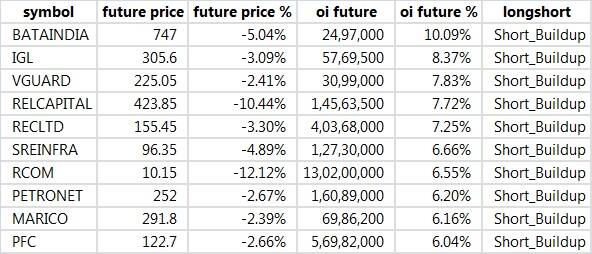

78 stocks saw short buildup

An increase in open interest along with a decrease in price mostly indicates short positions being built up.

90 stocks saw long unwinding

Long Unwinding happens when there is a decrease in OI as well as in price.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!